|

Sheng predicted that China's economy will grow at a stable and faster pace in the fourth quarter. While ongoing industrialization and urbanization will continue to provide impetus for China's economy, the further development of central and west China as well as the upgrading of the consumption structure will bring about more opportunities, said Sheng. Moreover, the Chinese Government is energetically promoting reforms and innovation, which will also greatly jack up the economy.

The World Economic Outlook Report released by the International Monetary Fund on October 7 predicted China's economic growth will linger at 7.4 percent in 2014 and slow down to 7.1 percent in 2015.

"The sluggish credit growth will continue to affect investment, and at the same time, the housing market will be stagnant as it is," said the report.

UBS Securities economist Wang Tao believed the property market will maintain its downward trend next year, because the recent decline is really a result of supply exceeding demand.

The East Asia and Pacific Economic Update published by the World Bank on October 6 predicted China's GDP growth will level off at 7.4 percent in 2014 and drop to 7.2 percent in 2015. As it stated, the Chinese Government has taken a series of measures to contain local government debts, crackdown on shadow banking, eliminate overcapacity, and in particular to curb environmental pollution, which if left unchecked will further pull down the growth of investment and the output of the manufacturing industry.

These measures and policies will put the Chinese economy on the track of more sustainable development, the report said.

Email us at: dengyaqing@bjreview.com

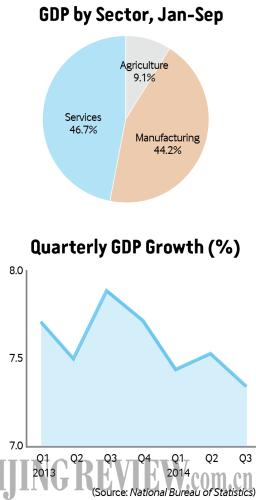

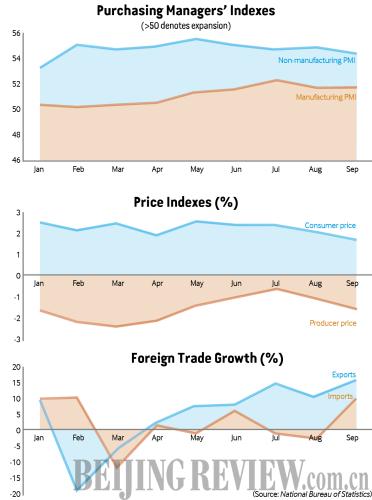

Macroeconomic Indicators, Q1-Q3

- Consumer price index (CPI), the main gauge of inflation, rose 2.1 percent.

- Producer price index (PPI), which measures inflation at the wholesale level, contracted 1.6 percent.

- Foreign trade increased 3.3 percent to $3.16 trillion. Exports increased 5.1 percent to $1.69 trillion while imports increased 1.3 percent to $1.47 trillion.

- Inward foreign direct investment (FDI) onto the Chinese mainland stood at $87.36 billion, down 1.4 percent.

- Outward FDI from the Chinese mainland stood at $74.96 billion, up 21.6 percent.

- Value-added output of industrial enterprises above a designated size—principal business revenue of more than 20 million yuan ($3.15 million) a year—grew 8.5 percent.

- Fixed assets investment totaled 35.79 trillion yuan ($5.85 trillion), up 15.3 percent with inflation deducted.

- Retail sales totaled 18.92 trillion yuan ($3.09 trillion), up 10.8 percent with inflation deducted.

- Per-capita disposable income of urban residents stood at 22,044 yuan ($3,601.08), up 6.9 percent with inflation deducted.

- Per-capita cash income of rural residents stood at 8,527 yuan ($1,392.96), up 9.7 percent with inflation deducted.

- New yuan-denominated loans amounted to 7.68 trillion yuan ($1.25 trillion), 404.5 billion yuan ($66.08 billion) more than the same period last year.

- As of the end of September, M2, a broad measure of money supply that covers cash in circulation and all deposits, reached 120.21 trillion yuan ($19.64 trillion), up 12.9 percent.

- Fiscal revenue rose 8.1 percent year on year to 10.64 trillion yuan ($1.74 trillion).

(All growth rates are on a year-on-year basis)

(Sources: National Bureau of Statistics, Ministry of Commerce, Ministry of Finance)

|