|

|

|

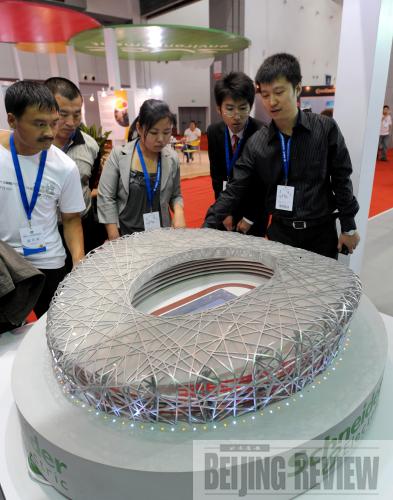

INVESTMENT MANIA The 5th China Jilin Northeast Asia Investment and Trade Expo kicks off on September 2 in Changchun, capital city of Jilin Province. The six-day exhibition attracted thousands of domestic and foreign investors (JIANG LIN) |

Fuel Prices

The National Development and Reform Commission (NDRC), the top economic planner, announced a rise in the prices of gasoline and diesel by 300 yuan ($44.1) a ton, or about 4 percent, effective as of September 2.

The retail price of gasoline will increase by 0.22 yuan a liter, and that of diesel will rise by 0.26 yuan a liter, said the NDRC. The price hike is in line with international price changes, it added.

This was the sixth fuel price adjustment since China put in place a new pricing regime on January 1. Under the new rules, the NDRC will consider price adjustments when the moving average of international crude oil prices changes more than 4 percent over a period of 22 straight working days.

Auto Venture

The state-owned Chinese automaker FAW Group Corp. and General Motors Corp. of the United States have announced plans to jointly invest 2 billion yuan ($293 million) to set up a venture in Changchun, capital city of Jilin Province.

The venture, a 50-50 merger between the two sides, will focus on manufacturing and sales of light-duty trucks and vans, as well as research and development, exports and after-sales support, according to the two companies.

"It will address demand in China and other markets for high-quality, affordable products in one of the industry's most robust segments, while complementing the portfolio of products that GM and FAW currently offer," said Nick Reilly, Executive Vice President of GM.

Going Australian

Baosteel Group Corp., China's largest steel maker by market share, has agreed to pay 285.6 million Australian dollars ($240.7 million) for a 15-percent stake in the Australian miner Aquila Resources Ltd., Xinhua News Agency reported.

The deal, which will make Baosteel the second-biggest shareholder in Aquila, is yet to get approval from Australian and Chinese regulators.

Baosteel values the growth potential of Aquila's assets in the deal, and it is another major step in its overseas expansion, said the company in a statement.

The strategic cooperation will "fast-track the development of Aquila's key steel raw materials projects including iron ore, metallurgical coal and manganese," said Aquila.

Tariff Regulation

China has recently unified the duty tax rate for auto part imports at 10 percent, one year after the World Trade Organization (WTO) ruled against China over the auto part tariff dispute, according to a joint announcement by the NDRC, the Ministry of Commerce, the Ministry of Finance and the General Administration of Customs.

China had considered auto parts as a complete vehicle if they accounted for 60 percent or more of the value of a final vehicle and charged a higher tariff on them. This was intended to prevent complete vehicles from being imported in large chunks, allowing companies to avoid the higher tariff rates for finished cars. But the United States and the European Union filed a lawsuit to the WTO, claiming that the tariff discouraged automakers from using imported parts to build cars, which costs jobs abroad.

Tightening Supervision

The China Insurance Regulatory Commission (CIRC) has recently set up a new committee whose major task is to curb misuse of insurance capital and regulate the insurers' corporate governance.

The committee will help secure insurance assets and solve serious management problems of the insurers, said the CIRC.

Analysts believe the move comes in the wake of the capital abuse by the Anhua Agricultural Insurance Co. Ltd.

The CIRC in August fined the company 800,000 yuan ($117,100) for unauthorized investments in equities and fake financial documents. |