| With its fate up in the air in the past two years, China Guoxin Holding Co. Ltd. was finally established by the State-owned Assets Supervision and Administration Commission (SASAC) last December and will reorganize China's many state-owned enterprises (SOEs) and manage their assets.

Wang Yong, SASAC Chairman, said China Guoxin Holding will serve as a platform for optimizing the industrial structure of SOEs and managing state-owned assets in cooperation with the SASAC. Such a position indicates that the main task of the company is to reorganize centrally administered SOEs (central SOEs) and their assets. "It is an assets management company, not an enterprise for industrial operation, nor an investment company," Wang said.

According to a SASAC news release, China Guoxin Holding's registered capital for its first phase of operation is 4.5 billion yuan ($680 million). The company's major tasks include: holding the state-owned property rights of the central SOEs; performing investor's responsibilities and promoting reorganization of central SOEs; taking over and integrating the assets left by central SOEs after they are listed; and improving the competitiveness of core businesses by cooperating with central SOEs.

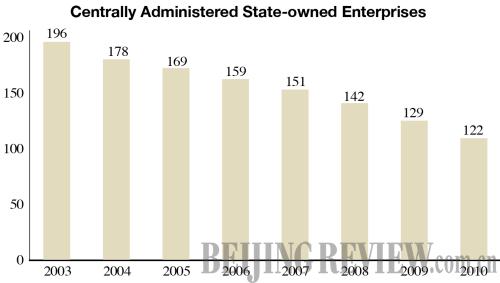

Wang said establishing China Guoxin Holding is an important measure to promote reconstruction of the state-owned economy. Since its establishment in 2003, the SASAC has pushed forward restructuring as a significant measure for the sustainable development of central SOEs and promoted SOE reorganization. The number of central SOEs has been reduced from 196 in 2003 to 122 by the end of 2010.

Some SOEs, small in scale and lacking any substantial public benefit, are not suitable to be integrated with other enterprises. After SOEs are listed, there are also some assets left, which are hard to be reorganized without relying on the enterprises themselves. China Guoxin Holding will be a professional platform to push forward reorganization of these enterprises, optimize the industrial structure of central SOEs and improve the overall profitability of these enterprises.

China Guoxin Holding is SASAC's third asset management company. The other two are China Chengtong Group and State Development and Investment Corp.

In July 2010, former SASAC Chairman Li Rongrong said that the commission aimed to reduce the number of central SOEs to 100 by the end of 2010. But on December 22, Wang said it would be too difficult to complete the reorganization as scheduled.

Under these circumstances, Wang said the SASAC will propel reorganization of central SOEs on the principle of voluntary participation by the enterprises to ensure stability of the enterprises after reorganization. It will also optimize resource allocation during reorganization of central SOEs.

On December 22, the SASAC also appointed Xie Qihua as chairman and Liu Dongsheng as general manager of China Guoxin Holding. Xie, 67, is known as the "Iron Lady" of China's steel sector. From 1994 to 2006, she acted as general manager and chairman of Baosteel Group Corp. Liu once acted as director of the Bureau of Enterprise Reform of the SASAC, which was responsible for establishing China Guoxin Holding.

With a triple layer structure—SASAC, assets management corporations like China Guoxin Holding, and central SOEs—the dual role of SASAC in the management of state-owned assets as both "coach" and "referee" will be changed.

"After this assets management company is set up, central SOEs can act as 'athletes,' state-owned assets management corporation as 'coaches' and the SASAC as 'referee' with each performing its own function," said Zhu Boshan, General Manager of Shanghai Tacter Investment Consulting Co. Ltd. "This kind of pattern can help reorganize and restructure central SOEs and with improvements to the operational mechanism of state-owned assets management corporations, the SASAC will play its due roles."

The SASAC has yet to announce the number and names of central SOEs to be consolidated by China Guoxin Holding, but Wang said the enterprises will likely be smaller, less competitive ones not related to state security or vital to the national economy.

Wang Zhigang, Director of the Enterprise Reform and Development Research Department of the Economic Research Center with the SASAC, said the country will maintain absolute control over seven industries, including the military industry, coal, power and grid, civil aviation, shipping, telecommunications, and oil and petrochemical sectors. It's therefore probable that companies designated to China Guoxin Holding will mainly involve some research institutes, trade-related central SOEs and other less profitable and small central SOEs.

Even before its official establishment, China Guoxin Holding was put to the test. On December 18, 2010, Minmetals Development Co. Ltd. announced that it received a notice from its former controlling shareholder, China Minmetals Corp. (China Minmetals). According to the notice, China Minmetals, together with two strategic investors, had jointly founded China Minmetals Co. Ltd., which will be engaged in the core business of China Minmetals. China Guoxin Holding Co. Ltd. is one of the above mentioned strategic investors, holding a 2.5-percent share in the jointly initiated China Minmetals Co. Ltd.

Other Asset Management Companies Under the SASAC

China Chengtong Group

Established in 1992, China Chengtong Group has total assets of 55 billion yuan ($8.31 billion). Its main business responsibilities include asset operation and management, modern logistics, composite trade and packaging papermaking.

The group has almost 100 subsidiaries and three listed companies: Shanghai-listed Zhong Chu Development Stock Co. Ltd., Shenzhen-listed Foshan Huaxin Packaging Co. Ltd. and Hong Kong-listed China Chengtong Development Group Ltd.

(Source: www.cctgroup.com.cn)

State Development and Investment Corp.

Established in 1995, State Development and Investment Corp. (SDIC) had total assets of 209.6 billion yuan ($31.5 billion) by the end of 2009. It has formed a unique triple-pillar business framework that integrates industrial investment, financial services and state-owned assets operations.

SDIC's industrial investment mainly goes to power generation, coal mining, ports and shipping, chemical fertilizer production and other infrastructure or resource-oriented fields as well as hi-tech projects. In the financial services sector, SDIC focuses on finance, assets management and consulting businesses.

(Source: www.sdic.com.cn)

|