|

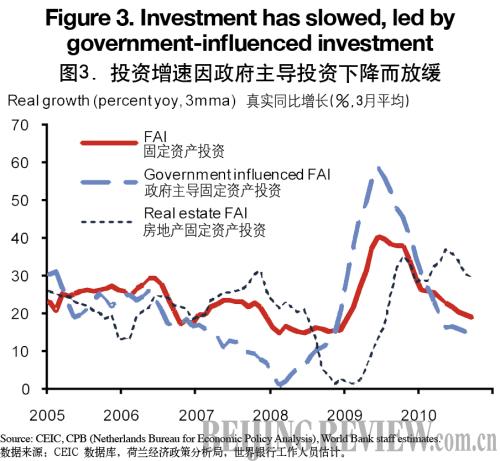

- Investment continued to slow gradually through the third quarter (Figure 3). After the surge, government-led investment has normalized in 2010, slightly lagging overall investment. Strong real estate investment has prevented a more abrupt slowdown in overall investment. In April, the government took measures to contain housing prices, including higher minimum down payments for mortgages, banning mortgage discounts, and restricting financing of developers. However, because of the lead-time, real estate construction and investment have not yet slowed significantly, even though sales initially weakened substantially (see below). Other market-based investment has continued to expand robustly.

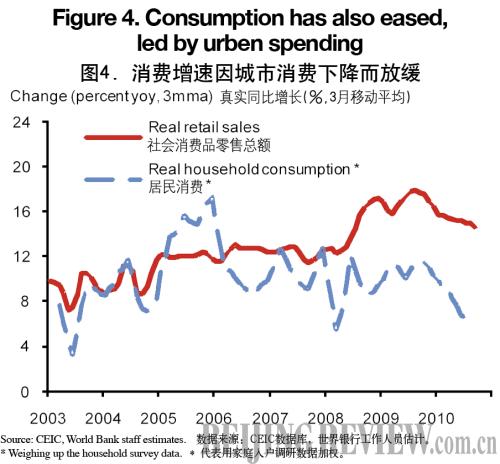

- Consumption growth has also softened, especially in urban areas. With real urban income growth moderating in 2010 because of higher food-price-driven inflation and slower housing sales (which trigger slowdown in consumption spending on household items), urban consumption has decelerated significantly through the third quarter. In rural areas, slower "business income"—in part because of the supply shocks causing the higher food prices—was more than offset by strong increases in migrant wage income and government transfers. Rural cash consumption growth held up through the third quarter. However, overall consumption growth decelerated, because of the higher weight of urban spending. Retail sales also moderated slightly (Figure 4).

With exports strong, domestic demand and imports easing, and a broadly unchanged growth pattern so far, the external surplus is increasing again.

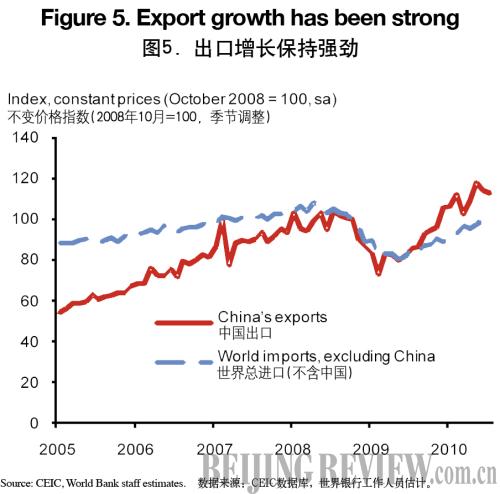

- China's highly competitive exports have continued to outpace global imports. Global import demand has slowed recently, after the post-recession rebound, and import volumes (in constant prices) in the world outside China are still somewhat lower than a year ago (Figure 5). However, despite recent easing, China's merchandise export volumes were up 9.6 percent on two years ago in the third quarter, implying further market share gains.

- The expansion of import volumes has slowed alongside investment. After the stimulus-driven surge earlier on, slower investment and heavy industrial production caused imports to decelerate this year, particularly raw material imports (Figure 6). Imports of machinery and equipment have held up better and car imports have also remained strong. Overall merchandise import volumes were 22.6 percent higher than 2 years ago in the third quarter.

- China's terms of trade (TOT) were unfavorable in the first half, but are turning around. In the first half of 2010, the TOT were an estimated 15 percent lower than a year ago as commodity prices were sharply higher while spare capacity in the manufacturing industry worldwide depressed China's export prices (Figure 7). However, as commodity price increases are moderating while export prices are recovering, the TOT are turning around again—in September they were down only 4.2 percent over a year ago—adding substantially to the current account surplus. - China's terms of trade (TOT) were unfavorable in the first half, but are turning around. In the first half of 2010, the TOT were an estimated 15 percent lower than a year ago as commodity prices were sharply higher while spare capacity in the manufacturing industry worldwide depressed China's export prices (Figure 7). However, as commodity price increases are moderating while export prices are recovering, the TOT are turning around again—in September they were down only 4.2 percent over a year ago—adding substantially to the current account surplus.

