|

Numbers of the Week

1%

Average home prices in 70 medium-sized and large cities grew 1 percent in July year on year.

5.5%

Energy consumption in China grew 5.5 percent annually on average in the past three decades, much lower than the average 9.8-percent annual GDP growth.

TO THE POINT: The Chinese economic rally has solidified as reflected in July macroeconomic data. Investment and consumption remained the biggest propellants of economic growth, while export decline slowed due to improved overseas demand. Inflation is not a problem for the time being as July's inflation indexes both stayed in the negative territory. New loans nosedived in July as the second half of the year has seen many companies pay back their loans. Auto figures this year show that China has replaced the United States as the biggest auto market in the world.

By LIU YUNYUN

Economic Figures

CPI & PPI

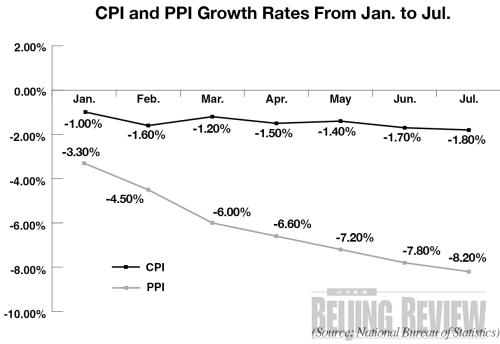

The consumer price index (CPI), a barometer for inflation, remained in negative territory in July, and dropped 1.8 percent from a year earlier.

The producer price index (PPI), an inflation gauge on the wholesale level, fell 8.2 percent in July year on year, the eighth month to experience a drop since December 2008.

The negative CPI growth cleansed recent worries of inflation, but aroused jitters over deflation, which is believed to be more disastrous since it is characterized by low demand, low prices and low income.

China is counting on consumption to offset the negative impact brought about by export deterioration. Deflation will almost certainly not solve this problem as the government has hoped. The deterioration could lead to a serious economic recession if no proper measures are taken.

Lu Zhengwei, Chief Economist at Fuzhou-based Industrial Bank Co. Ltd., said the CPI has already bottomed out, but when the PPI would begin to grow remains a question. He expected the PPI to experience positive growth in the third quarter of this year.

The government is now contemplating water price increases, and will deliberate the price hikes of resource products like electricity and natural gas, which are believed to be important factors that might prop up price indexes in the second half of this year.

Industry

China's industrial output rose 10.8 percent in July year on year, the second double-digit growth since September last year, thanks to the government's powerful fiscal and monetary stimulative policies taken after the outbreak of global financial crisis.

In July, the output of heavy industry rose 11.3 percent and light industry was up 9.2 percent. All 39 sectors posted year-on-year growth, with textiles up 8.6 percent, and chemical materials and products up 11.7 percent.

Retail sales

A total of 993.7 billion yuan ($145 billion) worth of goods were sold in China in July, growing 15.2 percent year on year. But the growth rate was 8.1 percentage points lower than that of July last year.

The Chinese Government pinned hopes on consumption to drive domestic economic growth against the backdrop of export declines. However, the retail sales slowdown indicated it might not be immediately helpful in that many people have put more savings into stock and property markets with hopes of getting a windfall in the market rally.

Fixed-asset investment

In the first seven months of 2009, urban fixed-asset investment stood at 9.6 trillion yuan ($1.4 trillion), growing nearly 33 percent year on year.

The growth rate slowed down compared with that of the first-half performance.

Rising investment showed investors' recovered confidence in the economy. But most of the investment was conducted by state-owned enterprises, leaving little room for private companies, which complained of enormous difficulty in getting bank loans.

Economists are calling on the government to take measures to encourage commercial banks to lend money to small and medium-sized enterprises, but no real effect is in sight.

(Source: National Bureau of Statistics)

New loans

July's new loans plummeted in sharp contrast with the surges in the previous six months. In July, commercial banks lent out 356 billion yuan ($52 billion), less than one quarter of what was borrowed in June, according to data from the People's Bank of China, the central bank.

