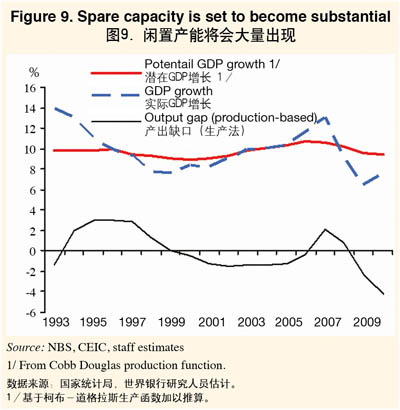

| Spare capacity is emerging, and is starting to have several types of effects. With the pace of growth significantly below potential growth, unused capacity is emerging (Figure 9). This excess capacity is set to show up in: (i) weaker market based investment in the absence of a need to expand capacity; (ii) less job growth and migration; (iii) downward pressure on prices and profit margins as firms facing spare capacity try to redirect exports to the domestic market or substitute for imports. On the latter, we are now projecting lower imports in 2009 than in November. In addition to the impact of lower exports, this is only in small part because of lower domestic demand. It is more because there are indications that China's industrial sector is more successful in import substitution than previously expected. As economic growth in China is projected to be significantly higher than in its trading partners, we still expect imports to hold up better than exports in 2009 (in volumes). However, we now project a somewhat smaller gap between the rate of change in imports and exports than in November.

With market based investment expected to retreat, government-influenced investment will be key (Table 3). Our analysis suggests that the downward pressure on profitability and the emergence of spare capacity tend to reduce investment growth in China, as would be expected in a market-based setting. Therefore, with these conditions present, market-based investment is likely to be weak this year, after two years in which it contributed the bulk of overall fixed investment growth of around 10 percent. Sectors where sales slowed down the most, and that have the largest spare capacity, are steel and other heavy industries, as well as several export-oriented sectors. Meanwhile, foreign direct investment (FDI) will suffer from the reduced investment plans of foreign firms (FDI fell by 26 percent (yoy) (in US$) in the first two months of 2009. Real estate investment is likely to remain weak for much of 2009, given the still very weak real estate sales. As housing prices come down, and with mortgage interest rates down significantly as well, the affordability of housing and mortgages improves substantially, creating the conditions for an eventual recovery. Based on the government's plans, including the stimulus packages, government-influenced investment will be strong in 2009 and 2010 (see fiscal section).

