|

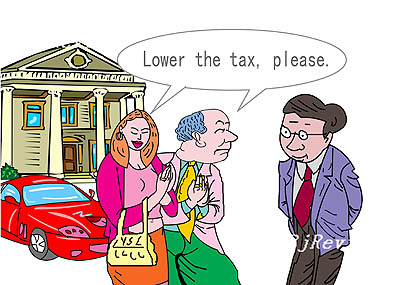

In March, Zhang Yin, the richest Chinese mainlander in 2006 whose assets were estimated at 27 billion yuan ($3.4 billion) then, proposed to cut the individual income tax rate for the country's wealthy. Her reason is that China's high tax burden has spooked many rich people and tax cuts would encourage high-income professionals to stay in the country.

China's individual income tax rate is currently capped at 45 percent, compared with 17 percent in Hong Kong, 30 percent in Singapore and Malaysia, and 35 percent in the United States.

Zhang suggested cutting the ceiling of the progressive individual income tax rate from the current 45 percent to 30 percent, making it lower than that in developed countries; and raising the cutoff point of the highest tax rate to 150,000 yuan ($2,140) per month from 100,000 yuan ($1,430) per month, while also raising the thresholds of taxable income for all citizens.

Zhang's proposal was applauded by many who believe that China's overly high individual income tax rate is emerging as a new bottleneck in the country's economic growth. Many multinationals, they say, are now basing their regional headquarters in other Asia-Pacific countries and regions to help their employees avoid high taxation.

They deny that lower income tax rates will increase the wealth gap as this part of tax revenue only accounts for about 3 percent of the national total, which can in no way balance wealth distribution.

However, not all people are supporters of new tax cuts. Some argue that as far as the high-income earners are concerned, the focus should be on tax evasion, rather than amounts of tax payable. While ordinary people whose monthly salaries exceed 2,000 yuan ($300) have to pay tax on every additional yuan earned in accordance with the law, in most cases, the wealthy do not need to pay individual income tax, as they shuffle their daily expenditures into their company's cost accounts.

Moreover, it's unfair to say the rich are paying heavy taxes just because the tax rates are relatively high. In some sense, China provides a paradise for the rich. For example, China charges no inheritance tax and the state offers many preferential policies to businesses. In addition, high-income earners are taking advantage of far more social resources than the common people, although the latter greatly outnumber the former. Taxation means to balance national income distribution, so it's unacceptable to cut tax rates for the rich when the country's income gap is sharply widening.

Missing the point

Chen Qinggui (hlj.rednet.cn): Individual income tax is an important means to redistribute social wealth and also a way to promote income equality.

China is now faced with two severe challenges: First, it is plagued with an extremely high Gini Coefficient, 0.47, which is higher than all developed countries and most of the developing countries and which is also the all-time high throughout Chinese history. The income gap in China has far exceeded the internationally recognized alert level, with a Gini Coefficient of 0.4. Moreover, the individual income tax seems unable to fulfill its obligation to redistribute social wealth in China. For years, it is the middle- and low-income earners who pay income tax while many of the top-income earners are avoiding and evading tax payments. This is an open secret in today's China. As a result, the income tax is playing a reverse role to what was intended, enlarging, instead of narrowing, the income gap. In this context, it's urgent to raise the thresholds of taxable income for average workers, rather than reducing the tax burden of the rich as proposed by Zhang.

Zhang's argument that high-income professionals will leave China because of the high individual income tax rates is unpersuasive. Based on Abe Maslow's Hierarchy of Needs Theory, when they've already led a very comfortable life, the elite of society will no longer pay too much attention to material things such as tax rates, but they are more likely to seek cultural and spiritual inspiration and enjoyment. In other words, the tax rate is not the decisive factor in their choice to leave or stay.

Ye Tan (The Beijing News): As far as the individual income tax is concerned, the biggest headaches facing China are unfair tax burden and complicated and ineffective taxation scheme and procedures, instead of over-taxation on the wealthy.

The underdeveloped taxation system makes it possible for high-income earners to avoid and evade tax payments by transferring their individual expenditures to the categories of operation costs and cash trade. Therefore, most of the tax burden is transferred to ordinary workers, who contribute 40 percent of the country's total income tax revenues. In the meantime, the low tax cutoff point is causing dissatisfaction among low-income earners.

Rather than sharpening social conflict by cutting tax rates for the rich, the government should extend popular tax breaks in order to increase the enthusiasm and vitality of emerging businesses.

