|

|

|

BANKING WONDER: Passers-by walk past the headquarters of Bank of China, one of the biggest state-owned banks in China. Regulatory departments are working to strengthen their oversight to protect the banking sector (GAO XUEYU) |

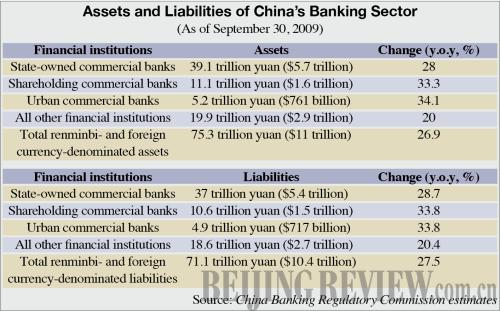

Regulatory departments are strengthening their supervision over financial institutions to prevent an incomprehensible financial scenario from unfolding: the failure of the Chinese banking system, an event which would overshadow the collapse of Lehman Brothers Inc. in the United States in 2008. Because the robust Chinese economic development has been a major foundation for renewed confidence worldwide, if Chinese banks—which experienced the least turmoil during the financial crisis—were to encounter serious problems, the world could once again be thrown into an economic abyss.

Recently, the China Banking Regulatory Commission (CBRC) and the central bank publicized a number of policies guiding the capital adequacy ratio of commercial banks to ensure the banking sector run safely and smoothly.

Inadequate capital is considered the biggest threat to the banking industry, supervisory authorities said. In order to cushion the blow from the financial crisis and secure sufficient liquidity, banks began shoveling money liberally into the market. In the first 10 months of this year, newly added renminbi-denominated loans stood at 8.92 trillion yuan ($1.31 trillion), the equivalent of roughly one third of the China's gross domestic product in 2008.

The generosity of the banks' monetary measures resulted in a drop of 1 to 3 percentage points in their capital adequacy ratio, leaving small and medium-sized commercial banks under even greater pressure than the larger financial institutions.

In the December 1 issue of China Finance magazine, Vice Minister of the CBRC Wang Zhaoxing outlined the CBRC's increase in the minimum capital adequacy ratio from 8 percent to 10 percent for small and medium-sized banks and 11 percent for larger banks. The CBRC also expanded the non-performing loans provisioning coverage ratio from 100 percent to a more encompassing 150 percent.

Wang said increases in the two ratios were meant to encourage the banks to turn profits into concrete assets and provisioning coverage to cope with unexpected losses, allowing the banking industry in its entirety to operate soundly.

Despite the CBRC guidelines, many banks are on the verge of falling below the threshold. According to third quarter reports from the three major listed banks, capital adequacy ratios had amounted to 11.63 percent by September 30 for the Bank of China, 12.6 percent for the Industrial and Commercial Bank of China and 12.11 percent for China Construction Bank.

CBRC requirements

Earlier in December, the CBRC issued a notice on its website, instructing all commercial banks to properly and prudently manage their credit risks that may increase before the year's end. The commission also required self-inspections of possible problems stemming from large loans issued during the last quarter of 2008 and the first two quarters of 2009.

The notice reiterates that the CBRC will place restrictions on financial institutions with low capital adequacy ratios and those that fail to take rational and feasible capital replenishing actions in the following areas: market access, overseas investments, and office and operation expansions. As for financial institutions whose provisioning coverage ratios have not reached 150 percent, they must make every effort to reach the CBRC target by the end of the year.

To avoid sharp upticks and downturns in the credit market, the CBRC required all commercial banks to properly handle the speed of issuing loans in accordance with their risk control abilities, capital adequacy and provisioning coverage.

|