|

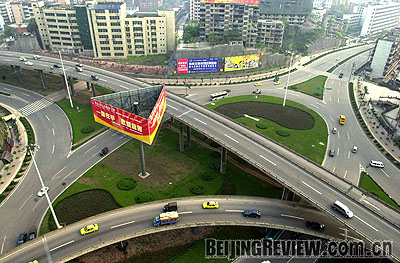

HIGHWAYS AND BYWAYS: Experts believe that the government should adjust the country's fiscal policy, including issuing more bonds to fund infrastructure projects, to boost economic growth

A global economic recession, ignited by the U.S. subprime mortgage crisis, might be unavoidable in the near future. In the meantime, a significant slowdown in China's economic growth in the third quarter is posing daunting challenges to the government's macro-control policies. Ha Jiming, Chief Economist at China International Capital Corp. (CICC), recently wrote an article in the 21st Century Business Herald about what he believes to be the root cause of China's economic slowdown and how the government can revive the economy. Excerpts follow.

Judging from China's economic cycle during the past three decades, a slowdown in economic growth normally will last for no less than three years. We assume that after reaching a peak in 2007, China's economic growth will hit rock bottom in 2010 at the earliest.

Rebalancing act

The bursting of the U.S. property bubble is the most direct reason for the global economic slowdown. As early as September 2007, we issued a report elaborating upon this conclusion. Property prices in the United States will be going through years of readjustment, reducing American consumption and seriously affecting the profits of export-oriented companies.

|