|

|

|

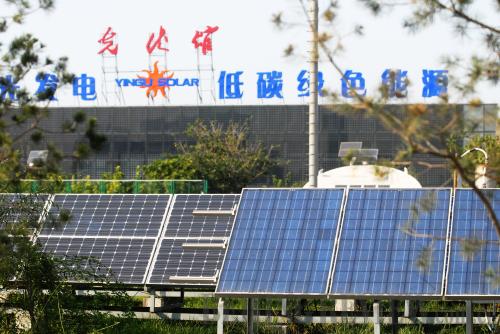

GREEN PRODUCTS: Solar panels can be seen everywhere in the plant area of Yingli Green Energy Holding Co. Ltd. in Baoding, north China's Hebei Province (WEI YAO) |

In the past five years, China's PV industry has undergone rapid capacity expansion, partly due to the boom in installation of solar panels in Europe as the EU looks to increase its share of renewable energy, such as solar and wind, to 20 percent. In 2011, China exported $20.4 billion of PV products to the EU, accounting for 73 percent of its total export volume, according to statistics from the MOFCOM.

At present, China occupies 60 percent of the global polycrystalline silicon market, 70 percent of the polycrystalline silicon panel market and 70 percent of the solar module market. The Chinese Government included renewable energy in its development plan for strategic emerging industries and it is one of the few industries worldwide in which China is a leader.

"Three factors contribute to the alleged 'dumping price' by Chinese solar cell makers—the price cut for raw materials, lower production costs and oversupply," said Liang. "The price of silicon dropped from $400-500 per kg to $20 per kg in recent years."

Given lower labor costs in China, it seems irrational to impose punitive actions on Chinese manufacturers. Moreover, lower solar panel prices will help downstream enterprises cut costs and make solar power more affordable. That's why the Association for Applied Solar Energy has called on the European Commission to uphold free trade in order to secure jobs and support industry growth.

Two fatal weaknesses make China's PV industry vulnerable to external factors. Chinese solar cell makers export nearly 90 percent of their products to other countries, so every little move from the outside will put Chinese makers on tenterhooks. Over dependence, in many cases, is dangerous. In addition, Chinese enterprises should prioritize developing core technology rather than act as low-priced module producers. Currently, core technologies regarding the purification of polycrystalline silicon and the manufacturing of PV equipment are dominated by countries like the United States, Norway, Germany and Japan.

"Solar power will be an indispensable energy resource in the near future, and it also may be the engine that spurs a third industrial revolution," said Liang. "As China is gradually taking a predominant position in the global PV industry, the EU's anti-dumping investigation may ruin a promising future."

Yingli Green Energy

Headquartered in Baoding, Hebei Province, Yingli Green Energy Holding Co. Ltd., which markets its products under the brand Yingli Solar, topped the list for solar panel sales across the world in the first nine months of 2012. It entered the solar industry in 1998 and began to experience rapid expansion since then. In 2007, the New York Stock Exchange listed the PV giant under the code "YGE."

Currently, it maintains a balanced vertically integrated production capacity of 1,700 megawatts per year, with its manufacturing covering the entire PV value chain, from the production of polycrystalline silicon to solar cell production and module assembly.

Yingli accounts for 10 percent of the global solar panel market and every year 70 percent of its products head to the EU. Since the United States and the EU always set retroactive dates in anti-dumping cases, Yingli is predicted to witness a gradual shrinking of its share in the EU even though a verdict is not scheduled until June 2013.

To alleviate the adverse effects of the U.S. and the EU anti-dumping actions on its long-term development, Yingli has drafted the "334" strategy: 30 percent of its products will be employed in the installations of solar power generation stations, 30 percent will be fixed on the roof and 40 percent will be used to establish independent solar power generation systems.

(Source: Yingli Green Energy Holding Co. Ltd.)

Email us at: dengyaqing@bjreview.com |