|

|

|

SETTING UP: Workers put up huge wind turbines during construction of the second phase of Rudong wind farm (GAO XUEYU) |

At present, Longyuan is moving on to develop the second phase of wind power projects at Rudong, which are scheduled to begin full production in October this year. By then, the total installed capacity of Longyuan in Jiangsu Province will reach 350 megawatts, capable of generating 800 million kwh a year, which can meet the power demand of roughly 800,000 residents a year.

The nation at a glance

The Rudong wind farm is just one example of the white-hot wind power development in China.

The country is now mapping out an ambitious blueprint for wind power development.

According to targets stated in the Middle and Long-Term Development Plan of Renewable Energy, passed by the State Council in 2007, total installed wind power capacity will reach 30 gigawatts by 2010 and surpass 100 gigawatts by 2020.

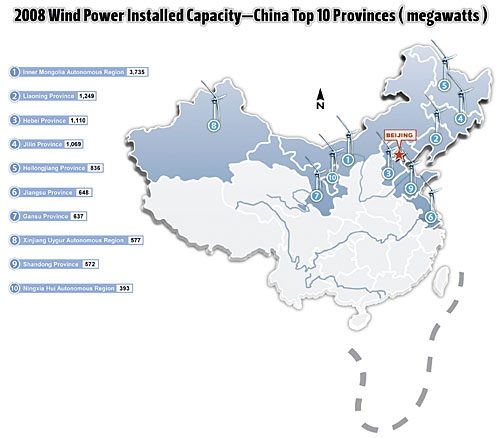

To achieve the goal in 2020, China will build seven large wind power bases, each with installed capacity of over 10 gigawatts, in six provinces and autonomous regions, said Shi Pengfei, Vice Chairman of the Chinese Wind Energy Association. Inner Mongolia Autonomous Region will shoulder the biggest proportion, having two such proposed bases with planned installed capacity reaching 5.78 gigawatts by 2020.

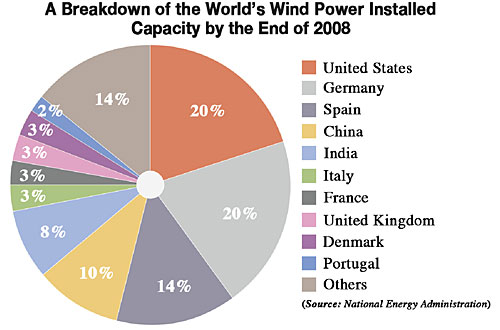

China's soaring wind power industry is aided by favorable government policies and advances in technology, with installed wind power capacity growing 70 percent annually. By the end of 2008, the country had built up 239 wind farms with total installed gross capacity of 12.17 gigawatts, according to NEA figures.

In 2008, wind farms sent 14.8 billion kwh of electricity to the power grid, enough to meet the electricity consumption needs of 10 million urban households.

The grand plans have triggered white-hot competition among wind turbine manufacturing companies. Both foreign and domestic suppliers are fighting to grasp slices of the huge Chinese market. The U.S.-based General Electric, Denmark's Vestas Wind System A/S and Siemens AG of Germany are major players in the arena. They have all either directly exported wind power equipment to China or set up a joint venture manufacturing company with a Chinese counterpart. For instance, the wind turbines installed at the Rudong wind farm are products of GE's joint venture with local manufacturers in Liaoning Province.

Foreign suppliers dominated half the market until 2006, but since then they have lost market share to rising domestic manufacturers. Some companies, such as Dalian Sinovel Wind Co. Ltd., China Dongfang Electric Corp. and Goldwind Science & Technology Co. Ltd., are capable of producing wind turbine generators with unit capacity of 1.5 megawatts. Domestic manufacturers now take up three quarters of the domestic market.

But the industry's rapid growth has raised concerns about overheated development. "We believe wind power equipment, especially turbine production, will face an overcapacity problem in the short term," Guodu Securities Co. Ltd. said in a report.

Judging by figures from the China Electricity Council, about 30 percent of established wind power facilities are idling due to various reasons. Meanwhile, the shrinking market demand in developed countries will push manufacturers to dump wind power equipment in China.

NEA official Shi Lishan also warned investors of overcapacity risk and called for rational investment.

The wind puzzle

Though overcapacity has emerged in the wind power industry, its utilization is far from mature.

In an interview with Beijing Review, Shi revealed several problems in the development of wind energy.

Since wind speed is not constant, the power generated by wind is highly variable from hour to hour, day to day and season to season. The irregularity of wind energy poses a big challenge to power grids, which are designed for controllable and stable electric currents. More research needs to be carried out in connecting mass wind power to the grids.

Moreover, the areas with rich wind resources are mostly remote, sparsely populated and far from power grids. Delivering the electricity generated by wind thus remains a big problem.

Domestic wind power equipment manufacturers must also devote more resources to research and development. At present, there are numerous wind turbine manufacturers but they have a limited scale of production. Many of them directly import turbines from foreign countries or use foreign technologies, as they lack independent research abilities.

Wind power companies also require more policy support. Shi said that although the government has taken a series of measures to encourage wind energy development, in many cases, it is difficult to implement those policies. He called for detailed and feasible policies to back wind power developers.

|