|

|

DEBT WOES: Protesters call for national debt cuts during a demonstration in Washington D.C. on July 28 (ZHANG JUN) |

Given its fiscal incompetence and stark lack of solidarity, Europe is currently mired in an even deeper debt crisis than the United States. Japan has yet to recover from devastation caused by the massive earthquake and tsunami in March. Under these circumstances, many private Chinese investors have downsized their portfolio investment in Japan and Europe and shifted to less risky dollar-denominated assets.

The rapid growth of private Chinese investment abroad has made it impossible to gauge China's foreign exchange reserve investment mix based on U.S. Treasury data. If foreign governments and institutional investors want to profiteer from following the direction of China's foreign exchange reserve investment, their attempts are likely to fail.

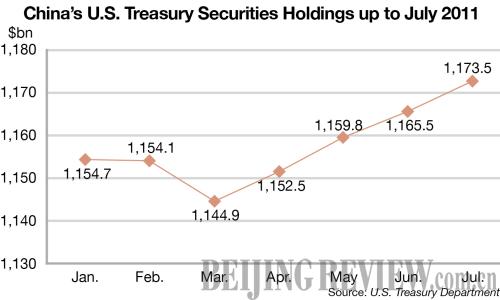

Moreover, not all the additional U.S. Treasury bonds in China's official foreign exchange reserves are purchased with increased principal. Instead, a large part of them are bought with China's investment returns. China has reaped increasing profits from its foreign exchange reserve investment. The country's balance of payments statements show investment income soared from $35.6 billion in 2005 to $131 billion in 2010.

In light of these factors, there is reason to believe U.S. Treasury Department data may give a false impression that China keeps pumping new foreign exchange reserves into U.S. Treasury bonds.

While China relies on the United States as one of its main export markets, the United States depends on financing from China. This so-called "balance of financial terror" has helped ensure the stability of Sino-U.S. relations. If Washington assumes Beijing will continue to boost its Treasury bond holdings no matter how badly the U.S. economy performs, the balance will be tilted, posing risks to overall Sino-U.S. relations.

The debate over the national debt ceiling in the United States has brought to light flaws in U.S. political and economic systems. The moral hazards created by U.S. politicians' calling for "selective default" have also sounded the alarm for investors. If it wants to prevent China from selling Treasury bonds, the United States must guarantee the safety of China's investment.

U.S. Treasury bonds and China's investment safety were high on the agenda during U.S. Vice President Joe Biden's visit to China in August. While in China, Biden projected an air of modesty almost unparalleled by other visiting senior U.S. officials since the two countries established diplomatic relations in 1979.

In particular, he said the United States appreciated China's investment, showing Washington has acknowledged the rise of China's status in the two countries' economic relations. He applauded China so much that conservative U.S. media accused him of cozying up to the country.

Biden, of course, made pledges to reassure China on U.S. debt. Presumably, he would have promised the U.S. Government will pursue a responsible fiscal policy, cut its public debt and refrain from debt default.

Considering the United States' importance to the economies of China and world at large, the Chinese Government will take a prudent stance on its holdings of U.S. Treasury bonds. But Washington should see to it that the emerging moral hazards in the United States do not harm its interdependent relationship with China.

The author is an associate research fellow with the Chinese Academy of International Trade and Economic Cooperation

|