|

|

|

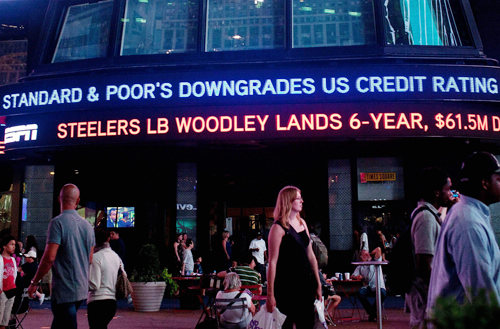

DOWNGRADING THE COUNTRY: A news ticker on Standard & Poor's lowering of the United States' credit rating in Times Square, New York City, on August 5 (XINHUA/AFP) |

The months-long debt ceiling debate in the United States has affected the global financial market, and its impact may further spread to the real economy and even change world political and economic structures. Although the debating parties reached a deal before the deadline of August 2, the ensuing stock market disaster that swept stock exchanges across the world and rating agency Standard & Poor's downgrade of the United States' sovereign credit rating on August 5 fully displayed the impact of the debt ceiling debate.

The risk of a U.S. Treasury bond default, which was previously unimaginable, was thrust in front of creditors around the globe as some Republican congressmen proposed postponing U.S. Treasury bond interest payments. As the biggest overseas holder of U.S. bonds, China's eyes have been glued to the matter.

Ideals and reality

U.S. Treasury bonds, originating from war bonds issued by the Continental Congress during the American War of Independence, have a history even longer than that of the federal government. When it was established in 1789, the U.S. Federal Government had a debt balance of $75 million.

The principle of a balanced budget held by the third U.S. President Thomas Jefferson dominated orthodox fiscal theories in the United States. Although the functions of the U.S. fiscal budget were changed by the Great Depression (1929-33) from funding the government to one of the most important regulating levers of the U.S. economy, and fiscal deficits are consciously and perennially used, claims of a balanced budget and tax reduction have been dominating the commanding height of U.S. society. As a result, conflicts tend to arise when the administration attempts to stimulate economic growth by using fiscal policy tools at the cost of deteriorating fiscal situations and raising taxes during an economic crisis. That is why the debt ceiling debate has continued for so long.

During the sub-prime mortgage crisis in 2008, the U.S. monetary policy fell into a zero-interest-rate trap, and the fiscal policy became the only choice for the country to deal with the crisis. Moreover, of the two major fiscal stimulus tools, public investment is more effective in stimulating the economy than tax reduction. But in a country that has spent on deficit for several decades and accumulated astronomical government debts, a massive anti-crisis fiscal policy has inevitably exacerbated the country's financial problems.

Since the United States was born on the struggle against colonial taxes, the public has embraced tax reduction. Many Americans were disappointed at the inadequate efforts by the Obama administration to cope with the crisis. In addition, American people were quite discontented because the government rescued the morally degenerated financial industry and increased fiscal deficits, so it's only natural that this disappointment turned to rage.

On April 15, 2009—the deadline for tax return filing—massive anti-tax protests broke out in American cities such as Washington, D.C., Chicago and Boston. This echoed the actions of colonists, who in 1773 raided British ships in Boston Harbor and dumped barrels of tea overboard in protest of a British tea tax. Today, just as then, a movement was born—the Tea Party Movement, which has since become a major player in the U.S. political arena.

After the midterm election in 2010, Republicans gained control of Capitol Hill, and it became inevitable that they would snipe the Democratic Obama administration when the balance of U.S. bonds neared its ceiling of $14 trillion. Robbing Peter to pay Paul—that's how the U.S. Government has financed its spending for years. Had the debate of raising the debt ceiling not been settled on August 2, there would have been serious consequences: either a replay of the farce of a federal government shutdown, or a default of the national debt.

|