|

|

|

(LI SHIGONG) |

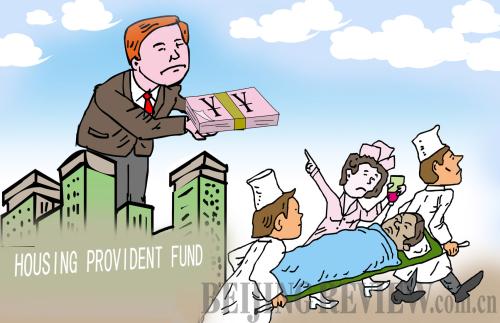

Recently, Guangxi Zhuang Autonomous Region issued a trial regulation guiding the use of the housing provident fund (HPF). The regulation says, from 2010, money deposited at the fund can be withdrawn and be applied to medical expenses if a depositor and/or his or her family members suffer from a major disease. This essentially means the fund has a second tier.

The HPF is a compulsory housing savings plan and is exempt from income tax. It is designed to help ordinary wage earners with little purchasing power to complete a housing purchase. Depositors can apply for subsidized mortgage loans from the fund when buying home.

Besides Guangxi, there are some other places across China that have come up with similar regulations.

The adjustments are believed to have been made because of insufficient use of the HPF. According to a report by the Ministry of Housing and Urban-Rural Development, by the end of 2008, the total deposits at the HPF had stood at 1.2116 trillion yuan ($177 billion) in China, while loans from the HPF had totaled 609.4 billion yuan ($89 billion).

A debate has heated up about whether the HPF should be used for multiple purposes or be kept solely for housing purchases, even if depositors have no intention of buying an apartment.

Some people believe the HPF should retain its original function. They said where it is the condition that both HPF and health insurance funds have large amounts of idle money, permission to use deposits at the HPF for medical purposes would in effect cover up flaws in the existing social security system and problems such as fund mismanagement.

But supporters insist that current housing prices are too high, and the adjustment of the fund use is a blessing for low-income earners because they can use the money to rent a better apartment or treat a major disease. They say that allowing the HPF to be used for disease treatment is a people-oriented action, as the money is part of personal assets and should be used for individual purposes.

Not for medicine

Zhang Guifeng (Oriental Morning Post): There is an unavoidable fact. The HPF is designed to meet people's housing needs. When putting a roof over one's head is such a big problem at present, how can there be such a huge amount of idle funds? If the government treats idle HPF money by allowing people to use their deposits to cure diseases, deep-rooted problems of the current social security system itself (for instance, unfairness and inefficient management) will be virtually shrouded from public attention.

Of course, if health insurance funds are insufficient, it has every reason to turn to the HPF. But health insurance funds have had the same problem of idle money as the HPF for a very long time.

Evidently, China's health insurance system has inherent and serious problems. The government should first resolve the problems rather than turning to the HPF for help.

The prerequisites for the interflow of the HPF and health insurance funds are scientific design and healthy operation of the two systems. Otherwise, if the two systems both incur age-old malpractices, sloppy interflow is neither helpful for strengthening the health insurance system nor for improving housing guarantees.

Wu Licheng (www.cnr.cn): According to the original intention of establishing the system, the HPF should be used only to help depositors purchase homes and should not be used otherwise. Indeed, there are problems stemming from the inefficient use of the fund, that have been complained about by the people. But the large amount of idle money is largely caused by rigid withdrawal standards and complicated application procedures, and does not mean the people do not need money to buy homes.

The nature of the HPF is similar to bank deposits and could be speedily used up. Compared to the skyrocketing medical expenses, the HPF is utterly inadequate.

In addition, insurers all have antifraud systems to effectively prevent insurance frauds and other malpractices, but HPF operators, who lack experience in a medical care system, could be easily deceived, giving rise to abuse of the fund. Then how should we guarantee the safety of the HPF?

Fu Wanfu (Chinese Business Morning View): From a legal perspective, Guangxi's adjustment of the use of the HPF violates the Regulations on Management of the Housing Provident Fund, which state clearly the fund is used for facilitating housing purchases. On the other hand, the adjustment helps cover up flaws in health insurance and medical care systems and hampers the advancement of the health care system.

There are some major problems in the use of the HPF. First, dealings concerning the huge HPF have not been carried out in a transparent manner but have sometimes been embezzled, giving rise to people's suspicion against the safety of the fund. Second, there are too many restraining policies in terms of HPF deposit withdrawals, which to some extent reduce HPF efficiency.

|