The world's largest chipmaker, Intel, is sending a ripple effect through its pool of labor globally, including in China, with the announcement of deep workforce cuts.

On September 5, Intel announced a two-year effort to reduce its workforce by 10 percent, while cutting $5 billion in costs.

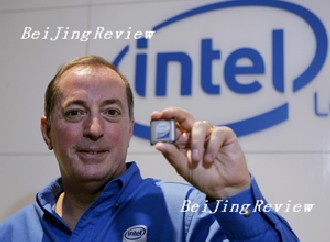

"These actions, while difficult, are essential to Intel becoming a more agile and efficient company, not just for this year or the next, but for years to come," commented Paul S. Otellini, Intel's president and CEO, in a statement.

If the cuts are to be proportionate to Intel's geographic markets, observers speculate that Intel China could lose some 600-700 people, although such specifics are not yet known as Intel is in a "quiet period" and will not reveal more details until the release of financial results on October 17.

Restructuring, however, is more likely to focus on bloated structures and failed business lines in Intel's properties in developed economies, where growth is stagnating, than emerging markets where growth prospects remain promising, such as China.

In spite of the cuts, the Shanghai Daily reported September 16 that in the coming five years, Intel will invest $30 million in China with special focus on people living in rural areas to raise revenues.

In the long term, the restructuring may actually strengthen the role of Intel China within the parent's corporate structure. At a minimum, the company's history in China, its strategy here and recent executive comments (albeit made before the restructuring was announced) suggest the cuts won't unfavorably impact Intel's China operations.

The cuts in context

Best known for its Pentium and Celeron microprocessors (about four fifths of new PCs have them), Intel started operations in China in 1985, albeit modestly with one person in the Beijing office. Three years later, the company established a joint venture and as the PC industry in China started to grow in the 1990s, Intel began its real push to "support and drive the development of China's IT industry."

Currently, with more than 7,000 mostly local employees in 13 cities, Intel has devoted $1.3 billion in direct investment to China. Through a virtuous circle, it has benefited from China's rapid growth while contributing to it technologically.

So while Intel China will not be unaffected by the worldwide restructuring, as promised by the company's executives, Intel's long-term vision of growth in China will remain.

While Intel currently will not reveal more restructuring details, two executives, in speaking with Beijing Review sometime before the cuts were announced, suggested a prosperous future for Intel China.

"We are quite proud of the enabling work we have done," said Wee Theng Tan, President of Intel (China) Ltd. and North Asia Director. "We have been growing with China."

Meanwhile, James Jarrett, Intel Vice President and Director of Worldwide Government Affairs, who also served as president of Intel China from 1996-2000, suggested the company prefers to scale up in China, not down.

"In China, we have followed the dictum of Andy Grove, Intel's former CEO, that we should build on success," Jarrett said. "The economic interdependencies between the United States and China are deep and growing. You really need to tap into the wealth of engineering talent in China and participate in emerging markets. If you don't participate there, somebody else will."

Intel inside China

And regardless of employee cuts, there's strong evidence that Intel wants to grow even more with the China market. That, after all, is what has been happening.

"Today, we have invested over $1.3 billion in R&D and test and assembly, and grown our sales and marketing operations to over 300 cities," said Intel PR manager Nancy Chang after the cuts were announced. "The strategic importance of the China market to Intel's global business is growing."

Intel has deep roots in China not only because it has manufacturing or sales offices here, but because it catalyzed China's IT industry, contributing to the development of Chinese PC manufacturers Lenovo, Founder and TCL.

"Some of these emerging PC producers are now household names," Tan said. "Our work and cooperation with Lenovo began when it was still a small company looking at opportunities to expand. From Intel's standpoint, its success was important to the success of the Chinese IT industry."

More recently, Intel has signed memorandums of understanding with four provinces (Heilongjiang, Hubei, Shanxi and Shandong) to establish government-assisted PC programs to improve the availability, affordability and accessibility of PCs across China. It has discussed similar programs with 10 additional provinces.

"China is a very bipolar market," Tan said. "In order to overcome the digital divide, it is critical to develop the rural market for PCs and thereby support growth."

Supporting growth is more investment than favor though, and Intel has been witnessing significant returns.

Between 2000 and 2005, the proportion of Intel's revenue in the United States halved from $12.4 billion to $5.7 billion, while that from China more than doubled from $2.1 billion in 2003 to over $5.3 billion in 2005.

Short-term pain, long-term health?

Intel has not been immune to inflection points, but it has managed to survive them more profitably than its rivals.

In the 1980s, Intel exited the DRAM memory business. In the early 1990s, a flaw in the Pentium chip led to a microprocessor recall that reportedly cost $500 million.

And due to outstanding localization, Intel ranked again among the top 10 "Best Employers in China" in 2005 by Hewitt Associates.

Competition, however, has become more innovative technologically.

In response to competitive attacks by Advanced Micro Devices (AMD), Intel has launched a slew of well-received products, but a price war has squeezed its profit margins.

In the second quarter, Intel's share of the worldwide chip market shrank from 13.2 percent to 11.4 percent. At the same time, Intel's share of the microprocessor market declined from 82 percent to 73 percent, while AMD's rose from 16 percent to 22 percent.

The two rivals are not of equal weight. Last year, both companies experienced sales growth. But, while Intel's revenues were $38.8 billion, AMD's were $5.8 billion.

The critical difference is in productivity. Last year, Intel had 99,000 employees, against AMD's 9,860 people. A single employee of AMD accounted for $593,000 in sales, against just $389,000 at Intel.

And the productivity difference is deepening. Last year, the number of employees at Intel grew by 17.5 percent, while AMD's actually shrank by 38 percent.

In order to achieve a lot more with a lot less, Intel had to initiate worldwide restructuring and cuts. The reductions are expected to trim Intel's work force from 102,500 employees at the end of the second quarter, to 92,000 by mid-2007.

Despite a massive recruitment campaign at the end of last year, Intel China has reportedly suspended most positions involved, while several hundred employees may be affected by recent cuts.

But the fact remains that unlike the United States, China has been Intel's growth market in recent years.

Dr. Dan Steinbock (dsmba@hotmail.com) is the ICT research director of the India, China and America Institute

|