|

Domestically, there are also several risks. On the downside, although there are no signs of it, there is always a possibility that policymakers become complacent after the first signs of stabilization. Relatedly, market-based spending may weaken more after disappointment about the lack of a speedy rebound. The large amount of spare capacity poses risks of significant downward price pressures and company failure, although policymakers have some weapons to fight deflation. In the medium term, if the bulk of stimulus spending is oriented to investment instead of consumption, rebalancing may be postponed. On the upside, additional stimulus measures may support growth further, although, as argued below, this policy response may not necessarily be the most appropriate.

Economic Policies

As short- and medium-term policy objectives overlap, the medium term objective of rebalancing needs to shape economic policies as much as possible. Notably, the very weak prospects for the global economy—and thus for exports—increase the importance of boosting domestic demand and domestic consumption, which is also key for rebalancing. Less emphasis on targeting short-term growth would allow for more focus on the reform agenda. Meanwhile, limiting the adverse consequences of the downturn can be done by using and expanding the social safety net, preferably combined with education and training.

China has important short-, medium-, and long-term challenges. The key short-term challenge is to limit the adverse consequences of the downturn for employment and people's livelihood. The medium- and long-term challenges are enshrined in the 11th Five Year Plan (5YP) that is now in the fourth year of implementation. The key medium-term challenge is to rebalance the pattern of growth to make it more sustainable economically, socially, and environmentally (see our December Quarterly for a discussion and possible policies—page 13 and Box 3). The key long term challenge is to continue with reforms to raise productivity and living standards. The World Bank's report on a mid-term evaluation of progress in implementing the 5YP recently concluded that "significant progress has been made toward several of the major objectives of the 11th 5YP, but important challenges remain."9

With the short- and medium-term objectives overlapping, the medium-term objectives need to shape economic policies in 2009. As emphasized by China's leaders, the subdued prospects for the global economy—and thus for exports—increase the importance of boosting domestic demand and domestic consumption, which is also key for rebalancing.10 Thus, several measures needed for rebalancing are also good for stimulating growth in the short term. These include increasing the role and spending of the government in health, education, and social security and measures to sustainably boost household disposable income, particularly of lower income people. This is not true for all policies: some rebalancing policies will not stimulate growth in the short term and some policies to stimulate growth in the short term do not help rebalancing. However, China has strong economic fundamentals and the medium- and long-term objectives are important. Less emphasis on targeting short-term GDP growth would allow for more emphasis on the reform agenda, and there is a premium on stimulus measures that fit well in the rebalancing agenda.

Looking ahead, measures other than new investment-oriented stimulus may be preferable. China's traditional policy response to a downturn emphasizes stimulating investment to help achieve economic targets. This is done by large government-influenced projects, funded by both fiscal spending and bank lending. In the current downturn, the rapid policy response has been key in dampening the impact on growth. However, employment and people's livelihood are equally important, and the number of jobs created by growth depends on not just the rate of growth but also the pattern. China's growth has been capital intensive in the recent decade, meaning that a lot of new investment is needed to create new jobs. Also, since not all investment-oriented projects are in line with rebalancing needs, the quality of growth may deteriorate as a result of the traditional approach. Thus, the government has rightly added more consumption-oriented stimulus measures. There is room for a further shift in this direction. Also, somewhat lower overall growth is not likely to jeopardize China's economy or social stability, especially not if the adverse consequences of dislocation and lay-offs are alleviated by using and expanding the social safety net. Thus, there is a case for maintaining the current level of short term policy stimulus and putting more emphasis on reform and rebalancing.

Box 2 discusses possible and recommended labor market policies to alleviate the labor market consequences of the downturn. It argues that using the social security system has advantages over several other labor market policies.

