|

|

|

(CNSPHOTO) |

Alleviated burden

"Under the new amendment, about 7.7 percent of wage earners will have to pay tax, down from the current 28 percent," said Wang Jianfan, head of the tax policy department of the MOF. The number of income tax payers will be reduced from 84 million to 24 million.

Wang said by readjusting the income tax rate structure, the government will alleviate tax burdens on most wage earners.

After the introduction of the new tax rate, the income tax revenue of the government will be reduced by 160 billion yuan ($25 billion) each year, Wang said. After the new law is implemented in September, the government will receive 53 billion yuan ($8.28 billion) less in tax revenue in the last four months of 2011.

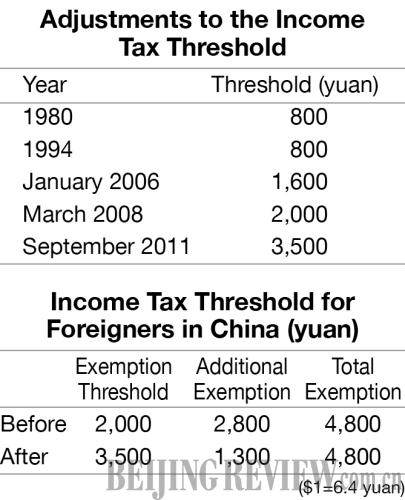

Liu Zuo, Director of the Taxation Science Research Institute of the State Administration of Taxation, said that before payment of income taxes, 8 percent of basic pension insurance, 2 percent of basic medical insurance, 1 percent of unemployment insurance and 12 percent of housing provident fund will be deducted first from the wages.

"That means people whose monthly wages are below 4,545 yuan ($710) won't have to pay income tax," Liu said.

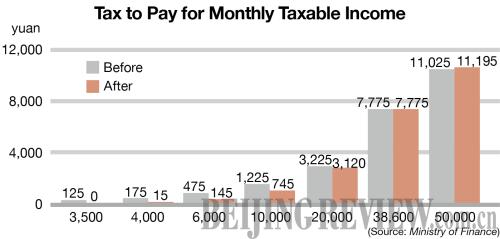

For example, after the adjustment a person who earns 5,000 yuan ($781) each month only needs to pay tax of 10.5 yuan ($1.64) after deduction of social insurance and housing provident fund, with the tax burden reduced by 93.4 percent.

However, for people with high incomes, the tax burden has increased. After the exemption is raised to 3,500 yuan, people who earn more than 38,600 yuan ($6,031) must pay a higher income tax.

Still not enough

"The adjustment this time doesn't involve non-wage incomes, such as stock dividends and other investment incomes, hence it will have little influence on high-income earners," said Liu Yi, a professor at the School of Economics of Peking University. She said China should incorporate more people with high incomes into the tax system and adopt an individual income taxation scheme that incorporates not only wages.

Liu Huan, Vice Dean of the School of Taxation of CUFE, thought adjustment of the income tax threshold should be more "elastic," considering different regional economic development levels and prices changes and allowing local governments to make adjustments in accordance with local conditions. He said tax exemption threshold should also be connected with CPI changes, being adjusted once or twice a year.

Raising the tax threshold is not enough to solve all the problems. He Zhenyi, a researcher at the Institute of Economics of CASS, said to alleviate the impact of inflation on ordinary people, "we should not just rely on raising the threshold of individual income tax exemption."

"Low- and middle-income earners are worst affected by inflation, but their monthly incomes may not reach the exemption threshold of 3,500 yuan, hence the adjustment this time will bring almost no benefits to them," He said.

|