|

growth, but Americans' waning confidence about the future of their economy, Chen said. While they do not lack the money to buy goods and services, they worry about their futures. "The U.S. Government's plan to salvage the economy helps the consumers to regain their confidence, even before the rebate checks are issued," she said.

Shen Minggao, chief economist at Citibank China, told China Business News that while the massive rebate check plan would stimulate U.S. consumers' desire to buy goods and services, the contemporary tax benefit plan would promote investment by enterprises. The plan would save nearly $50 billion in taxes for companies by cutting their tax levied on purchases of new equipment, software and fixed assets by 50 percent this year. For example, if a company purchases equipment valued at less than $800,000, it would save about $12,800 to $25,000, Shen said. This would enable firms to expand and create more jobs, he said.

Other causes, other means

The economic stimulus package comes as the U.S. Government is also trying to fix its financial sector, which has been badly damaged by the subprime mortgage crisis. The crisis not only had a negative impact on banks and investors who purchased bank bonds, but also created a large amount of bad debts that triggered a liquidity shortage inside the American banking system, Chen from the CICIR said.

Because the American real estate industry has been in a downturn since 2001, the real estate industry and mortgage banks started issuing loans to lower-income borrowers, many of whom were unable to pay increasing bank interest rates. This in turn caused a liquidity shortage. The crisis prompted the Bush administration to make a deal with the mortgage loan industry in December 2007, in which lenders would freeze part of their interest rates to sustain borrowers' abilities to pay their loans.

Chen said this measure would not only eliminate the pressure of holding bad debts from the mortgage banks and sooth the current liquidity shortage, but also prevent the country's economy from a possible financial crisis, which would have both national and global reverberations. The bright side of the U.S. economic downturn is that although the real estate industry has nosedived, the stock market is still afloat, she said. The market is wavering, but remains in a controllable range, she added.

Chen said that there were other options for the U.S. Government to take to help revive the economy. As of mid-February, the U.S. Federal Reserve had cut benchmark interest rates to 3 percent. Chairman Ben Bernanke hinted that it was planning a further cut.

"Compared to the lowest interest rate level of 1 percent, there is still space for reductions, but the space is more and more limited," Chen said.

Chen also noted that the depreciation of the U.S. dollar could transfer the possible economic crisis to other countries.

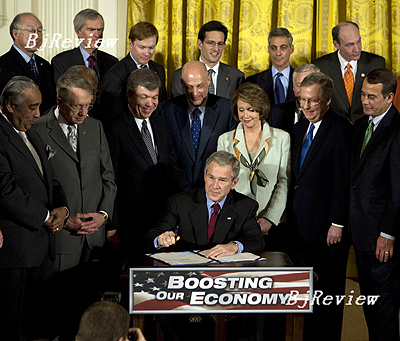

Although the stimulus package aims to create a quick economic boost in the short term, there is sill a possibility that the Bush administration could issue a longer-term policy on improving the economy, especially before the U.S. presidential election in November this year.

The following months will be crucial for the presidential candidates of both parties. If the Bush administration is not successful in salvaging the U.S. economy, the Republicans will not have a chance to win the election, Chen said. Neither the Republicans nor Democrats want to be responsible for slowing down the country's economic development during such a decisive period, she said, noting that this was the reason why leaders from both parties very quickly approved the economic stimulus package. |