|

|

|

GREEN BUS: A driver charges his electric bus at a station in Chongqing on February 26, where 500 million yuan ($90 million) will be invested in local EV charging facilities by the end of 2015 (LIU CHAN) |

Although the United States has taken a lead in supercapacitor technologies, China could find a foothold in the bus market.

As of the end of 2012, there had been 27,800 EVs in China, with 80 percent being electric buses. The Beijing Municipal Government plans to have 8,000 electric or hybrid public buses on the streets by 2015—a third of the total number in the capital.

According to the report released by Roland Berger in June, government subsidies for electric mobility are falling in all countries—except China, providing an opportunity to catch up in the long term by leveraging industrial and technological development; the next five years will be crucial.

"In China, we believe that the market will take off in the long run if the government and the industry keep investing," said John Shen, partner at Roland Berger.

Uncertain future

While carmakers are heartened by the future of EVs, experts are dampening that enthusiasm. In 2008, EVs sprang up at several international auto events and hopes were high that EVs were the near future.

"Five years later, people found that the EV era did not arrive as expected," said Guan Yunshan, an industry analyst.

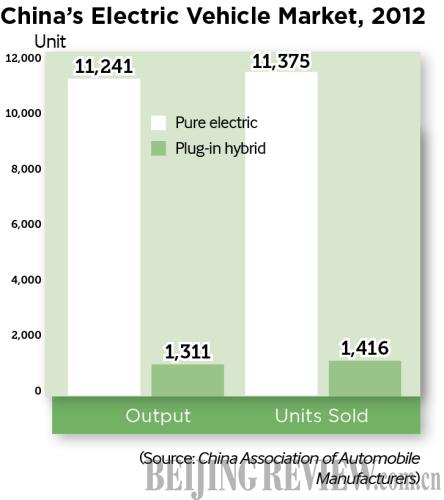

In 2009, the State Council planned to have the output of pure electric and plug-in hybrid vehicles reached 500,000 by 2015, accounting for 5 percent of the total number of passenger vehicles. The Ministry of Science and Technology called for pure EV ownership of 2.6 million by 2015.

But Beijing is scaling back its ambitions. The annual sales of EVs in China was only 13,000 units in 2012, a trivial share compared to conventional cars.

The United States was no better. Only 50,000 EVs were sold in that country in 2012. A123 Systems, the U.S.-based advanced battery manufacturer for EVs and power grids, declared bankruptcy and was later acquired by Wanxiang, a Chinese industrial group.

California-based Coda Automotive sold only about 100 EVs since its first product hit the U.S. market last year and it recently filed for bankruptcy protection. U.S. electric car company Fisker Automotive Inc. also announced recently that it might go bankrupt if it cannot find new investors soon.

The United States is not an isolated case. Renault and Nissan have together just sold 70,000 electric cars last year, a long way to go to meet their goal of selling 1.5 million units worldwide by 2016.

China's EV makers are learning that developing the EV industry is a lot tougher than they had hoped. Whether the supercapacitor will rescue the EV industry awaits to be seen.

"Although the government has pledged to subsidize the sector, the effects have not paid off as expected," said Guan. "The commercialization of EVs is chastened by technological hurdles and lack of buyer interest."

Email us at: lanxinzhen@bjreview.com

|