Financial sector and capital market reform could help rebalance the growth pattern. New investment in the coming years needs to be consistent with the desired kind of demand. Encouraging investment by providing financial incentives and subsidies runs the risk of generating backward-looking investment—investment that was successful under China's traditional, capital intensive and industry heavy, export oriented growth model. However, for China to thrive in the medium and long run, new investment needs to be forward looking—that is successful under a rebalanced growth model. This consideration is relevant as stimulus measures are considered. It also suggests reforms in: (i) monetary policy and the banking system, to moving away from a traditional bias towards large traditional clients (such as industrial SOEs) (see below); (ii) the capital market, where more development would help increase the flow of capital from mature sectors to new growth sectors, and (iii) more significant dividend payments for SOEs.11

Fiscal policy

The government was right to provide a forceful fiscal stimulus. Looking ahead, though, there may be limits to the amount of traditional, largely investment-oriented fiscal stimulus that can be spent efficiently. Consumption-oriented fiscal stimulus can be considered. However, the costs and benefits of additional overall stimulus and growth need to be weighed against those of using the social safety net, preferably combined with education and training. As additional fiscal measures are considered, it may not be obvious to cut taxes further. But, recent measures to expand the government's role and spending in health, education, and social safety are very welcome, and there is room to do more.

Fiscal policy in 2009 is likely to lead to a sizable but manageable increase in the government deficit. Our scenario for 2009 sees government-influenced direct expenditure contributing a massive 4.9 pp to GDP growth, or three fourths of the total, but only part of government-influenced investment is financed by the central and local governments. In terms of the government budget, we estimate that the combined effect of the expenditure increases, the discretionary reduction in revenues because of tax rate reductions and increases in VAT rebates to exporters (including the whole-year impact of tax changes introduced in 2008), and some impact on revenues from weaker growth is an increase in the government deficit to 3.2 percent of GDP in 2009. This is a little higher than in the Ministry of Finance's budget presented to the NPC, which is based on somewhat higher GDP growth and inflation.

How strongly should fiscal policy respond if the growth target for 2009 is in danger, and how? If economic growth falls short of the target, one response would be to add more fiscal policy stimulus along traditional (investment-oriented) lines. As noted above, this would require a lot of additional spending, and there may be limits to how much such stimulus measures can be expanded efficiently. This downside of investment-oriented stimulus may be less of a concern with consumption-oriented measures. Nonetheless, a second reason for capping the overall fiscal stimulus in 2009 is that the global slowdown may well extend to 2010 or longer. This would require additional fiscal stimulus (increase in the deficit) in 2010. Since there are limits to how high fiscal deficits can and should be, it would be prudent to preserve room to increase the deficit further in 2010, if needed.

The consequences of the downturn can also be alleviated by expanding and using the social safety net, preferably combined with training (Box 2). The private sector now plays a much larger role than in 1998, when China used fiscal stimulus to counter the impact of the Asian crisis. Thus, there may be a different trade off between the costs and benefits of boosting growth by overall government spending and those of improving and using the social safety net. Using the social safety net would surely be less costly for the government. As a very crude calculation, using overall (fiscal and bank-financed) spending to create enough growth for 20 million extra non-agricultural jobs requires additional spending of 3.5 percent of GDP, based on China's current pattern of growth, which is not labor intensive.12 Even assuming that the government needs to finance only one third of that, this would mean a fiscal cost of over 1 percent of GDP. Providing living assistance to 20 million people at twice the poverty rate would require only around 0.2 percent of GDP.

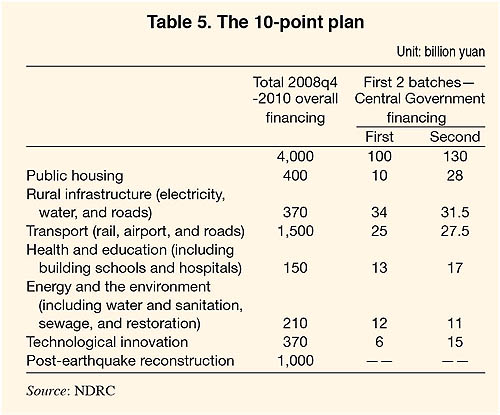

Spending under the 10 point stimulus plan is taking place. The plan has an emphasis on infrastructure and other investment, although of a different nature than 10 years ago, with many projects geared to broad long-term development needs and improving living standards instead of to the needs of industry (see our December Quarterly Update for more detail). The Central Government has committed 1.18 trillion yuan out of the total 4 trillion yuan, with the rest coming from local government financing, bond issuance by local entities affiliated with local governments, and, notably, bank lending. After spending 104 billion yuan at the end of 2008, the Central Government plans to spend 487.5 billion yuan (1.4 percent of GDP) on the 10 point plan in 2009 (the Central Government plans to spend 908 billion yuan in total on investment this year). In the Work Document presented to the NPC in early March, the government showed an adjusted breakdown (Table 5).