The freefall of new loans came as no surprise to analysts, who had been ringing alarm bells for the government to keep a vigilant eye on the ballooning loans that had flooded the stock and property markets.

Merrill Lynch said a breakdown of new loans suggested that excessive liquidity and funding were not a problem for the Chinese economy.

The 1.5-trillion-yuan ($219-billion) new loans in June was not so real in that bank managers rushed to make loans at the end of June in order to boost their quarterly-end performance. In the second half of this year, the corporate sector might need to first digest those loans borrowed in previous months before moving forward.

Fiscal revenue

The national fiscal revenue secured double-digit growth in July by growing 10.2 percent to 669.59 billion yuan ($98 billion) from the same month last year. It was the second double-digit growth this year.

The Ministry of Finance attributed the growth to escalating sales taxes by the economic revival. Major contributors to the revenue growth were the refined oil tax, which was hiked five times more than the previous rate at the end of 2008, as well as a high consumption tax levied on cigarettes.

Fiscal expenditures in July rose 9.3 percent from a year earlier to 498.57 billion yuan ($73 billion).

Foreign trade

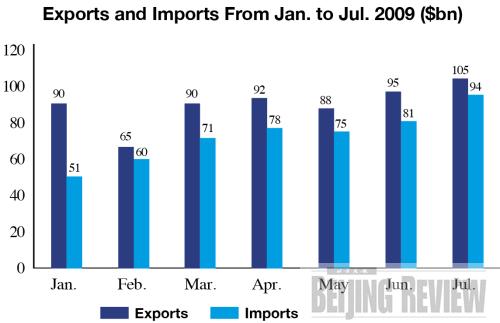

China customs data showed that the country's exports and imports fell 19.4 percent in July, the ninth consecutive month to fall, compared with July 2008. However, despite the year-on-year decline, trade with other countries has gradually gained momentum on a monthly basis since March this year.

In July, exports amounted to $105 billion, a decrease of 23 percent from a year earlier, while the import drop was slower, at 14.9 percent to almost $95 billion.

From January to July, China exported $627.1 billion and imported $519.6 billion, down 22 percent and 23.6 percent, respectively.

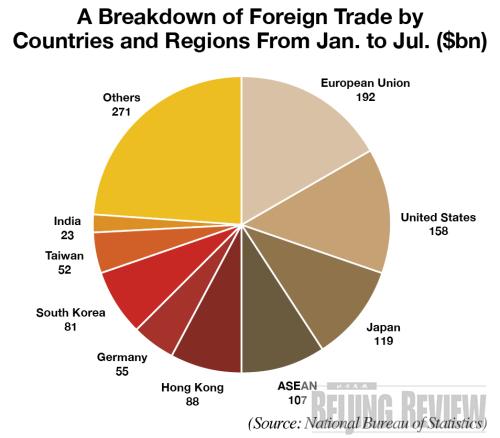

The EU remains the biggest trade partner, followed by the United States, Japan and the Association of Southeast Asian Nations.

In spite of the current recovery, the Ministry of Commerce admitted the country is still facing stiff headwinds in reversing export slides, citing uncertainties in the international economic recovery and external demands.

Auto Overcapacity

China secured its position as the world's biggest auto market as demonstrated in the July sales figures.

In July, a traditionally bleak month for automotive purchasing, auto sales soared 63 percent to 1.08 million units compared with the same month last year, according to the China Association of Automobile Manufacturers (CAAM). Passenger vehicle sales took the lead in driving the market, due to the government's favorable policies, including tax breaks for purchases of low- emission vehicles.

According to the announced production plans, the 14 major automakers in China will be capable of producing 15.82 million autos in 2010. But CAAM estimated that total sales will linger around 11 million in 2009. A 43-percent sales rise in 2010 is highly unlikely.

Zhang Xin, automobile analyst at Guotai Jun'an Securities Co. Ltd., warned of an overcapacity problem which would soon take place in the second half of this year. The biggest problem brought about by overcapacity is vicious price wars, said Zhang. |