|

According to the NBS, the growth of total retail sales of consumer goods in the first six months grew 1.7-percentage slower than in the same period last year. Weak domestic consumption could put a dent in the country's plans to build an economy more dependent on domestic spending.

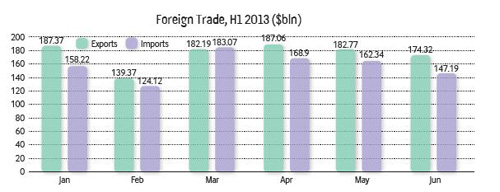

In addition, import and export figures are hardly inspiring. Statistics from the NBS hint China's import-export trade is also in the midst of a slowdown. In the first quarter, imports and exports totaled $975.25 billion, up 13.5 percent year on year; in the second quarter, it was $1.02 trillion, up 4.3 percent year on year, although in May, imports and exports only grew 0.3 percent. In June, the figure even slid to negative 2 percent.

Zheng Yuesheng, spokesman for the General Administration of Customs, said gloomy foreign markets cramped China's export growth, and the substantial appreciation of the yuan in combination with rising labor costs made exports more expensive.

Statistics from the Bank for International Settlements showed that the yuan's real effective exchange rate was 116.3 in late May, up 5.6 percent from the end of last year. At the same time, domestic labor costs keep going up. Several provinces and cities have increased their respective minimum wage standards so far this year. Of the 2,000 enterprises that participated in a monthly customs survey, at least 70 percent regularly said they were under mounting cost pressure, and the competitiveness of their products was eroding.

What's worse, China's trade environment is deteriorating due to frequent outside frictions. According to the Ministry of Commerce, 18 countries launched 22 anti-subsidy investigations against China in the first quarter. In May, the European Commission declared an anti-dumping and countervailing probe into some of China's telecom equipment makers. On June 6, the commission announced an 11.8-percent anti-dumping duty on China's photovoltaic products. All these investigations and duties slapped on Chinese products have greatly undermined the country's international competitiveness.

Economic outlook

The Central Government is scheduled to hold a series of symposiums to gather economic data in July and unveil a number of reform policies in September. In the meantime, the outlook of China's economy over the next six months is mixed.

Economists predict growth of China's GDP in the second half of the year will remain more or less the same as the first. Li Daokui, Director of the Center for China in the World Economy at Tsinghua University predicted that the economy would grow 7.8 percent in the second half, a slight increase over the first half. A report released by China Investment Consulting on July 1 stated that China's GDP would grow 7.5 percent and 7.3 percent in the third and fourth quarters respectively, and the growth rate for the whole year would be 7.5 percent.

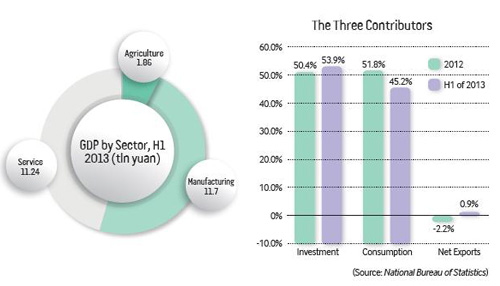

But Anbound Consulting, a renowned think tank for public policy in China, says in a report that the three pillars of the country's—investment, consumption and net exports—have not shown signs of any rebound.

In terms of investment, tight policies, high local debt and declining corporate profits will not get the economy back on a track of rapid growth. Additionally, great employment pressures, poor income prospects and restrictions on government spending have dimmed investment as a strong driver of economic growth. Finally, external demand for Chinese-made products is still weak.

"Given the above-mentioned reasons, the economic outlook for the second half is not so optimistic," reports Anbound.

Email us at: lanxinzhen@bjreview.com

|