|

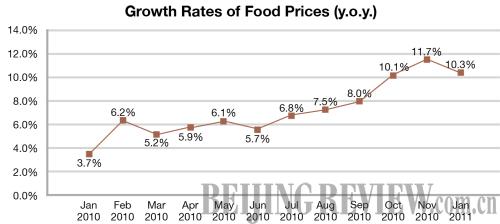

The greenbacks produced by the United States have flooded the global market, pushing up international commodity prices and fueling inflationary jitters in China, said Guo Tianyong, Director of the Research Center of China's Banking Industry at the Central University of Finance and Economics.

Countermeasures

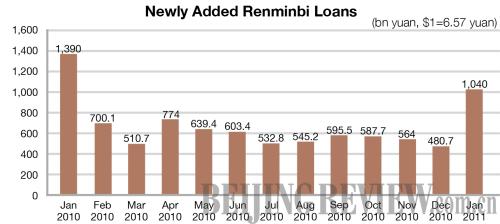

The policymakers have been pushing all the buttons to tame inflation. The government has pledged to take a prudent monetary stance this year, bidding farewell the moderately loose policy adopted to counter the financial crisis.

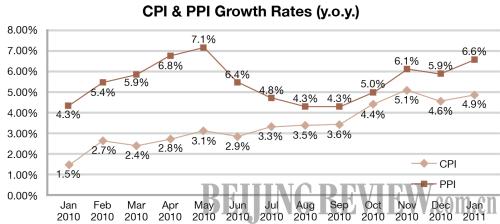

Inflation in China is broader and more stubborn than many economists have expected, forcing the central bank to rely on a mix of tightening measures, said Gao.

The People's Bank of China, the central bank, has ordered to raise the interest rates three times and the ratio of deposits commercial banks must set aside in reserves eight times since last year, punching the banks' ability to lend.

In addition, the State Council announced 16 measures in November 2010 to rein in rising commodity prices, including bolstering supply of agricultural products, enhancing price supervision and striking hard against speculation.

As part of its drought relief efforts, the government recently distributed heavy subsidies to disaster-stricken farmers and pumped investments to improve irrigation in wheat-growing areas.

Further policy moves are already in the pipeline since the government has put the task of fighting inflation at the top of its agenda.

(Source: National Bureau of Statistics)

(Source: People's Bank of China) |