|

|

|

APPLE APPEAL: Customers experience the colorful services of the iPhone at an Apple store in Beijing (CFP) |

One year after China kicked off its third-generation (3G) wireless services, an increasing number of Chinese mobile users are flocking to the concept of digital lifestyles via their handset devices.

According to the Ministry of Industry and Information Technology (MIIT), 3G users nationwide soared to 18 million at the end of March this year. Such gleaming performance should be a reason to cheer though it remains to be seen whether China could meet the government-set target of 240 million by 2011.

With a richer and tech-savvier consumer base, it is not difficult to see how the new technical standard has found such strong traction here. What added fire to the 3G mania was a spending spree of operators beefing up their network construction and improving technology reliability.

The telecom operators have spent more than 160 billion yuan ($23.4 billion) on 3G network construction in 2009, and the investments will add up to 450 billion yuan ($65.9 billion) over the next two to three years, said Li Yizhong, Minister of the MIIT, at a recent news conference.

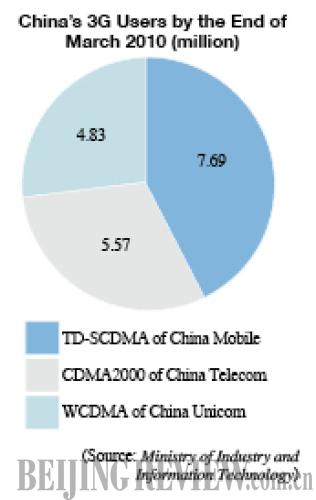

Chinese regulators had been under pressure for dragging their feet in handing out 3G licenses to allow more time for the fledgling TD-SCDMA technology to mature. But now the government's patience has turned out to be worthwhile. China Mobile, the top operator, now leads the race, with 42.5 percent of all users subscribing to the homegrown TD-SCDMA network, followed by 30.8 percent of China Telecom's CDMA2000 and 26.7 percent of WCDMA operated by China Unicom—both proven and mature technologies used globally.

Like their counterparts in other more developed markets, Chinese telecom operators are looking to value-added 3G services for a source of revenue at a time when cellphone penetration is on the rise, said Chen Haofei, a telecom analyst with the China International Capital Corp. Ltd.

Heated competition

Since China fired the starting gun for 3G services, competition between the operators has been fierce, with smartphones being the latest battleground.

China Unicom in early May announced to step up subsidies to iPhone buyers, aiming to have 10 million 3G users paying at least 100 yuan ($14.6) per month for basic packages by the end of this year.

When the company became the only legal channel for the iconic iPhone handset in China in October 2009, it seemed to count on the trendy multimedia device as a wonder weapon for poaching subscribers from market dominator China Mobile.

But the success hopes did not become realities. Sales of the handset stalled as its prices, at least 5,000 yuan ($732.3), were simply out of reach of average Chinese consumers.

The price subsidies could help pick up sales, but the iPhone can never be a panacea for China Unicom, said Fu Liang, a renowned independent telecom analyst.

With an over-dependence on iPhones for new subscribers, the company is ignoring the biggest advantage of its WCDMA standard—the wide range of handsets already on offer, said Fu.

While there are hundreds of handsets available on the WCDMA network, TD-SCDMA users could choose from only around 70 models as of the end of 2009. Such limitations cast an ominous shadow over prospects of the homegrown technology, but the government boosted its chances of success by awarding the license to market leader China Mobile.

China Mobile controls around 75 percent of telecom market shares in the country, laying a solid groundwork for a 3G takeoff. But what really set it apart from rivals was a deep-rooted commitment to filling in TD-SCDMA terminal offerings.

|