| Overview

China's real economy has been hit hard by the global crisis, but has been holding up. Indeed, China has weathered the storm better than many other countries because it does not rely on external financing, its banks have been largely unscathed by the international financial turmoil and it has the fiscal and macroeconomic space to implement forceful stimulus measures. As the global crisis has intensified, however, China's exports have declined sharply, and this is affecting market-based investment and sentiment, as well as employment, notably in the manufacturing sector.

Although China's growth is set to decline, it is still likely to be higher than in most other countries. The forceful stimulus policies will help dampen the downturn by supporting domestic demand, production, and employment. Banks have been keen to expand credit, after having deleveraged in recent years. And private consumption has been fairly resilient so far and should be able to continue to grow significantly, while government-influenced investment is accelerating already thanks to the stimulus package.

However, the continued global crisis is bound to contain China's growth in 2009 and 2010, especially via weaker exports and market-based investment. The World Bank has just downgraded sharply its projections for global GDP and imports in 2009. In this light, we expect China's exports to shrink in 2009. Government influenced activity will support growth, but it makes up a modest share of the total. It therefore cannot and probably should not offset fully the downward pressures on market-based activity. We project GDP growth of 6.5 percent in 2009. This is significantly lower than potential growth, and spare capacity is likely to lead to weaker market-based investment, less job growth and migration, downward pressure on prices, redirection of exports to the domestic market, and import substitution in the coming years.

Nonetheless, China's economic fundamentals are strong enough to allow policymakers to consider policies that will affect the economy well beyond 2009. So far, the policy response to the downturn has emphasized stimulating investment to help achieve the economic targets. Looking ahead, less focus on targeting short-term GDP growth would allow for more emphasis on the rebalancing and reform agenda. Meanwhile, somewhat lower growth is not likely to jeopardize China's economy or social stability, especially not if the adverse consequences of the downturn for employment and people's livelihood can be limited via the social safety net, preferably combined with education.

There are useful synergies between China's short and medium term policy objectives. The subdued prospects for the global economy-and thus for exports-increase the importance of boosting domestic demand and domestic consumption, which is also key for rebalancing. Thus, recent initiatives to stimulate consumption and improve people's livelihood by expanding the government's role and spending on health, education, and social safety are very welcome, and there is room to do more.

Financial sector reforms will help. They would help China manage the downturn and facilitate the transition to a more balanced economy.

Recent Economic Developments

The global financial and economic crisis intensified in the fall of 2008. Since September 2008, global financial market conditions have remained turbulent, with spreads in many funding markets still painfully high, despite wide-ranging policy measures to provide additional capital and reduce credit risks. Across the world, widespread disruptions of credit are affecting consumption, production, and trade. High levels of uncertainty and destruction of housing and equity wealth are affecting consumer and business confidence globally, with a strong negative impact on consumption and, notably, investment.

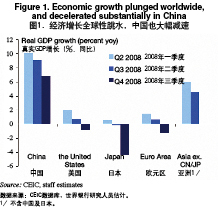

The adverse impact on output and trade is very large and geographically broad-based. Global industrial production declined by an estimated 4.5 percent in the fourth quarter of 2008, or 20 percent at a seasonally adjusted annualized rate (SAAR), with producers of capital goods especially hard hit. Overall GDP fell in the fourth quarter of 2008 in almost all of China's main trade partners, to levels often significantly down on a year ago (Figure 1). Global GDP may have fallen by 5 percent (SAAR) in the fourth quarter, and a similar decline may occur in the first quarter of 2009. On the back of the record decline in industrial output, the growth of world trade fell rapidly through 2008 and turned negative in the final months of 2008.

Against this backdrop, China's economy decelerated substantially. The international financial crisis has had limited direct impact on China's financial system, but China's open real economy has been affected significantly. Following mild overheating in 2006 and 2007, quarter-on-quarter (qoq) GDP growth declined steadily throughout 2008. This reflected the impact of the intensification of the global crisis-on exports, investment, and sentiment-as well as, domestically, the impact of policies to cool off the economy and housing market weakness (see our December Quarterly). On our estimates, GDP grew 2.5 percent (SAAR) in the fourth quarter, to a level 6.8 percent up on a year ago. This is a major slowdown, even if it compares favorably with data for other countries.

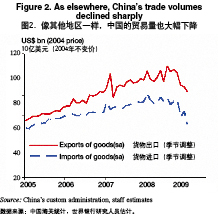

The intensification of the global crisis hit China's exports hard. As the impact of the crisis deepened in the United States and Europe and started to hit demand in many emerging markets, China's export volumes fell sharply in November (Figure 2). Falling further, they were down 21 percent (yoy) on average in the first two months of 2009, in US$ (Table 1). Exports were particularly weak in February, both processing and "normal". Turning to imports, these had up to January been lagging, even though China's economic growth exceeds that in most other countries. One factor that depressed imports was destocking of raw materials. Raw material imports seem to have recovered in February, although it is too early to say whether this will be sustained. On the price front, sharply lower commodity prices push the import bill down. After averaging almost $ 40 billion for three months, the trade surplus suddenly dropped to $ 4.8 billion in February. This is however unlikely to be representative of underlying trends.

