|

Unlikely to crash

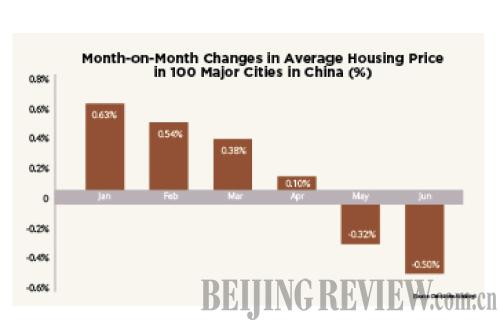

The new round of price declines in two years have crystallized worries of a grisly end to the housing boom, but analysts say fears of an American-style sub-mortgage crisis or Japanese-style collapse are overblown.

Lu Ting, an economist at Bank of America-Merrill Lynch, ruled out the possibility of a large-scale crash in China's housing market. Instead, he said the biggest problem in the property sector is a misallocation of resources.

"With only about one third of the 1.3-billion Chinese population living in urban centers, too many homes that will never be filled have been built in small cities. This will likely see a sharp spike in bankruptcies among small developers," Lu said. "But it will not cause a big crash."

Fan Jianping, chief economist of the State Information Center, a top government think tank, also said there won't be a collapse in the property market.

"The most important reason is that China's home buyers are totally different from those in countries that have witnessed property collapse," Fan said.

Fan predicted that it will take China 20 years to increase its urbanization rate to 70 percent. Before that, strong purchasing power exists among farmer-turned-city-dwellers, first-time home buyers and buyers who want to improve living conditions.

According to Fan, China is still a developing country, with a per-capita GDP of $6,700 and a very high savings rate. When property investment declines, the government can jack up infrastructure investment to cushion the impact of the real estate downturn. This is totally different from the conditions in countries that have a per-capita GDP of over $30,000 and an urbanization rate of over 70 percent. Those countries' urban infrastructure construction has finished and investment opportunities are limited. China, on the other hand, has many alternatives to shore up economic growth, such as infrastructure construction, tenement housing renovation and the building of affordable housing.

Although price falls will bring about some financial risks, no systematic risk will occur, said Fan.

Wang Tianlong, an associate researcher with the China Center for International Economic Exchanges, said the most distinctive characteristic of China's property market is polarized development between large cities and small cities. Wang suggested the government adopt differentiated policies for these two categories.

"For first-tier cities where housing prices are frothiest, moderate price drops can reduce the asset bubble and are on the whole good for economic growth. The government should stay out of it. For small cities that face more downward pressure, lifting purchase limits can prevent a price plummet," said Wang. "In addition, the government should introduce preferential policies for first-time home buyers."

Email us at: zhouxiaoyan@bjreview.com

|