|

Road ahead

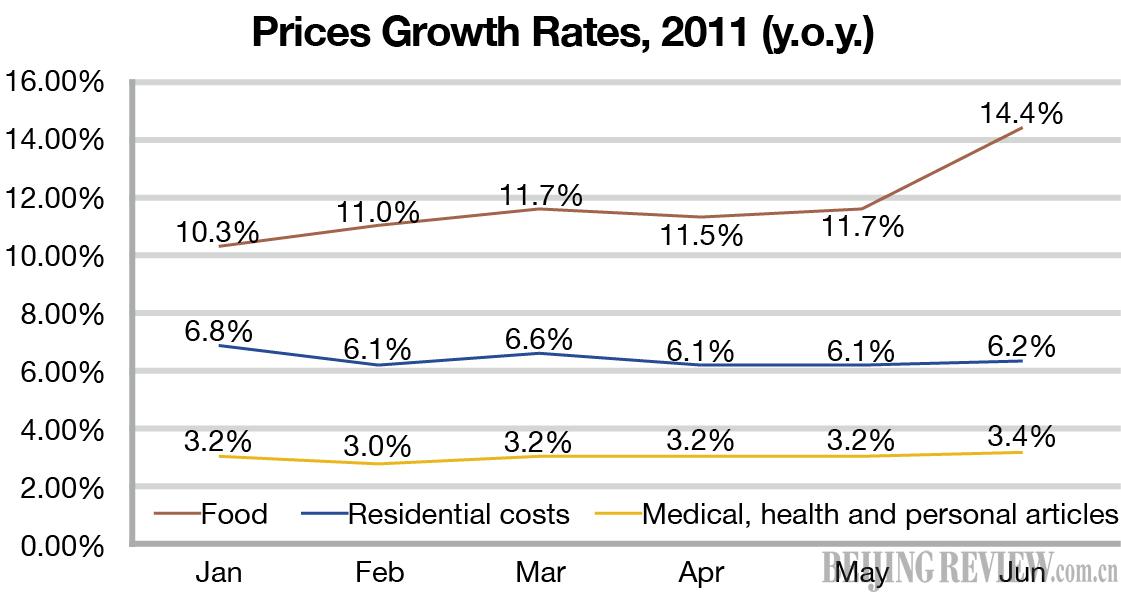

"China needs to strike a balance between maintaining growth and taming inflation," said Ba Shusong, Deputy Director of the Research Institute of Finance at the Development Research Center of the State Council.

But for the rest of the year, will policymakers continue tightening the credit screws to combat inflation? Economists are divided over the issue.

Over-tightening, Ba said, would drain steam out of the already weakening economy for three reasons. First, a string of small and medium-sized enterprises are already struggling to make ends meet due to a lack of credit. Second, over-tightening may lead to a break in the cash flows of many infrastructure projects, worsening the debt risks of local governments. Third, property developers are also coming under intense financial pressures as home sales nose-dive, curtailing real estate investments.

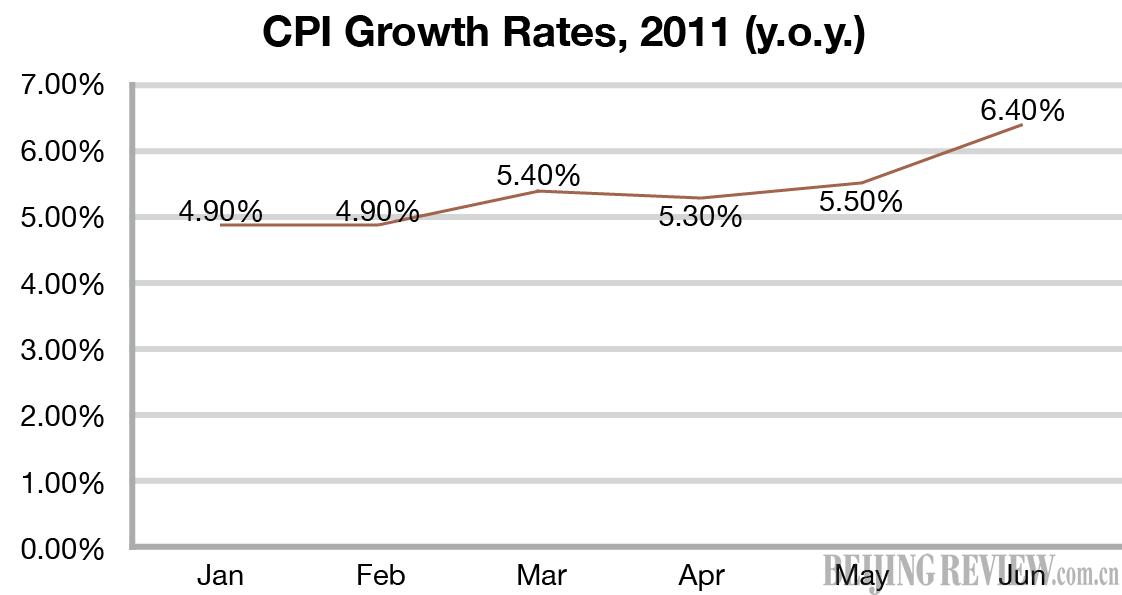

"With a coming decline in headline inflation and rising concern on growth, I believe the chance for further interest rate hikes this year is small," said Lu Ting, an economist at the Bank of America Merrill Lynch. "We expect CPI growth to fall steadily after June to around 4-4.5 percent at year-end and then will stay there for a couple of years."

"The battle against inflation is still on, although China's tightening cycle is likely close to the end," said Qu Hongbin, chief China economist at HSBC, forecasting inflation will start to slow in China in the second half of this year.

But Andy Xie, an independent economist and a director at Rosetta Stone Advisors Ltd., disagreed.

"The government is less likely to relax its efforts to combat inflation, the biggest risk for the economy," he said. "There will probably be two to three more interest rate hikes this year since the country's benchmark one-year deposit rate remains negative in real terms."

|