|

Long-term prospect

In spite of the favorable new lending policies, some analysts have cautioned investors against thinking that the housing market could stage a stunning recovery. A glut of unsold or unoccupied homes and buyers' expectations of further price declines could temper any rebound.

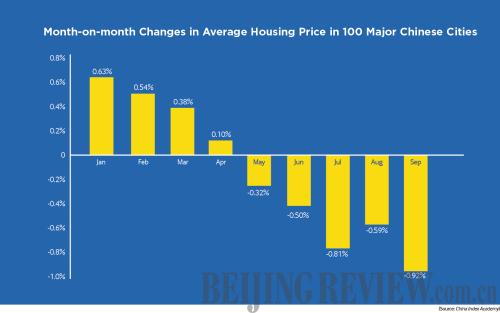

Chen Xiaotian, Deputy Secretary General of the Market Commission with the China Real Estate Association, said that it is hardly feasible to reverse the downward trend of the property sector in the immediate term. Chen forecasts that housing prices will continue to fall in November and December, but will pick up in the second half of 2015.

"Housing purchase deals have been shrinking since the beginning of this year, which means demand is stacking up. Since July, China's top 20 real estate developers have bought the least land in two years, which will result in a lack of supply in the second half of 2015," Chen elaborated.

Wang Tao, Chief China Economist at UBS, said this round of housing market adjustment is entirely different from previous adjustments.

"The total supply has exceeded demand. Also, there has been a misallocation of resources. A glut of homes have been built in third- and even fourth-tier cities, while most people prefer to live in first- and second-tier cities," Wang said.

Qin Hong, Director of the Policy Research Center with the Ministry of Housing and Urban-Rural Development, said China's property market is mired in an industry-wide adjustment and business reshuffle.

"First, the overall growth rate will decline and there will be differentiated growth between first-tier cities and second- and third-tier cities. In addition, the demand for new homes will decline with secondhand homes being increasingly preferred. Finally, the market concentration ratio will be increased after a large number of smaller developers are crowded out by big ones. After the adjustment and reshuffle, the development level and quality of the whole industry will be improved," Qin said.

"In the long run, in order to achieve sound and steady development in the property sector, reforms on the land system, fiscal and taxation system and the property tax should be pushed forward," she said.

Li Daokui, Dean of the Schwarzman Scholars Program at Tsinghua University, said the property market is giving way to other growth drivers in China including consumption-based infrastructure investment, private consumption, and the "greening" of various production capacities in the steel and petrochemical industries, as well as in power generation.

On October 8, Premier Li Keqiang said that China will launch major investment projects in information networks, water conservancy and environmental protection this year. Premier Li also made it clear the government will accept a slightly lower overall growth rate than the 7.5 percent targeted for this year and rely more on reforms to generate new growth.

The nation is seeking to push reforms to put the world's second largest economy on a more sustainable footing over the long term. In quest of this, the Chinese Government has launched several policies in hopes of spurring structural upgrading, ranging from streamlining administration and delegating powers to the lower levels, to adopting measures such as cutting the reserve requirement ratios for certain banks and reducing taxation on small and micro businesses.

"We'd rather use reforms to shore up growth instead of stimulus measures," Premier Li said.

Email us at: zhouxiaoyan@bjreview.com

|