|

China Life is ushering in a new era for China's insurance industry and for the A share market by listing there. China Life is ushering in a new era for China's insurance industry and for the A share market by listing there.

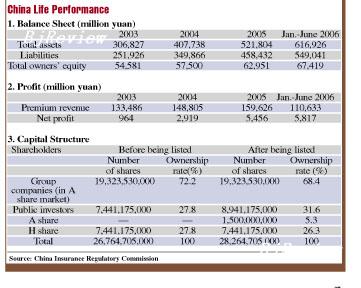

January 9 marked the day for the listing of China Life Insurance Co. (China Life) on the Shanghai Stock Exchange after being listed on the New York Stock Exchange (NYSE) and the Hong Kong Stock Exchange (HKSE) in December 2003. China Life has thus become the first insurance company listed in the Chinese stock market and also the first of its kind in the world listed in the stock markets in New York, Hong Kong and Shanghai.

The initial public offering (IPO) of China Life in the renminbi-denominated A share market was eye-catching. On January 9, China Life opened at 37 yuan per share and closed at 38.93 yuan, exceeding market expectations with an increase of 106 percent compared with the IPO price of 18.88 yuan. At the end of the day on January 9, the total market value of China Life reached about $141 billion, making it the world's third largest insurance group after American International Group Inc. (about $185 billion) and Berkshire Hathaway Inc. ($165 billion).

China Life made several new records during its listing, with both the amount of money subscribing to its IPO (832.5 billion yuan) and its price-to-earnings ratio (92.6) hitting an all-time high.

China Life is now the third largest company in the A share market following the Industrial and Commercial Bank of China (ICBC) and Bank of China. Securities insiders generally believe that the listing of China Life on the Shanghai Stock Exchange has greatly enhanced the overall quality of listed companies in the A share market. China Life was listed in New York and Hong Kong three years ago. As a flagship insurer, China Life will join ICBC and Bank of China, as well as Ping An Insurance Co., Bank of Communications and China Construction Bank, which are preparing to be listed, to form the financial part of the Shanghai Stock Exchange. The performance and profitability of these financial institutions will directly reflect the performance of the entire financial industry in China and will provide a sound investment platform for domestic investors to enjoy the fruit brought about by the rapid economic development of the country.

"Big companies are calling the shots in the domestic stock market," said Qiu Yanying, an analyst with the Shanghai-based TX Investment Consulting. He pointed out that before China Life was listed, profit from the banking, iron and steel and petrochemical industries accounted for 60 percent of the total profit in the A share market, with over half of the market value of the Shanghai and Shenzhen stock exchanges attributed to big companies like ICBC and Bank of China. "The listing of China Life and other industry gurus in the future will change the situation and make the market index more credible."

Veteran analyst Teng Yin from Everbright Securities Co. Ltd. believes the listing of China Life in Shanghai will help enhance the value of the whole financial sector in the stock market. Teng said financial stocks, including those of China Life, ICBC and CITIC Securities Co. Ltd., will become important propellants in the A share market.

A great buy?

Investors are keen on the first insurance stock in the A share market. Even before China Life was listed, not only institutional investors but also private investors had agreed that China Life stock was worth buying.

"It is very probable that the price of China Life stocks will further pick up," contended Luo Yi, an analyst with China Merchants Securities. Luo pointed out that China Life is No. 1 in the industry and is the first one to be listed. "Even if its price soars to 43 yuan per share, it is still reasonable," said Luo. He believes China Life stock has room to grow and "if you can buy its stocks below the price of 40 yuan, you should buy it!"

Analyst Xu Yiding from China Minzu Securities is even more optimistic.

"The A shares of China Life will stay at 35 yuan in 2007 and will rise to 90 yuan in three years," Xu said.

Xu assumed that as the first insurance company listed, China Life is a "must buy" for institutional investors. The prospects of China's life insurance sector are bright. From the perspective of the international insurance industry, China's insurance industry is in a developmental stage, and there is still huge room for growth.

Some other institutional investors sensed potential pitfalls with the new stock.

