|

More targeted easing?

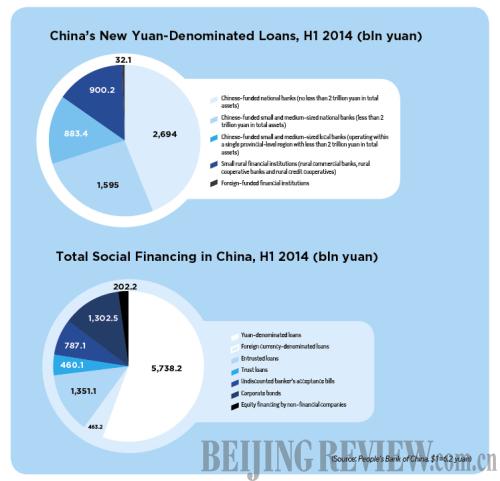

To further encourage financial institutions to lend to agriculture-related sectors and small and micro businesses, the central bank carried out targeted easing twice this year, in April and in June, respectively.

Targeted easing has paid off, according to the report. New loans to agriculture-related sectors and small and micro businesses have exceeded loans that flow to other sectors in the second quarter.

Wen, the researcher with Minsheng Securities, said the focus of monetary policy should be reducing financing costs in society, especially for agriculture-related businesses and small and micro businesses.

"On the one hand, the central bank should use instruments—including repo, reverse repo, short-term liquidity operation and standing lending facility—to maintain stable interest rates in the money market," Wen said. "On the other, targeted easing and favorable lending policies should be used to guide funds to the weak links in the Chinese economy."

But the central bank also said in the quarterly report that monetary policies are mainly for controlling the total money supply, while changing the lending structure only plays a supporting role.

"If carried out over a long period of time, targeted easing will create a number of problems, such as compromising the authenticity of data, undermining the market's role in determining money flow and influencing the effects of reserve requirement instruments," the central bank warned in the report.

"In the long run, the pickup in growth momentum, the transformation of growth patterns and the optimization of lending structure should be achieved by comprehensive reforms, in which the market should play a decisive role in allocating resources," said the central bank report.

Guan Qingyou, Assistant Dean of Minsheng Securities Research Institute, said targeted easing is only curing the symptoms, not the disease, when it comes to lowering financing costs for businesses.

The obvious question, then, is how exactly should China cure the disease?

"Radical solutions to the problem include cutting funding for industries with excess capacity, accelerating reforms of state-owned enterprises and stripping banks of bad assets. Mild measures include slowly deleveraging the broad economy, reducing inefficient investment and refraining from injecting liquidity whenever the economy shows any sign of slowdown," Guan said.

"Targeted easing for weak links of the economy is needed but will create serious repercussions," Guan warned.

"Monetary regulation can't replace reform," said Guan. "Reform, on the other hand, requires the concerted efforts of all parties concerned. The central bank can't do the entire job by itself."

Email us at: zhouxiaoyan@bjreview.com

Monetary Policy Guidelines

- Using quantity and price measures to realize moderate liquidity and reasonable growth in credit and total social financing

- Vitalizing stock money and optimizing incremental money supply so as to back up economic rebalancing and industrial upgrade

- Pushing forward the market-oriented reform of the interest rate and yuan exchange rate to improve the efficiency of resource allocation

- Improving the system of financial markets by building a highly efficient investment and financing market, diversifying financial products and market participants, building a multi-layer capital market, and enhancing regulation

- Bolstering reforms of financial institutions by encouraging more market players and competition

- Guarding against systematic financial risks and maintaining financial stability by closely monitoring risks in financial innovation, local government financing platforms and the shadow banking system

(Source: People's Bank of China)

|