|

Second, economies across the globe will gradually soften their stimulus plans, which will increase the flow of capital. For example, an increase in interest rates by one country will entice more money from others. It has also been widely accepted that emerging markets and countries rich in resources will be hotspots for an influx of capital. That is to say, the withdrawal of stimulus plans at different intervals among different countries will bring about a liquidity imbalance.

Third, China's foreign trade will do better than this year, even if stimulus policies are less forceful.

What will be the biggest concerns for the Chinese economy in 2010?

The core issue will still be focused on China's monetary policy, mainly the money supply. But I don't think it will necessarily be the policy that is the problem, but rather the enforcement mechanism that will require attention.

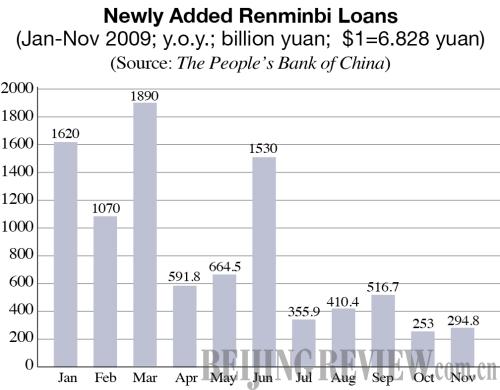

China has invested heavily in infrastructure and social security systems in 2009 through local financing platforms. The investment cycle for these projects will be rather long. Therefore, the local governments' impetus for investment will remain high next year and will force an expansion of money supply despite the Central Government's desire to moderate its stimulus plan.

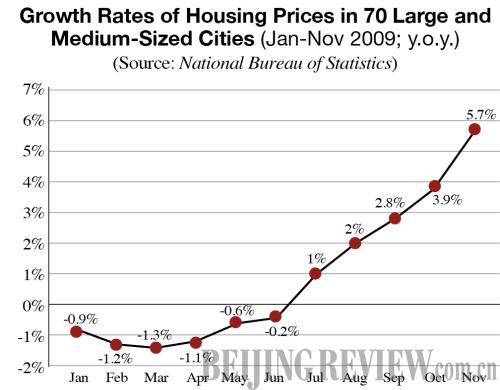

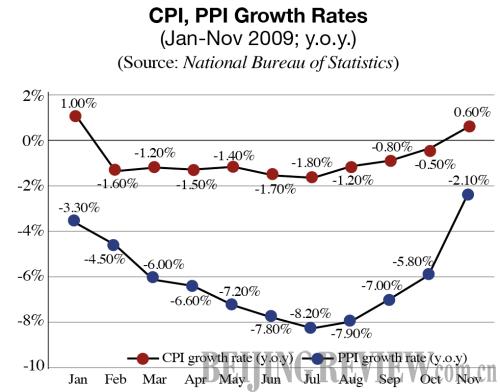

Another issue will be reforming the GDP-oriented mechanism for government performance evaluation. In pursuit of a higher GDP growth, administrations at various government levels may still cling to radical stimulus policies, which will cause a money oversupply. In 2009, China planned a broad money supply growth of 17 percent, which eventually swelled to 29 percent when put into practice. If it continues this year, the risk for inflation and property price hikes will be significantly high.

The third issue will be the government's debt in the post-crisis era.

In fact, the proactive fiscal policy is likely to carry on for the next three to five years, which will cause government expenditures to continue to rise. In turn, the country's debt ratio will also increase.

For this reason, achieving a financial balance will be another major task for the coming year.

|