Wu Jie (www.xhby.net): Tax rates do affect taxpayers' incomes and they also impact on the macroeconomic and social development.

Both high and low tax rates have their advantages and disadvantages. While low rates can help to increase people's incomes and encourage the rich to create more wealth, thus promoting the economic growth in underdeveloped areas, high rates are not always bad. There are so many examples of high-tax welfare states in the world. Despite the extremely high tax rates, instead of being frightened away, many rich people are deeply attracted by the well-developed welfare system and safe social environment there, which further improves the national welfare. Therefore, if handled properly, high tax rates are also helpful.

The criteria to raise or cut tax rates should not be based on whether "the rich people will be frightened away."

Gao Zejin (www.chinavalue.net): In any society, it's reasonable to ask the rich to pay more taxes and it's all right to adopt a progressive tax rate to deal with rising incomes. Taxes are used to provide and improve public goods. The rich are undoubtedly the biggest beneficiaries. Although the Constitution says that everyone is equal, it can't change the fact that the rich are consuming more social resources and enjoying more privileges. In this sense, isn't it necessary for them to pay more taxes?

During China's prolonged social and economic transitional period, the rich people's exclusive control of excessive resources and opportunities, which actually should be shared by more, is sharply widening the rich-poor gap.

Actually, as far as China's top income earners are concerned, their real tax burden is not too high, but too low, possibly unimaginably low, given the many privileges they enjoy in economic and social affairs.

Give the rich a break

Zhang Chunyang (www.cnhubei.com): China is already a paradise for the rich, who do not need to pay taxes on inherited wealth. Some argue that China's rich groups are already world famous for their tax evasion and avoidance.

The rich group is supposed to undertake more social responsibilities. Taxation is an important tool for the country to narrow the gap between the rich and the poor.

Let's have a deep and rational analysis of the tax rate.

Take Brazil for example, which also belongs to the developing camp like China. After Brazil cut its individual income tax rate from 27 percent to around 6 percent, the country saw its individual income taxes double. The reason is that the low tax rate attracted talented individuals from across the world.

Lower tax rates might affect the country's national tax revenues and even widen the rich-poor gap, but it will attract and keep those with skills. This will give a big push to China's economic growth.

Guo Lichang (www.chinacourt.org): How to improve the taxation system so that it will have the least negative impact on the country's economic and social development is always a big concern for the government and scholars. China's high-income earners are now pressed by high tax payments and the country's individual income taxation system is gradually becoming a new barrier in China's economic growth, weakening the country's competitiveness.

Many of China's neighbors and the world's major developed countries have much lower tax rates, supplemented by tax exemptions, refunds and so on. They also have much better developed social welfare and social security systems. China's tax rates have never changed since the country adopted individual income tax in 1980.

Extensive social welfare guarantees are the best demonstration of taxation equality while unreasonable taxation system will disturb economic growth and thus reduce social welfare.

Li Mingxu (The Beijing News): China's economy will be severely affected when the overly high tax burden forces tens of thousands of talented individuals and the regional headquarters of multinationals out of the country.

We believe that China's development needs the rich, as they are able to make bigger investment and thus employ more people and produce more.

To cut the income tax rate for the rich might help to reduce tax evasion and avoidance, which is a frequent practice of the rich. A lower income tax rate will help to produce more rich people in China and at the same time more rich people will be attracted from throughout the world. An expanding tax base will boost the total tax revenues.

To cut the individual income tax rate for the rich will not necessarily widen the income gap between the high-income as well as middle- and low-income earners. The solution is very simple. While the ceiling of the progressive tax rate is lowered to 30 percent, the tax cutoff point can be further raised from the current 2,000 yuan/month to 5,000 yuan ($714) per month or 8,000 yuan ($1,143) per month. In this way, not only can the income gap be narrowed, but the low-income group can also have more disposable incomes. Meanwhile, more investors will be attracted by the low tax rate here.

Dear Readers,

"Forum" is a column that provides a space for varying perspectives on contemporary Chinese society. In each issue, "Forum" will announce the topic for an upcoming issue. We invite you to submit personal viewpoints (in either English or Chinese).

Upcoming Topic: Can excessive charges on plastic bag use effectively wipe out this environment-unfriendly packaging?

E-mail us at byao@cipg.org.cn

Please provide your name, telephone number, zip code and address along with your comments.

Editor: Yao Bin

|