| Overview

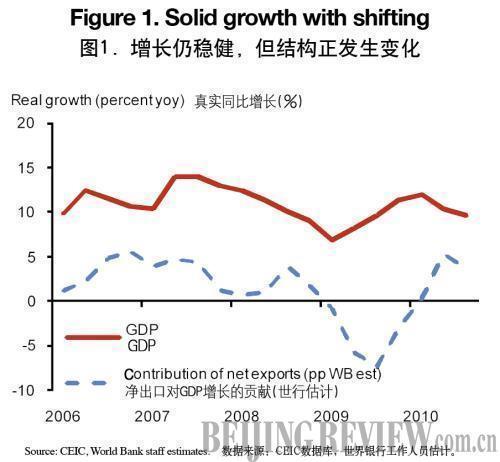

China's growth has moderated somewhat, with a shifting composition. GDP growth declined from 10.6 percent in the first half to a still surprisingly strong 9.6 percent (yoy) in the third quarter. The domestic economy cooled as the stimulus impact is fading out and the monetary stance is being normalized. Investment and urban consumption have decelerated, and so have imports. Meanwhile, with exports strong, net external trade has contributed significantly to (yoy) growth and the external surplus is rising again.

The global outlook is broadly favorable, but risks remain. Despite an expected deceleration, global growth prospects are fairly favorable due to emerging market strength. But risks include a weaker outlook in high-income countries and ample international liquidity as well as the global imbalances and possibly contentious policies triggered by them. Global price pressures remain contained by spare capacity in many countries. But there are upward inflation risks internationally.

China's own economic prospects remain sound, with risks both ways. Growth may ease further as global growth decelerates and the macro stance is normalized further. However, the expansion should remain supported by the traditional growth drivers and a robust labor market. We have edged up our GDP growth projection for 2010 to 10 percent after the third quarter data. We see growth at 8.7 percent in 2011 and easing somewhat further in the medium term. Pushed up by higher food prices, inflation may stay above the 3 percent target for a while. It is unlikely to escalate as core inflation remains in check. However, raw commodity prices may rise further while sustained high wage growth is unlikely but cannot be ruled out. Given the fundamental drivers of property prices, they are unlikely to be contained for long. On current trends and policies, the external surplus is on course to rise in 2011 and the medium term.

Further normalization of the macroeconomic stance is needed to guard against macro risks. The key concerns are asset price increases, strained local finances and non-performing loans, while inflation risks cannot be ruled out. Two-way risks call for policy flexibility. The authorities are broadly on track to normalize the overall monetary stance and meet the 2010 quantitative targets. They have also started to raise interest rates, although interest rates will need to rise further. International liquidity poses challenges to monetary policy, but these should be more manageable in China than in some other emerging markets. Nonetheless, measures can be taken to enhance protection against unwanted capital flows.

The preparations for the 12th Five-Year Plan (2011-15) call for focus on structural issues and reforms. Changing the growth pattern is rightly a key target. The need to rebalance to more domestic demand-led, service sector-oriented growth seems stronger now than five years ago, in part because the international environment is less favorable. Rebalancing will not happen by itself—it will require significant policy adjustment. This update also discusses policies that would help boost private sector development, focusing on opening up sectors and reducing entry barriers, addressing investment climate constraints, and supporting research and development and innovation by the private sector. Further progress in energy conservation and renewable energy calls for further rebalancing the pattern of growth, energy pricing reforms, more market-based mechanisms, lower cost of renewable energy, and accelerated development and diffusion of new energy technologies.

Recent Economic Developments

China's continued rapid growth during the global crisis reflected large scale stimulus and strong underlying growth drivers. The stimulus package implemented since end-2008 gave a well-timed temporary domestic demand boost. The underlying growth drivers, in place since long, stem from sound fundamentals and a policy setting that stimulates industry-led, capital intensive growth.

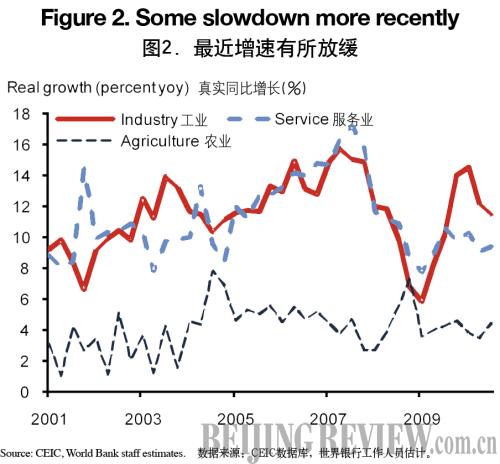

Growth moderated to a still rapid pace of 9.6 percent (yoy) in the third quarter of 2010, with a shifting composition (Figure 1). The domestic economy cooled as the stimulus impact is fading out and the overall monetary stance is being normalized. Since August, measures to meet the 11th Five-Year Plan's energy efficiency targets may also have had some effect. Meanwhile, the (yoy) contribution of net external trade shifted from strongly negative in mid 2009 to strongly positive in mid-2010, reflecting a rebounding world economy and further global market share gains. Sequential GDP growth held up better than expected at 9.1 percent in the third quarter at a seasonally adjusted annualized rate (SAAR). Production-wise, the slowdown was led by industry—heavy industry in particular—with the expansion in the service sector steadier (Figure 2).

So far, the growth moderation has been largely domestically-led.

|