|

In June, the World Bank raised its estimate for Chinese GDP growth in 2009 to 7.2 percent from the previous 6.5 percent; Credit Suisse predicted 8-percent growth this year and 9 percent in 2010. The International Monetary Fund also expects 8-percent growth.

Chu Jianfang, Chief Macroeconomic Analyst at CITIC Securities Co. Ltd., said there is no doubt that China can meet the goal of 8-percent GDP growth set by Premier Wen Jiabao at the beginning of this year. But he emphasized that the government should invest more in social undertakings such as health care, education and pensions.

NBS's Li said the government would continue to adhere to an active fiscal policy and appropriately accommodative monetary policy to fuel economic growth in the next half. The decision was made after Central Government leaders conducted intensive investigations and reviews of nationwide economic operation in the past 30 days.

Li said the financial crisis actually provided China a good opportunity to carry out structural readjustment.

Future investment will be poured into five areas, according to Li. First, more investment will be appropriated to infrastructure like railways and social undertakings.

Second, the government will encourage scientific innovation that boosts the competitiveness of domestic companies, such as innovation in next-generation telecommunications, software, bio-pharmaceuticals, nuclear power plants and wind power plants.

Third, the government will heavily promote energy conservation and emissions reduction in achieving sustainable economic growth.

Fourth, more investment will be directed to the central and western parts of the country in a bid to realize more balanced regional economic development.

Fifth, the government will urge companies to carry out mergers and acquisitions and optimize company structure.

Wary of new problems

Though the economy is making headway toward 8-percent growth, ballooning asset prices have again triggered anxiety over excessive liquidity that once plagued the country in 2007.

Li admitted that the upward trend of national economic growth was not solid enough as uncertainties and unstable factors remain.

Many economists have contended that recovery via easy money and loosened credit will eventually poison the national economy. New bank loans recorded a skyrocketing 7.37 trillion yuan ($1.08 trillion) in the first half, according to the central bank, far outpacing the 5-trillion-yuan ($732-billion) target amount for the whole year set by the government at the beginning of 2009.

The central bank is now caught in a dilemma. If it tightens money supply and restricts lending, the real economy will suffer since there are still many companies in desperate need of cash. But if it continues to make money easily attainable, asset bubbles may come back and ignite inflation.

Ma Jun, chief economist for China at Deutsche Bank AG, warned of possible massive bad loans and uncontrollable inflation, citing the lax lending overhaul. Experts also worry that many of the loans have not actually gone to the real economy, but to the property and stock markets, as both markets have surged to unreasonably high levels before the financial mess clears up.

The government has foreseen the potential risks. China Securities Journal quoted a bank insider who said that the central bank is planning to issue more than 100 billion yuan ($14.6 billion) in central bank bills to small and medium-sized commercial banks to rein in lending.

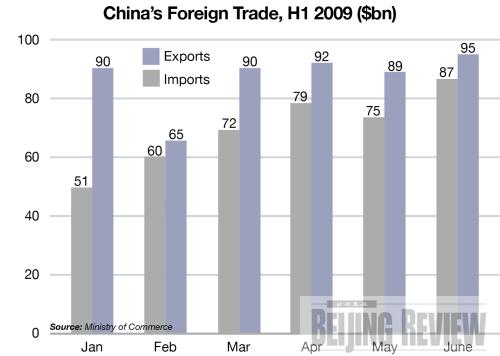

A freefall in foreign investment and exports has dampened economic recovery efforts. Both were previously major drivers of Chinese economic growth. In the first half of this year, exports plunged 21.8 percent year on year and paid-in foreign direct investment dropped 18 percent.

Economists suggested the country shift gear given the bleak external demand and give more support to domestic consumption.

The collapse in exports has also led to rising unemployment. Li acknowledged the heavy unemployment pressure at the press conference, but did not reveal the unemployment rate.

Xia Bin, Director of the Institute of Finance Research at the Development Research Center under the State Council, said the central bank should send signals of stabilizing monetary policy instead of tightening policy, because the economy is on the path to recovery but is still far from a complete revival.

Xia said top priority should be given to structural readjustment, so as to drive the economy by consumption rather than exports and investment. He said the government needs to adopt more measures to tap the vast rural market. |