- The trade surplus is rising again (Figure 8). The trade surplus declined strongly in 2009 because China's domestic economy—and thus imports—kept on growing, supported successfully by massive stimulus, while the global crisis depressed China's exports. Now, with the impact of the stimulus fading out and imports slowing, little change so far in China's underlying pattern of growth, and the world economy recovering, the external surplus is rising again, even though this was masked in the first half by TOT effects. Thus, while in the first quarter of 2010 the trade surplus was $47.7 billion lower than a year ago, in the third quarter it was $26.5 billion higher than a year ago.

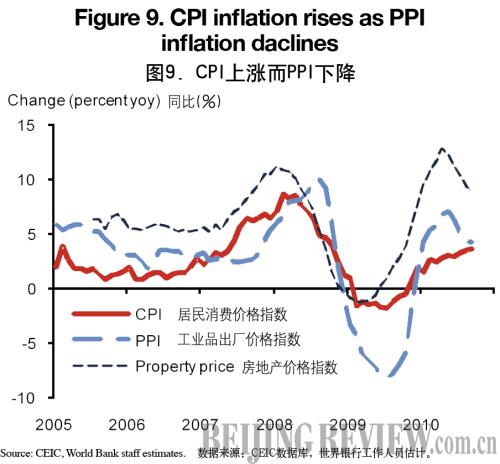

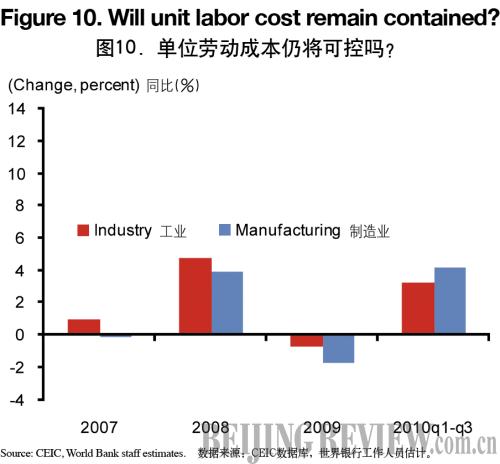

Consumer price inflation has risen on higher food prices. CPI inflation rose to 3.6 percent (yoy) in September (Figure 9). About two thirds is contributed by higher food prices, largely because of problematic weather domestically but with additional impact from higher international food prices. Despite renewed increases in international prices for industrial raw materials, input prices in China are still falling month on month and the (yoy) PPI increases are moderating. Meanwhile, core inflation remains low as strong productivity growth in manufacturing has largely offset sizeable wage increases in recent years (Box 1). Nonetheless, after falling in 2009, unit labor costs in manufacturing rose significantly in the first three quarters of 2010 (yoy) because of the particularly high wage increases granted earlier this year (Figure 10).

Property prices have hardly budged since April. According to the NBS's 70 cities index, the most closely watched by policymakers, price rises were contained during June-August amidst weak housing sales. However, housing prices rose again by 0.5 percent month on month in September as sales recovered. In response, the government added some measures in September, including increasing the minimum down payment ratio for first mortgages to 30 percent.

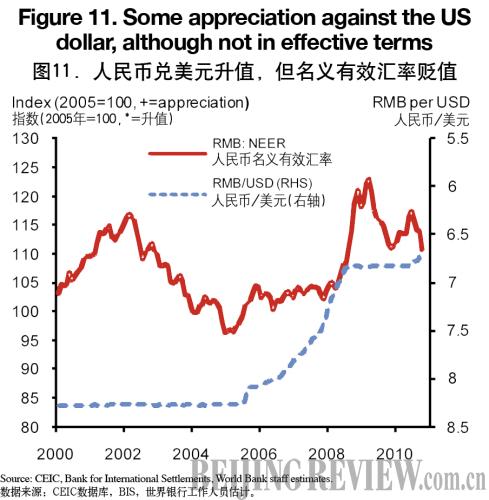

Despite some exchange rate appreciation against the U.S. dollar, foreign exchange accumulation is accelerating again. Between the end of the temporary peg in mid-June and early November the RMB has appreciated 2.3 percent against the U.S. dollar. As the U.S. dollar weakened substantially against many other currencies, in nominal effective terms the RMB has depreciated in this period, although the nominal effective exchange rate is still more appreciated now than in mid 2008, when the temporary peg was introduced (Figure 11). The foreign exchange purchases required to keep the RMB from appreciating more against the U.S. dollar has gained speed again in the third quarter. Even after accounting for about $80 billion in valuation effects, the net inflow was $114 billion in the third quarter, due to a substantial trade surplus, more net FDI, and some net financial capital flows.

|