|

Profitability matters

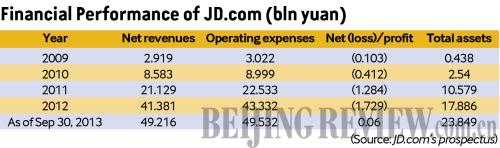

The IPO filing shows that in the first three quarters of 2013, JD.com brought in sales revenue of 49.23 billion yuan ($8.06 billion), soaring 70 percent year on year.

However, its operating expenses in the same period reached 49.53 billion yuan ($8.11 billion), therefore the company still had losses of more than 300 million yuan ($49.5 million) in its major business during the first three quarters of 2013.

That means although JD.com has a huge volume of business, it is still losing money. This appears to be the case across the board with Chinese B2C e-commerce companies, almost all of whom are suffering losses at present.

According to the IPO filing, however, JD.com registered net profits of 60 million yuan ($9.82 million) in the first three quarters of 2013. Indeed, this is the first time the company has reported profits since its establishment.

Wang Yong, a macroeconomic researcher with CITIC Securities Co. Ltd., said that the profits of JD.com did not come from its major business, but from revenues in its financial business as well as other operating revenues.

According to Wang, when it comes to listed companies, investors are concerned more about their future profitability than present financial status. In this regard, JD.com may be an eminently attractive prospect.

According to the financial figures included in the IPO filing, JD.com's efforts to reduce losses have become more effective. From 2009 to 2012, JD.com recorded annual operating losses of 103 million yuan ($16.86 million), 416 million yuan ($68.09 million), 1.4 billion yuan ($229.13 million) and 1.95 billion yuan ($319.15 million) respectively. But in the first three quarters of 2013, operating losses stood at only 316 million yuan ($51.72 million), much lower than before.

Moreover, two competitive strengths of JD.com may ensure its future profitability. First is its independent logistics service. A timely and reliable logistics service is crucial to the success of an online retail business. JD.com has the largest logistics facilities among all Chinese e-commerce companies. By December 31, 2013, it was operating 82 warehouses of more than 1.3 million square meters in 34 cities. It also had 1,453 delivery stations and 209 pick-up stations in 460 cities, and its delivery staff comprised nearly 20,000 persons.

Leveraging this nationwide delivery infrastructure, JD.com delivers a majority of the orders directly to customers via its own couriers, which is an advantage compared with other e-commerce companies. Suning, Amazon China and some other e-commerce companies are also building their own logistics infrastructure, but the task of constructing logistics networks which cover the whole country cannot be completed in a single day. JD.com's competitors are effectively "playing catch-up."

Another advantage is that the company is the leader in the self-operated B2C sector with a market size of 100 billion yuan ($16.37 billion), followed by Suning, whose volume is only 20 billion yuan ($3.27 billion).

The prospectus indicates JD.com is fully confident in its future, because it is a technology-driven company and one which has invested heavily in developing its own highly scalable proprietary technology platform. JD.com has a sophisticated business intelligence system that enables the company to refine its merchandise-sourcing strategy, to manage its inventory turnover, to control costs and to leverage the large customer database in order to create customized product recommendations and cost-effective and targeted advertising.

Besides its major business B2C, JD.com also regards Internet finance and international expansion as its new business initiatives. On December 6, 2013, JD.com launched its Internet finance service, offering a three-minute completed credit service to its suppliers. The credit can extend to up to 90 days, while the amount borrowed and repayment schedule can be decided upon by the suppliers themselves.

Since early 2012, JD.com has offered a supply-chain financing service to its suppliers, which has maintained high growth. Up to now, the company has granted more than 8 billion yuan ($1.31 billion) of credit, with the largest single loan surpassing 100 million yuan ($16.37 million). JD.com's financial partners include banks, trust companies, fund management companies, securities companies, guaranty companies and insurance companies.

In addition, JD.com possesses financial service licenses for third-party payment, microcredit and fund payment. The company has begun selling insurance products through open platforms and it will soon offer wealth management and personal credit consumption products. A "financial group" under JD.com is also on the cards.

Wang said a major target of JD.com's IPO is that it plans to use the money raised to buy land use rights, build new warehousing centers and more delivery stations, improve its logistics infrastructure, develop its financial business and offer financial support for potential investments and acquisitions. Wang thinks this is a fairly good plan for business expansion and that signs for the future profitability of JD.com are certainly promising.

Email us at: lanxinzhen@bjreview.com

|