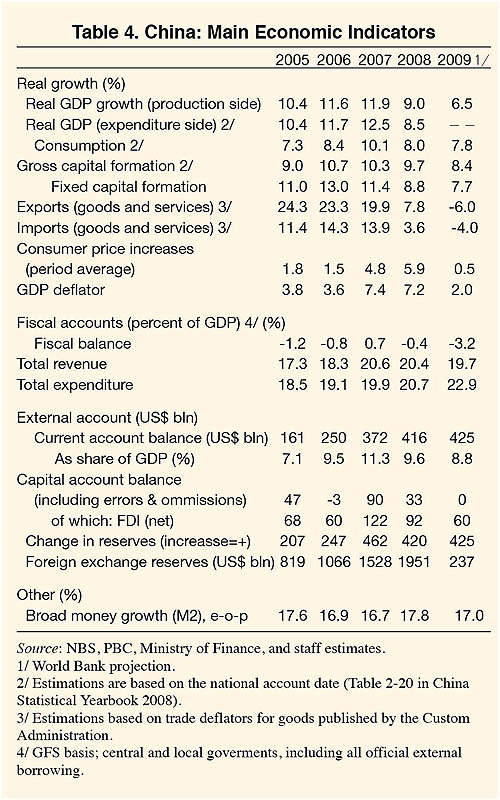

We expect private consumption growth to decelerate, but to remain significant (Table 4). In urban areas, growth of nominal wages and employment will slow, and consumer confidence has deteriorated (although it has not yet plunged as sharply as in many other countries). However, a few factors are likely to support consumption. Significantly lower inflation than in 2008 will help offset the lower wage growth. Public sector pensions are set to rise 10 percent in 2009 and 2010, and minimum living allowances are increased. Additional fiscal support comes in the form of somewhat higher transfers including higher government contributions to medical insurance and one-off payments or coupons to lower income households. Moreover, looser monetary policy after a tight stance for much of 2008 may stimulate consumer lending somewhat. With average nominal urban wage growth of 4-5 percentage points (pp) lower this year than in 2008, urban employment growth much lower than the 3 percent in 2008, and some fiscal support for urban households, nominal urban disposable income growth may decline about 5 pp in 2009. However, with CPI inflation down 5 pp, real urban income growth may not be much lower than in 2008. Assuming some increase in household saving rates because of lower consumer confidence and more uncertain economic prospects, urban consumption growth would be lower than in 2008, but still significant.

Rural consumption is likely to lag behind. Rural incomes will benefit from the 13-16 percent increase in the minimum grain procurement price, although the average effective price increase may be lower because this minimum is often not binding.8 Other agricultural output prices are likely to be more subdued, given the outlook for international food prices. Moreover, rural incomes will be significantly affected by the likely lower growth of migrant wages and employment. Several fiscal initiatives will support rural disposable incomes and consumption, including—as in urban areas—higher government contributions to medical insurance and one-off payments or coupons to lower income households, as well as subsidies for spending on household appliances in rural areas,. Nonetheless, this support may not be large enough to prevent a slowdown in rural real income growth. Indeed, looking further ahead, realistically, rural incomes are likely to continue to lag behind urban incomes, keeping up the pressure for fiscal support. Turning to public consumption, direct government consumption should grow substantially faster than GDP, reflecting the stimulus policies.

In all, due to substantial policy stimulus, China's economy should continue to grow significantly in a very challenging external environment. Our forecast of 6.5 percent GDP growth for 2009 is 1 pp less than in end-November 2008, with the bulk of the downgrade due to the much weaker international outlook. In this scenario, government-influenced direct expenditure would contribute 4.9 pp to GDP growth, two thirds of total growth, of which more than two thirds from government-influenced investment and the rest from direct government consumption. There are both downside and upside risks to this GDP growth projection.

China's economy is likely to receive support from the expected global pick up if and when it occurs late in 2009 or in 2010. With China's stimulus measures having effect earlier than in most countries, and the adverse impact of the global crisis on market based investment seemingly showing up later than in other countries, China may see less of an increase in growth in 2010 than some other emerging markets.

With raw material prices low and a significant output gap building up, inflationary pressure will be very low in 2009. Weak demand in many sectors, and the resulting spare capacity, is adding downward pressure. As some exporters redirect their sales to domestic markets, additional downward pressure on prices and profits may emerge.

Price pressure resulting from the slowdown drags down profitability. Looking ahead, the reversal of relative price trends, with raw material prices falling, is good for profits in manufacturing. On the other hand, downward pressure on margins from increased competition on the domestic market from the redirection of sales due to spare capacity is likely to intensify.

In this scenario, labor market weakness is set to continue. Between 2002 and 2008, non agricultural GDP grew impressively. Despite rapid productivity growth, this allowed non agricultural employment to grow 3.9 percent per year on average. Substantial migration contributed to a decline in agricultural employment of 16 percent during 2002-08. Our estimates suggest that every 1 percentage point less non-agricultural GDP growth means around 5.4 million lower non-agricultural employment. On a whole-year basis, GDP growth is likely to be about 3 percentage points lower than potential growth in 2009. But growth may be lower in the beginning of the year. This suggests about 16-17 million less non-agricultural employment because of weak growth for the year as a whole, peaking at perhaps 20-25 million early in the year. These numbers are broadly consistent with the estimates of the MHRSS on the situation in early March.

|