|

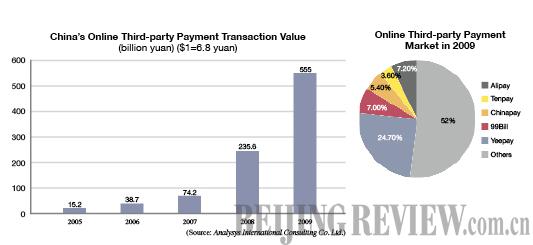

But not every provider has such close ties with C2C platforms. As a result, it is a more viable option for most small players to specialize in a particular area. The Beijing-headquartered Yeepay, for instance, has gained a foothold in the education sector while Tenpay focuses on air ticket businesses by tapping the rich customer resources of QQ, an instant messenger service of Tencent. But not every provider has such close ties with C2C platforms. As a result, it is a more viable option for most small players to specialize in a particular area. The Beijing-headquartered Yeepay, for instance, has gained a foothold in the education sector while Tenpay focuses on air ticket businesses by tapping the rich customer resources of QQ, an instant messenger service of Tencent.

But most small players are struggling to make ends meet due to fierce competition and low brand recognition, said Nuan Minmin, General Manager of International Payment Solutions Ltd.

Worse still, clouds have been gathering over the industry due to a lack of market regulation, and some unscrupulous providers are believed to be involved in illegal activities, such as money laundering and credit fraud. There are even reports that the online payment company 99Bill Corp. helped an overseas gambling group transfer funds of more than 3 billion yuan ($441.2 million) leading to the detainment of one of its senior managers.

Many analysts believed this might make it difficult for 99Bill Corp. to get a license. But the company dismissed the worries, citing that it was also a victim in the case and was deceived by its business partners.

Streamlining

Major payment companies have welcomed the new policy.

"The regulation will accelerate consolidation within the sector. It allows more room for large players and will bring tangible benefits to our customers," said Su Hui, spokeswoman of the Hangzhou-based Alipay."We are preparing to apply for the license and are confident we will get approved."

"The policy is expected to steer the sector on a steady path toward growth," said Yu Chen, Vice President and co-founder of Yeepay. "Due to an implicit regulatory environment, many companies have been hesitant to expand and explore innovative business models."

Guo Tianyong, Director of the Research Center of China's Banking Industry under the Central University of Finance and Economics, estimated that two thirds of third-party payment companies will be forced out of the market. "But it represents an official recognition of status of the new industry, and will help remove uncertainties hanging over the industry."

Hu Yuanyuan, a senior analyst at the iResearch Consulting Group, agreed. "The top 10 players will not be impacted," she said. "From a long-term perspective, it will help with risk control and will also polish the sector's appeal to investors."

The positive effects have already been felt. "Since the new policy was introduced, many investors have been looking for opportunities in the payment sector," said Huang Shengli, Vice President of the China Renaissance, an independent investment bank based in Beijing.

Future payments

The new policy indicates a bright future for the sector, but players like Alipay are not without their concerns—especially since state-owned companies are already rushing to cash in on the payment bonanza.

China UnionPay, the country's sole bankcard processor, has been upgrading its point of sale networks to support mobile payments, an emerging business with no clear champions.

Before this, Chinapay, a third-party payment platform of China UnionPay, reached an agreement with Dangdang.com to provide payment services for online bookstore customers.

In another move, China Mobile announced on March 18 that it had agreed to pay 39.8 billion yuan ($5.85 billion) for a 20-percent stake in the Shanghai-based Pudong Development Bank. The tie-up was expected to pave the way for the telecom giant to make inroads into 3G mobile payment services.

"With a better credit reputation and financial strength, state-owned companies will pose a huge threat to the private businesses," said Cao Fei, a senior analyst with Analysys International Consulting Co. Ltd. "But private companies have their own advantages in customer resources and business innovations. Now, it's imperative for them to improve their professional services and strengthen customer loyalty."

|