|

|

|

Senior executives of Alibaba Group and Suning Commerce pose for a group photo at a ceremony announcing the companies' tie-up in Nanjing, Jiangsu Province, on August 10 (CFP) |

In the business world, there are no everlasting friends or everlasting enemies. There are only friends with the same interests. The proverb was exemplified by a recent teaming up between China's largest e-commerce giant Alibaba and leading electronics retailer Suning, which also owns the country's third largest online marketplace.

According to the deal reached on August 10, NYSE-listed Alibaba Group Holding Ltd. will pay 28.3 billion yuan ($4.4 billion) for a 20-percent stake in Suning Commerce Group Co. Ltd., and in turn, Suning will agree to invest 14 billion yuan ($2.2 billion) to acquire a 1.1-percent stake in Alibaba. With this strategic combination, the two heavyweights will establish an all-round online-to-offline system encompassing e-commerce, logistics, aftersales services, marketing and big data.

"Both Alibaba and Suning are now at the crossroads. Integration is a better option than confrontation," said Chairman of Suning Zhang Jindong at the First Internet Plus Retail Summit held in Nanjing, capital of east China's Jiangsu Province, on August 10. Zhang believes that Internet companies aligning with traditional retailers will become an inevitable trend.

"The future development of Alibaba lies in brick-and-mortar stores. If we fail to explore offline resources, Alibaba will be phased out," said Jack Ma, founder and Chairman of Alibaba at the summit, laying an emphasis on the development of a new business ecosystem and noting that cooperation rather than monopoly will help them seize the opportunities singular to this generation.

However, Alibaba is not the first e-business giant to attempt to access traditional retailers. On August 7, NASDAQ-listed JD.com Inc., the second largest e-business company in China, declared its intention to purchase a 10-percent stake in domestic supermarket Yonghui Superstores, a supermarket chain headquartered in southeast China's Fujian Province, for 4.31 billion yuan ($670 million), with the right to nominate two directors to the board.

"In five years' time, there will be no pure Internet companies, because online and offline integration is the direction of future development," said Wang Jianlin, Chairman of Wanda Group at the summit.

|

|

Employees of Tmall.com, a B2C platform operated by Alibaba Group, celebrate in the company's headquarters in Hangzhou, Zhejiang Province, after its turnover recorded an all-time high during the annual online shopping festival on November 11, 2014 (XINHUA) |

Complement each other

In the days to come, Suning will set up a super flagship store on Tmall.com, a business-to-customer (B2C) platform operated by Alibaba, while Tmall.com will open a portal ushering consumers to Suning.com, the e-commerce branch of Suning. Meanwhile, Suning will share its own logistics service system with Tmall.com, and allow Tmall.com and Taobao.com, Alibaba's customer-to-customer (C2C) platform, to exploit its offline store resources. In addition, Alibaba will also completely open its financial resources to Suning both online and offline.

According to rough calculations, Suning owns more than 1,600 home appliance stores, more than 3,000 after-sales outlets and about 5,000 franchised service providers and small city service stations. In addition, as statistics from China Electronic Commerce Research Center show, Suning's logistics network is comprised of warehouses covering 4.52 million square meters, four aviation hubs, 12 automated sorting centers and 660 city distribution centers.

Zhuo Saijun, an analyst from Analysys International, an Internet business information service provider, said that what Alibaba valued was the offline resources Suning has accumulated in the past years.

For one thing, Suning can help Alibaba expand its marketing network and strengthen its brand influence in third-tier and fourth-tier cities; for another, the e-commerce titan can lay its hands on the sophisticated logistics and storefront resources Suning possesses, and exert a greater influence among traditional 3C home appliance suppliers and consumers, said Zhuo.

The 28.3-billion yuan paid by Alibaba to Suning will mainly go to the construction of offline stores and logistics system. By equipping Suning's logistics system with automated storage, sorting and delivery facilities, Suning and Alibaba can realize their goal of sharing inventory, combining transportation and distribution by automatizing logistics functions such as B2C delivery, return, transfer and allocation of goods.

"By integrating the complete network of our Cainiao logistics with Suning's own delivery system, and making full use of the edge Alibaba possesses in big data and cloud computing, the best delivery schemes can be figured out immediately, and commodities may reach the hands of consumers within two hours," said Zhang Yong, CEO of Alibaba.

In fact, in response to the slowdown of the e-commerce sector, Alibaba has begun to expand its presence throughout the industrial chain of commodity retailing, as is evident in its cooperation with Intime Department Store, and the establishment of Cainiao, a logistics firm, in partnership with five major privately owned express companies. By infiltrating both the upstream and downstream of commodity transactions, Alibaba is trying to mold an invisible retailing empire covering research and development, production, logistics, payment, and offline trading.

On the other side, Suning can take advantage of Alibaba's online platform to accelerate its Internet-oriented transformation, diversify its item categories, attract more consumers to its offline stores, and gain access to Alibaba's commodity suppliers, said a report of Analysys International.

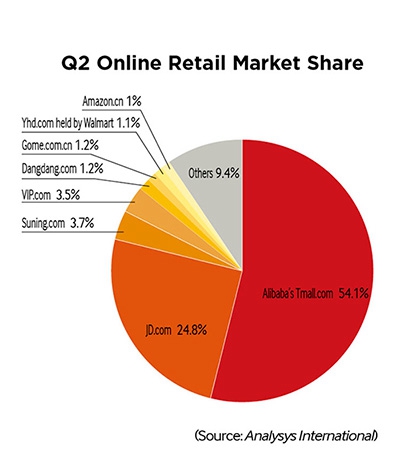

"As a B2C distributor, Suning's online business is far lagging behind JD.com and has shown a declining tendency in competition," said Zhang Ju, an analyst from Gartner, a leading information technology research and advisory company, noting that Suning is in urgent need of consumers and traffic.