As part of the 10-point plan, the government has announced 10 sector specific plans. Several of these largely investment-oriented plans have an environmental and/or energy efficiency element.13 For instance, in the case of the petrochemical sector, 500 billion yuan (1.4 percent of 2009 GDP) is meant to be spent in 2009-10 on upgrading of refineries and improving the quality of fuel to reduce emissions.

Other recent fiscal policy initiatives have focused on stimulating consumption and improving people's livelihood. The following initiatives are in addition to sizeable proposed increases in public sector pensions. The magnitude of consumption-oriented stimulus spending has so far been modest compared to investment-oriented spending. However, Central Government spending on health, education, and social safety is set to increase by 38, 24, and 22 percent in 2009. Looking ahead, there is room for more medium-term-oriented initiatives in these areas.

First, the government recently announced the outlines of a health care reform plan. Under the plan, 850 billion yuan would be spent in 2009-2011 to increase medical insurance coverage and payments, improve equality in accessing public health facilities and care, and "establish an efficient public health and medical system." (Box 3) This is moving in the right direction, although many specifics are still unknown, including on the role of local governments in financing it.

Second, steps are taken to improve the social safety net. The draft of China's first Social Insurance Law was released in late 2008 for public consultation. It specifies a common right for citizens, urban and rural, to social insurance for medical care, unemployment, work injuries, and childbirth, although it is not yet clear what the immediate impact of the introduction of the law would be. Also, the government distributed about 9.7 billion yuan to 74 million poor people before the Chinese New Year. While one-off, the initiative is noteworthy because it tested the capacity of the social safety net to target the most needy and transfer payments to them.14 In addition, several local governments have made one-off payments or distributed coupons.

Third, the government sees great potential to boost rural consumption and has taken initiatives to achieve this objective. The key challenge is to raise labor productivity in agriculture and thereby per capita incomes. In this context, our December 2008 Quarterly Update had a box on land reform. In the meantime, the government has rolled out nationwide a scheme through which it provides a subsidy of 13 percent for consumption of specific electronic items by rural people. An earlier pilot scheme launched in December 2007 in 4 provinces was considered successful, with rural sales of the products of the four major product categories (color TVs, refrigerators, washing machines, cell phones) in those provinces up 30 percent in 2008—significantly more than in other provinces. The new program will last four years and includes additional products (motor cycles, PCs, air conditioners, microwave ovens, and water heaters) at the discretion of local governments. The central and provincial governments will provide 80 and 20 percent of the funding. Other measures to stimulate rural consumption include a government program to increase the number of stores and distribution centers in rural areas and to renovate, standardize, and upgrade rural food markets.

There are also several tax policy changes. The reform to allow capital spending to be deducted from the VAT was rolled out nation-wide early this year. The consumption tax on fuel was raised. With regard to foreign trade taxation, many rebate rates of VAT on exports were raised, the VAT rate on some imported mineral goods was raised, and the export tax on some products including steel products and fertilizers was lowered.15

Additional tax cuts are also discussed, but may not be desirable. The combined package of recent tax cuts is already substantial, and comes on the heels of the earlier unification of corporate taxes at a lower combined effective rate. Also, tax revenues are already affected by the downturn. Finally, many tax cuts will also benefit people that are less affected and/or have a lower propensity to consume, eroding their effectiveness in raising domestic demand or protecting the most vulnerable.

If tax cuts are considered, several points are worth noting. First, further increases in the minimum threshold for paying personal income tax (PIT) would not be desirable. As a result of previous increases in this threshold (to 2,000 yuan/month), only an estimated 26 million persons still pay this tax.16 Were the threshold to be further increased to 3,000 yuan/month, this estimated number could fall further to only about 6 million, and it would benefit high-income earners as much as or more than middle-income earners. If the aim is to cut labor taxation, it may be more effective to cut the social security charges that fund social protection programs, since over 200 million people pay these. Such cuts could be complemented by offsetting measures to protect the revenue base of these funds. Second, given the need to promote rebalancing, it would be unwise to consider further cuts in the corporate tax rate (CIT), as the corporate sector has already benefited disproportionately from the noted recent tax cuts, and given the current distortions affecting the distribution of income.

Finally, to support rebalancing, further tax increases to improve the energy efficiency and environmental friendliness of economic activity in China should be considered.

|