|

The more, the better?

Not exactly.

China is vowing to curb its excessive trade surplus. And experts are calculating the pros and cons of the country's foreign exchange reserves of over $1 trillion.

There's nothing wrong with rising China-South Korea and China-Japan trade, though.

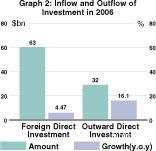

Meanwhile, the paid-in FDI increased 4.47 percent in 2006 compared with a year earlier. But experts warned that the quality of FDI needs to be improved immediately.

And in spite of a recent slight stock market fluctuation, Chinese citizens' investing enthusiasm is soaring, with bank deposits plunging dramatically in order to buy stocks and funds.

Chinese don't seem to have much confidence that plummeting oil prices will benefit them, however.

Harmony Trumps Surplus

A huge trade surplus-giving rise to trade friction and international political wrangling-might not be the best way to promote a "harmonious world," which China heavily promotes.

Shortly after the Ministry of Commerce (MOFCOM) announced the immense trade surplus of $177.47 billion for 2006, Minister Bo Xilai showed his concern.

"It is not conducive to the balanced development of the domestic economy and it hurts the sustainable development of foreign trade," he said.

The minister said reducing the excessive trade surplus will be a top priority related to this year's foreign trade. Export commodities whose processing is harmful to environmental protection, will be heavily restricted.

The country will no longer pursue growth at any cost, realizing it is even more costly to rebuild the environment and energy reserves.

Double-Edged Sword?

China's $1 trillion of foreign exchange reserves in 2006 might distort the domestic economic structure, experts say. The government needs to be cautious in how to spend the big bucks.

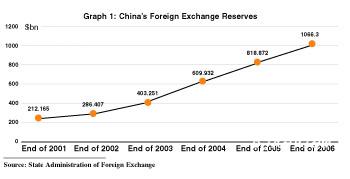

"(Foreign exchange reserves) are enough," said central bank Governor Zhou Xiaochuan. The central bank announced that by the end of last year, the Chinese foreign exchange reserves had totaled $1.0663 trillion (see graph 1), which is the world's largest, having surpassed Japan's last February.

The trade surplus and increasing foreign direct investment (FDI) have contributed to the mammoth reserves.

Peng Xingyun, a senior researcher with the Chinese Academy of Social Sciences (CASS), estimated that about two thirds of China's foreign exchange reserves are invested in U.S. government bonds.

What if China's renminbi continues to appreciate? What if the U.S. dollar keeps depreciating? The U.S. macro control policy could easily lead to dollar depreciation, thus easing U.S. obligations to pay back China for U.S. government bonds.

The good news is that enough foreign exchange reserves will make China more capable of controlling financial risks and handling international payments.

Bullish Market Steals Deposits

"Have you bought any stocks?" is a frequently asked question in offices.

Walking into a local bank, whichever it is, you would find it stuffed with people either opening fund management accounts or withdrawing fixed deposits "to buy stocks," as one customer recently said.

Intrigued by the burgeoning stock market, city dwellers have no patience to wait for meager interest returns on savings. They are switching attention to the seemingly more lucrative stock market.

A central bank financial report on January 15 revealed that last year, citizens deposited 2.09 trillion yuan into banks. That indicated deposit growth slowed down by 5.3 percent compared with a year before.

The report also showed since last May, the stock market attracted some proportion of bank deposits, leading to the significant growth reduction in deposits.

Zhao Xijun, a finance professor with Renmin University of China, applauded citizens' increasing awareness of investing. "It is good for them to invest in the stock market," said Zhao. "Banks are no longer the only caregivers."

Careful, though, China.

Investment is not always as safe and sound as deposits.

Gas Gouging No More

As the Organization of Petroleum Exporting Countries struggle to bring oil prices back to the normal track of steady increases, ordinary Chinese consumers have benefited from the latest round of oil price declines. As the Organization of Petroleum Exporting Countries struggle to bring oil prices back to the normal track of steady increases, ordinary Chinese consumers have benefited from the latest round of oil price declines.

Beginning January 16, refined oil prices were reduced between 0.17 yuan and 0.21 yuan per liter. It is the first time China cut its refined oil retailing price in 20 months. Lower gasoline costs and reduced fuel surcharges in air travel will certainly make life easier, though many citizens are not satisfied with the slight price cut.

The National Development and Reform Commission claims the best time to marketize Chinese oil prices according to international market price fluctuations is when the international oil price falls to $50-55 a barrel. But currently, the Chinese Government still holds the pricing right.

Citizens' reaction toward the price slide is only moderately favorable as a 0.2 yuan price cut is not a big deal, as most domestic newspapers reported.

Quality, Not Quantity FDI

Statistics from the UN Conference on Trade and Development show that China maintained its position as the largest FDI recipient among developing countries in spite of a slight drop in inflows in 2006 to $70 billion from $72 billion in 2005. Non-financial sectors (sectors excluding banking, insurance and securities) absorbed FDI of $63.021 billion, up 4.47 percent compared with the previous year, according to MOFCOM (see graph 2). Statistics from the UN Conference on Trade and Development show that China maintained its position as the largest FDI recipient among developing countries in spite of a slight drop in inflows in 2006 to $70 billion from $72 billion in 2005. Non-financial sectors (sectors excluding banking, insurance and securities) absorbed FDI of $63.021 billion, up 4.47 percent compared with the previous year, according to MOFCOM (see graph 2).

However, it is not always nice to be the largest. China's think tank, CASS, issued a research report warning that the quality of FDI needs to be improved.

A large proportion of FDI is export oriented and flows to the manufacturing sector, which is detrimental to the development of tertiary industry. Meanwhile, some free ports increased FDI to China and likely pose more financial risks. A large proportion of FDI is export oriented and flows to the manufacturing sector, which is detrimental to the development of tertiary industry. Meanwhile, some free ports increased FDI to China and likely pose more financial risks.

Asian Trade Wrap-Up

China and South Korea

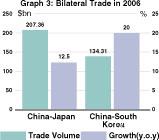

MOFCOM statistics show that in 2006 the trade volume between China and South Korea totaled $134.31 billion, up 20 percent compared with a year earlier. After South Korea admitted China's fully marketized economy, their relations have been sweetening.

China exported commodities and services worth $44.53 billion to South Korea, and imported $89.78 billion. South Korea has become the sixth largest trading partner of China and China is the biggest trading partner of South Korea.

It's very likely the goal of total trade volume of $200 billion can be achieved ahead of schedule if their trade relations continue along a rosy path.

China and Japan

The $200 billion in trade volume is a lofty goal for China and South Korea, but China and Japan already surpassed that, hitting the $207.36 billion mark in 2006, up 12.5 percent compared with the year earlier, according to MOFCOM (see graph 3).

Japan is China's third largest trading partner and the second largest FDI investor as of the end of November 2006.

Considering historical tensions between China and Japan, it's good to see money bridging the cultural divide.

|