|

|

|

(LI SHIGONG) |

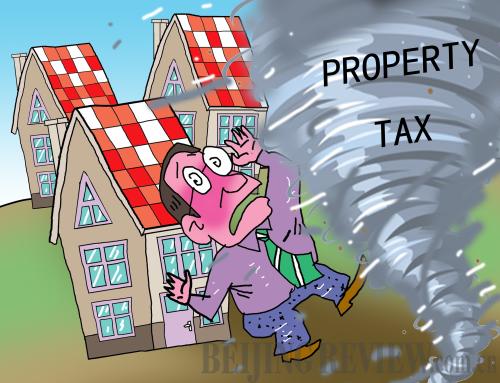

Chongqing and Shanghai announced on January 27 they would launch a long-awaited pilot property tax beginning January 28. The move is part of a larger Central Government effort to cool the housing market. The results of the trial program will determine how the tax is rolled out in other locations, according to the Ministry of Finance.

Chongqing will tax all villas and new apartments priced two or more times greater than average. Chongqing's tax rate ranges from 0.5 to 1.2 percent. For family residences, the first 180 square meters for villas and first 100 square meters for high-end apartments are exempt from the tax. Second homes will be taxed at 0.5 percent. The latter category covers housing for people who don't work or own companies in Chongqing.

As for Shanghai, permanent residents with more than one home will enjoy tax exemption for the first 60 square meters per person of floor space. Shanghai's tax rate ranges from 0.4-0.6 percent. All new homes bought by non-permanent residents of Shanghai will also taxed. But non-resident homeowners in the city are eligible for a tax refund on their first homes after they work in Shanghai for three years.

A recent survey by China Youth Daily shows 57.5 percent of the interviewees supported the levying of the property tax and 22.9 percent expressed strong support, while 35.2 percent said the tax would be very effective in curbing speculation and stabilizing prices.

Supporters say these taxes would have a big impact on owners of several houses. Of course, others think the property tax will not help to cool China's ever-heating property market, and there are those who are worried the tax will push up housing prices. Others think the 1 percent tax rate will have a limited impact on speculators given current prices.

Urgently needed

Ye Tan (Jiefang Daily): China is soon to collect tax on residential properties and this will be a breakthrough in China's overall tax reform and also a major revenue source for local governments during the 12th Five-Year Plan (2011-15).

My strong support for this tax is based on a couple of reasons:

First, the tax can help local governments quit the bad habit of depending on land finance, that is, the revenue from selling land. In the absence of a property tax, the country's land revenues in 2010 reached 2.7 trillion yuan ($403 billion). We can't expect local governments to give up such huge revenues without external pressure. Yes, a property tax will not surely shake up financing arrangements, but without it, land revenues will never shrink.

Second, the property tax will help to push forward the reform of the public financial system. A property tax should be made a milestone in China's real estate market and even in the national economy. The introduction of this tax will make local financial conditions transparent. This tax is not a new item added to those already existing, but a thorough improvement and reform of old forms of tax.

Although it will not replace the current land financing system, a property tax will have a far-reaching influence on China's economic reforms. It will be capable of gradually replacing land finance and keeping local governments from depending on land revenues. If this tax is not levied, we will never see the end of land finance. It's better to institute a trial as soon as possible rather than let various interest groups go on disputing and struggling.

Guo Songmin (www.xinhuanet.com): Chongqing's plan brings us the hope of decreases in housing prices.

|