|

|

|

The Bank of China's yuan clearing center in Paris is unveiled on December 3, 2014 (XINHUA) |

China's currency, the yuan, ascended to a higher global status in 2014, with the value of cross-border payments by the currency accounting for 23.6 percent of total cross-border payments, according to a report on the globalization of the yuan released by the People's Bank of China, the country's central bank, on June 11.

Data from the Society for Worldwide Interbank Financial Telecommunication shows that the yuan became the second most used currency in trade finance—letters of credit and collections, the fifth most popular payment currency and the sixth most used foreign exchange currency in the world in December 2014.

In an effort to make the yuan an international currency in a real sense, China is pressing ahead with financial reforms so that the yuan can become part of the basket of currencies determining the value of Special Drawing Right (SDR), an international reserve asset created by the International Monetary Fund (IMF) in 1969.

Allocated to IMF members on the basis of their contribution to the fund, SDR represents a claim to foreign currencies for which it may be exchanged in times of need. Currently, the SDR basket consists of four currencies—the U.S. dollar, euro, British pound and Japanese yen. The composition of the SDR basket is due for a once-in-five-year review this year. China has been seeking inclusion of the yuan so that the currency will be recognized as an international one.

In a display of support, IMF president Christine Lagarde said in March that the yuan's inclusion in the SDR basket is "not a matter of if, but when."

A team dispatched by the IMF visited China on May 15-16 to hold technical discussions with the country's monetary authorities, as part of the preliminary evaluation on whether to include the currency this year.

China will cooperate with the IMF on the assessment of the yuan's readiness to be included in the SDR basket of currencies, said Wang Yungui, director of the policy and regulations department at the State Administration of Foreign Exchange, during a news conference on June 17.

"We will actively push for SDR entry and assist the IMF on the evaluation," he said. "SDR entry is a major step in yuan internationalization and of great significance in easing financial risks."

If the yuan is included in the SDR basket, its status as a global reserve currency will be significantly enhanced. In addition, inclusion into the SDR basket will to a great extent catalyze reforms in China's financial markets, especially in foreign exchange administration and yuan convertibility under the capital account.

Gaining popularity

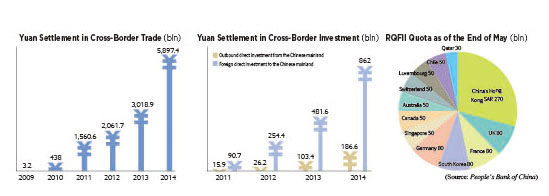

According to the central bank report, the Chinese currency is enjoying a greater popularity in cross-border trade and direct investment. In 2014, yuan payment under the current account totaled 6.55 trillion yuan ($1.06 trillion), surging 41.6 percent year on year. Outbound direct investment from the Chinese mainland priced in the Chinese currency totaled 186.56 billion yuan ($30 billion), a 117.9-percent increase, while foreign direct investment onto the Chinese mainland settled in the Chinese currency amounted to 862.02 billion yuan ($138.87 billion), a year-on-year jump of 92.4 percent.

Over the past year, China has also promoted the expansion of currency swap agreements and direct trading between its yuan and other currencies as well as the establishment of offshore yuan hubs.

China had signed currency swap agreements worth a total of 3.1 trillion yuan ($499.4 billion) with 32 overseas monetary authorities as of the end of May. Offshore yuan clearing and settlement services have been offered in 15 countries and regions across the world, read the central bank report.

In addition, remarkable progress has been made in the convertibility of the currency under the capital account. In 2014, the Shanghai-Hong Kong Stock Connect program, which allows mainland and Hong Kong investors to trade shares on each other's bourses, was launched; overseas institutions were able to issue yuan-denominated bonds on the Chinese mainland more conveniently; and foreign exchange administration under the capital account was further simplified by central authorities.

China is not far away from full convertibility of the yuan under the capital account, the central bank said.

Lu Zhengwei, chief economist with Industrial Bank Co. Ltd., attributed the rising popularity of the yuan to three factors.

China is speedily accumulating weight and influence in the global economy; its foreign trade, outbound direct investment and inward foreign direct investment are increasing fast; and finally, the central bank is making continuous efforts in promoting the cross-border use of the yuan, as evidenced by it signing currency swap agreements with an increasing number of economies and establishing more overseas yuan clearing banks, Lu summarized.

Zhang Monan, an associate research fellow at the China Center for International Economic Exchanges (CCIEE), said the globalization of the Chinese currency will be further pushed forward with the establishment of the Asian Infrastructure Investment Bank and the construction of the China-proposed Silk Road Economic Belt and 21st Century Maritime Silk Road Initiative.

According to Zhang, China has been promoting the use of the yuan in cross-border trade settlements since 2009. In the meantime, as the country transforms from a goods-exporting nation to a capital-exporting one, the Chinese currency has more room to be used in investment, compared to mostly being used in trade settlements, she said.

"The quick pace of the yuan's globalization is an inevitable result of China's cooperation with other countries as well as government support in this regard," Zhang said. "More and more countries hope to piggyback on China's success to boost their respective domestic economies."

"Also, the rapid overseas expansion of Chinese businesses makes the yuan more frequently used and better accepted worldwide," Zhang said.

Time to join the club?

According to the central bank report, further efforts will be made to improve infrastructure for the yuan's global use, to expand the yuan's use under the current account, to encourage the issuance of yuan-denominated bonds overseas, to sign currency swap agreements with more overseas monetary authorities and, most importantly, to actively advocate for the yuan's inclusion in the SDR basket.

A currency must be fully convertible for it to be included in the SDR basket. Therefore, China is expected to ease its tight control of the yuan to make the currency more freely usable than it is now. Central bank governor Zhou Xiaochuan said that laws and regulations will be revised and the upper limit of interest rates and quota on cross-border capital flow will be lifted within the year.

On May 26, the IMF said China's yuan is no longer undervalued after its recent substantial appreciation, but the

government should quicken reforms to get to having "a floating exchange rate." This is the first time in a decade that the IMF has changed its label that the yuan is undervalued.

"While the undervaluation of the yuan was a major factor causing the large imbalances in the past, our assessment now is that the substantial real effective appreciation over the past year has brought the exchange rate to a level that is no longer undervalued," the IMF said.

"We believe that China should aim to achieve an effectively floating exchange rate within two-three years," the IMF said.

Zhang, the research fellow with CCIEE, called this a momentous achievement for the Chinese currency.

It signals that substantial progress has been made in the yuan exchange rate formation mechanism and makes it more likely to be included into the SDR basket, Zhang said.

According to Lu, if a currency wants to be included into the SDR basket, it should account for a certain proportion in global trade settlement, and more importantly, it should be freely usable.

"China has become the world's largest goods trading nation; therefore, the first criterion will definitely be met. However, the second criterion is under dispute. China has yet to completely open up its capital account and realize the floating exchange rate."

Tan Yaling, President of China Forex Investment Research Institute, warned that becoming an international currency means incurring more risks as well as taking on more responsibilities.

All the four currencies in the SDR basket can be freely converted, therefore, if the yuan hopes to join the club, full convertibility of the currency should be achieved as soon as possible.

"Otherwise, it will have a very awkward status after being included in the SDR basket," Tan said during an interview with Hexun.com, a financial news portal.

That said, Tan argued the yuan is far from challenging the dominant status of the U.S. dollar.

"It's already a great success if the yuan can survive, develop and get stronger under the dominance of the dollar," said Tan. "It's way too early to discuss when the yuan can have an equal status with the dollar or even supplant it."

Copyedited by Kylee McIntyre

Comments to zhouxiaoyan@bjreview.com |