"On the platform of Tmall.com, not only can Suning maintain its brand independence, but it can also engage in traffic exchange with its partner," said Zhang Ju.

Moreover, Alibaba and Suning will eliminate all barriers existent in the process of data sharing. For example, the water purifier that often appears on the shopping lists of consumers on Tmall.com will soon find its way on the goods shelves of Sunning offline stores. Suning Chairman Zhang Jindong anticipates that the partnership will boost the sales volume of Suning and usher in a new era of customization.

|

|

A Suning salesman (left) helps a visitor download the company's mobile app on his smartphone at an exhibition in Zhengzhou, Henan Province, on May 22 (CFP) |

Irresistible trend

The tremendous benefits brought about by this significant coalition will undoubtedly squeeze the living space of other rivals, who also have their own arrangements. Huang Xuande, CFO of JD.com, said a focus will be laid on fresh food in their online-to-offline development scheme, justifying their newly established cooperative ties with Yonghui Superstores, which sees fresh agricultural and subsidiary products accounting for over 50 percent of its total sales and has established more than 300 physical stores and more than 20 purchase bases nationwide.

Teaming up with Yonghui Superstores is part of JD.com's online-to-offline plan in 2015, under which the second largest Chinese e-commerce player can send fresh food, flowers and supermarket goods to consumers who dwell within a radius of 3 km within two hours.

In turn, Yonghui Superstores, which has been frustrated in its attempts to seek online presence since 2013, can also be transfused with e-commerce and logistics distribution resources. As a matter of fact, large supermarkets like Walmart are scrambling to build their own e-commerce platforms in China. In July, Walmart took full control of online store Yihaodian.com after acquiring its 51-percent share in 2012. Yonghui Superstores badly needs external support to wrench it out of its dire circumstances.

"The channel resources of offline retailers will be revaluated," said China International Capital Corp. Ltd. (CICC) in a research report published on August 10. As some farsighted e-commerce giants have begun to cooperate with traditional retailers recently, the once underdog has shown signs of being able to reverse its declining fate.

"These alliances between e-business companies and offline retailers indicate that they have shifted from wrestling with one another to pursuing synergy, in order to make the cake bigger for all," said Wang Tian, Chairman of Better Life Group, a conglomerate headquartered in Hunan Province, which dabbles in supermarkets, department stores and e-business.

As the CICC report pointed out, online and offline integration is an inevitable choice. After several years of high-speed expansion, e-business companies are striving to maintain their growth momentum, and joining hands with physical retail outlets will be of strategic importance in breaking through that bottleneck. Offline stores can effectively enhance consumers' consumption experience, provide more value-added services and improve customer fidelity. Online and offline integration will give full play to information advantages and bring down the markup percentage of commodities.

"The groundbreaking cooperation between Alibaba and Suning is conducive to penetrating the entire industrial chain and channels of the retail sector, thus sewing the concept of Internet Plus into the retail industry," said Zhuo from Analysys International.

Yet, an array of challenges lie ahead. Chen Yuefeng, an expert on industrial chains, believes cultural integration will be the most difficult problem these business giants face. "While brick-and-mortar retailers lack the Internet gene, e-business enterprises are inexperienced in the traditional retail industry. Therefore, such coalitions can be fraught with challenges," said Chen.

What really matters is whether the two parties can accomplish cross-platform cooperation and allow consumers to benefit from such integrations. "The results may not be felt within two or three months. Only when brick-and-mortar stores and Internet companies appreciate and coordinate with each other can a new business ecosystem come into being," said Jack Ma.

Alibaba

Alibaba Group was founded in 1999 by 18 people led by Jack Ma in Hangzhou, capital of east China's Zhejiang Province. The company got listed on the New York Stock Exchange in September 2014.

Alibaba Group's major businesses include:

- Taobao.com, China's most visited customer-to-customer (C2C) online shopping website

- Tmall.com, China's leading online business-to-customer (B2C) mall

- Juhuasuan.com, China's most popular online group buying marketplace

- Alibaba.com, a leading global wholesale business-to-business (B2B) platform

- AliExpress.com, a popular international e-marketplace for consumers

- 1688.com, a leading online wholesale marketplace

- Alimama.com, a leading online marketing technology platform

- Ant Financial Services Group, a financial service provider focused on serving small and micro enterprises and consumers, with Alipay.com, a leading provider of online and mobile payment solutions in China, being its subsidiary company

- Cainiao Logistics, the operator of a logistics information platform

- Alibaba Cloud Computing (Aliyun.com), a developer of platforms for cloud computing and data management

(Source: Alibaba Group)

Suning

Suning Commerce was founded in 1990 by Zhang Jindong in Nanjing, capital of east China's Jiangsu Province. Originally an air conditioner seller, it has expanded to become a home appliance chain store and further to become a comprehensive online retailer.

In July 2004, Suning Commerce listed on the Shenzhen Stock Exchange. In 2009, it acquired 27.36 percent of LAOX Co. to become the largest shareholder of the time-honored Japanese electric appliance chain business.

By the end of 2014, Suning Commerce had a total of 1,696 chain stores, with 1,650 on the Chinese mainland, 29 in Hong Kong and Macao, and 17 in Japan.

(Source: Suning Commerce)

Copyedited by Eric Daly

Comments to dengyaqing@bjreview.com |