|

|

|

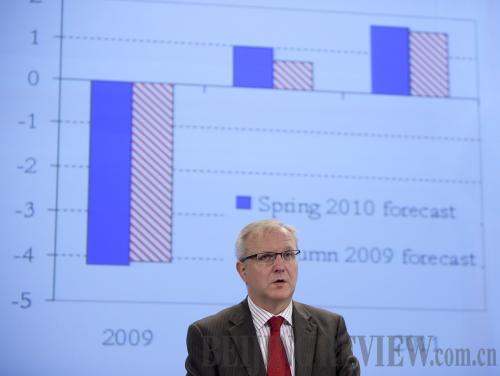

GOOD NEWS: European Commissioner for Economic and Monetary Affairs Olli Rehn presents the spring forecast for the European economy at a press conference in Brussels on May 5. The forecast said the EU economy would grow by 1 percent in 2010, 0.25 percentage points higher than the prediction in autumn last year (XINHUA) |

What's more, a high long-term interest rate will increase financing costs, and thus harm the banking sector.

In addition, banks will probably be exposed to systemic risks resulting from a high long-term interest rate. On the one hand, fiscal austerity will negatively influence economic growth. A real economy with a poor performance will impose a bigger credit risk on banks. On the other hand, a high interest rate raises investment costs and restrains private investment, which is bad news for bank lending.

Policy coordination

The Greek sovereign debt crisis left two lessons for Europe. One is that there are severe structural problems with the European economy. The other is that Europe's economic and fiscal policy coordination has serious shortcomings. Inside a highly integrated economy, a lack of coordination will only aggravate problems. In order to tackle the crisis and prevent unfavorable situations in the future, Europe needs to establish a sound coordination system.

Reforms are necessary to resolve the structural defects of the European economy. The current problems will not automatically disappear after economic recovery, as they emerged as long-term defects in the past decade, when economic growth was robust.

Problems in labor, product structure and service markets, as well as in the financial sector are the major reasons for the EU member states' current account differences. Economic disparities among eurozone member states have existed since the introduction of the euro. Internal imbalances in the euro zone are a reflection of the differences in the member states' economic structure.

Europe needs to solve its problems through coordination. First of all, it should strengthen the corrective and preventive role of the Stability and Growth Pact. All EU member states should implement fiscal management systems in line with the pact. This is good for strengthening fiscal discipline in the long term. In addition, finance ministers should strengthen the sense of responsibility and independence. This can be realized through submitting stability plans to the member states' parliaments.

Second, Europe should deepen its economic policy coordination. A mere reliance on fiscal policy cannot solve the underlying problems of the euro zone. The recently established eurozone countries' competitiveness surveillance system is an example of strengthened coordination.

Third, it is essential to establish a full-fledged crisis resolution mechanism. Emergency assistance should be provided only under certain financial and economic conditions. While the aid for Greece was indispensible, the EU member states and the IMF also imposed strict conditions on the loans to Greece. These conditions were set under the crisis resolution mechanism.

The author is a researcher with the Institute of European Studies of the Chinese Academy of Social Sciences |