"The seemingly good performance of China Life in the stock market now doesn't mean investors should buy those stocks blindly," said Zhou Xingzheng, an analyst with Southwest Securities Co. Ltd. As for investors, higher stock price means less profit margin. Zhou contended that China Life's price of over 35 yuan per share is unacceptable in the short run.

"The price-earnings ratio (P/E ratio) of China Life has already exceeded 90. If another 50 percent increase is added, the ratio would reach 150, which is incredible," said a researcher from a fund management company. Unless China Life can maintain a growth rate of 30 percent each year, the company is not worth such a high P/E ratio, said the researcher.

But Haitong Securities Co. Ltd. issued some good news: According to domestic accounting standards, the net profit of China Life from 2006 to 2008 is expected to reach 7.635 billion yuan, 10.245 billion yuan and 13.758 billion yuan for each respective year. That also would mean a growth rate of 39.9 percent, 34.2 percent and 34.3 percent respectively.

Setting an example

China Life has set an example for the reform and development of the Chinese insurance industry. Its A share market listing is just a prelude and marks the upcoming blue-chip era for insurance companies.

Industry insiders also believe China Life's listing will ultimately help make the Chinese insurance industry more professional.

"As there was no insurance company listed in the domestic market, investors would find it hard to evaluate Chinese insurance companies," said Hao Yansu, insurance professor with Central University of Finance and Economics. "But this time, thanks to effective communication between China Life management and its underwriters, domestic investors are able to have some insight into the evaluation of insurance companies."

Insurance professor Xu Wenhua, from Fudan University, added, "Generally speaking, insurance institutions attach great importance to risk control. They run stably with relatively good performance. Their listing in the A share market will help boost the overall quality of all listed companies."

From the microperspective, being listed will be conducive to the development of insurance companies in terms of fund collection and utilization. After being listed in Hong Kong, New York and Shanghai, China Life has grown to become a standard and well-managed company, which represents the future development prospects of the Chinese insurance industry.

The mainland stock market used to see the absence of insurance companies. However, the insurance industry now has room for growth along with the rise in China's GDP and citizens' income and consumption levels. According to Swiss Re, a reinsurer, the per-capita premium the Chinese people spent in 2005 accounted for 2.7 percent of China's per-capita GDP, ranking 50th in the world. The average rate of the world was 7.7 percent. The fact that the renminbi is expected to continue appreciating will assist the steady development of insurance companies. Xu believes insurance companies will become the darlings of the market if they are listed.

The successful listing of China Life greatly encouraged other Chinese insurance companies. As a matter of fact, another insurance icon, Ping An of China, intends to make an A share IPO. It plans to issue about 1.15 billion shares and is expected to be listed on the Shanghai Stock Exchange in the first quarter this year. Teng of Everbright Securities pointed out that a number of insurers will probably get listed following China Life and Ping An. It is reported that Chinese insurance tycoons including China Pacific Insurance (Group) Co. Ltd. and China Reinsurance (Group) Co. are preparing to be listed in the A share market.

But some experts also believe that the listing of China Life doesn't mean that all insurance companies can be listed because most of them are not strong enough. Professor Hao noted that not many insurers will follow suit to be listed, as only a few companies in China can measure up to required listing standards.

|

A brief introduction to China Life

China Life Insurance (Group) Co. is a state-owned financial insurance company based in Beijing. The group is made up of China Life Insurance Co. Ltd., China Life Insurance Asset Management Co. Ltd., China Life Insurance (Overseas) Co. Ltd., and China Life Property and Casualty Insurance Co. Ltd.

China Life Insurance (Group) Co. and its subsidiaries make up the biggest commercial insurance company in China. In 2005, the life insurance premiums collected by China Life reached 189.853 billion yuan, accounting for 51 percent of the mainland's life insurance market share. Its assets are valued at 724.747 billion yuan, accounting for 47 percent of the total of China's insurance industry. China Life Insurance Co. Ltd. was listed simultaneously in the NYSE and HKSE in December 2003, being the first Chinese life insurance company listed overseas.

|

|