|

Experts have also called for more reforms in the fiscal income distribution system, as local governments would have no choice but to borrow when they are obligated to pay for public works that are mandated but not paid for by the Central Government.

In 2010, local governments received 48 percent of total fiscal income but were responsible for 80 percent of public spending, according to a report on China's fiscal policy issued by the Chinese Academy of Social Sciences.

"We expect the government to unveil detailed plans for fiscal reform," said Shen Jianguang, an economist with Mizuho Securities in Hong Kong.

"The key to solving the debt (problem) depends on changing the distribution system for fiscal income between central and local governments, as well as (changing) local governments' over-reliance on land sale revenues."

Zhang Monan, an associate researcher with the China Center for International Economic Exchanges, said "bad debt banks" should be set up to dispose of local government debt and non-performing assets through debt restructuring and external transfers.

"Moreover, the government should establish a management and reserve system of land-transfer fees and compile balance sheets for local governments. And the National People's Congress and the NAO should play a stronger role in the supervision and auditing of land transfers by local governments."

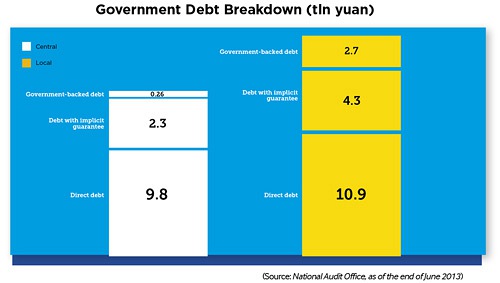

Lu from Bank of America Merrill Lynch suggested China deleverage its local governments while leveraging up the Central Government.

"To maintain both economic growth and financial stability, China should avoid simplistic deleveraging and debt reduction."

Email us at: zhouxiaoyan@bjreview.com

|