Domestically, with a strong starting position providing space, stimulus policies dampen the downturn. China entered this downturn with solid macroeconomic fundamentals and a financial sector largely unscathed by the global turmoil. This gives the authorities scope to forcefully pursue expansionary policies. The end-2008 fiscal data indicate that the fiscal stimulus measures were executed quickly. The boost in fiscal spending that started in November of 2008, combined with revenue weakness, quickly helped turn the government balance into a small fiscal deficit for 2008 as a whole.1 Leveraged by a boost in bank lending, the fiscal stimulus supports activity and sentiment. Table 5 in the fiscal policy section gives a breakdown of spending under the stimulus plan.

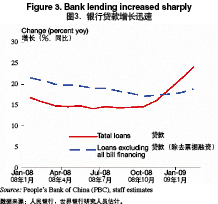

The relaxation of monetary policy is leading to more bank lending and support for economic activity. Following a major shift in the policy stance, bank lending increased rapidly. With new lending averaging 1,345 billion yuan per month in the first two months of 2009 (more than 4 percent of whole-year GDP), total outstanding credit rose 24.2 percent in the year to February (Figure 3). A significant amount of the new lending is short-term bill financing (40 percent in January). Some of this is meeting companies' demand for short-term lending after a period of tight financing conditions. Some of it seems to be "superficial", based on arbitrage. In recent months, the bill financing rate has been very low after the central bank dramatically increased liquidity. While still higher than the rate banks receive for reserves deposited at the central bank, for firms this rate is far lower than normal bank lending rate and even lower than short term bank deposit rates. The arbitrage-based financing is not associated with economic activity. But at least access to bank financing is no longer a systemic constraint on economic activity. At any rate, even excluding all bill financing, bank lending increased substantially, with (yoy) growth rising to 18.9 percent (yoy) in February. A substantial part of this is lending to infrastructure projects. However, presumably another reason for the rapid uptick in lending is that banks can quickly decide to finance pre-approved other projects that had been held up because of credit controls in place until October last year.

Thus, domestic demand has held up better than foreign demand. This is confirmed by data that differentiate between these two, such as on industrial sales and the PMI.

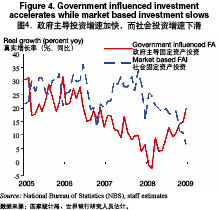

Government-influenced investment is coming on stream while market-based investment is decelerating (Figure 4). Real estate investment continues to weaken in response to depressed housing sales, despite recent measures to boost the property market.2 Other market-based investment has also decelerated, notably in manufacturing, held back by subdued exports and profits and the emergence of spare capacity. However, government-influenced investment has accelerated impressively since end-2008.3

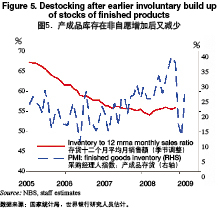

The unwinding of involuntary stock building has subtracted from activity since November, but the stocks overhang does not appear very large. Since mid-2008, when the slowdown became visible, manufacturing firms started to reduce inventories of raw materials. On the other hand, for much of the second half of 2008, inventories of finished goods increased involuntary across China's manufacturing sector (Figure 5). Surprised by a sudden demand shock, the deceleration in production lagged the one in industrial sales. This happened across sectors, notably in heavy industry sectors such as steel. For manufacturing as a whole, the size of this inventory build up (overhang) was not very large, however. Since December, the PMI shows a shift towards destocking of finished products across manufacturing, notably in heavy industries such as steel. This destocking means that production lags sales. However, the PMI data and sector specific data on steel suggest that the period from the onset of the demand shock to the start of the destocking was not very long. Also, the increase in the ratio of inventories of finished products to (the 12 month moving average of) sales during this period (from 54.9 in January 2008 to 55.8 in November) was not very large. Thus, looking ahead, the drag on production from inventory overhang is likely to be modest. Indeed, the February PMI data suggests that the pace of destocking was declining.

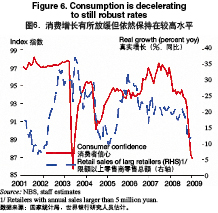

Consumption is decelerating to still robust rates. The extraordinarily strong retail sales growth since early 2008 is probably not representative of underlying trends.4 Nonetheless, other indicators confirm that private consumption is holding up-decelerating in response to worsening economic and labor market prospects but to a still solid pace. Retail sales of large retailers decelerated to around 12 percent (yoy) in the fourth quarter in real terms, with the deceleration most pronounced in discretionary items such as cars and housing related items (Figure 6). Retail sales during the Chinese new year were 13 percent higher than a year ago in real terms. Income trends indicate a renewed widening of the urban-rural income gap, with implications for rural consumption. Real urban household disposable income growth accelerated in the fourth quarter of 2008 to 10.5 percent, due in large part to disinflation led by food prices. But rural per capita cash income growth decelerated in the fourth quarter, due to subdued farm output prices and rising job losses among migrants. Fiscal data suggest growth of government consumption-responsible for more than one-fourth of total consumption-picked up in late 2008.

Weaker labor demand is creating labor market pressure. The official urban unemployment rate rose by 0.2 percentage points to 4.2 percent in the year to the fourth quarter of 2008. However, with large sections of the working population (including migrants) not eligible to register as unemployed, this captures only a small part of the pressure. According to a survey held by the Ministry of Agriculture, before the Chinese new year festival 20 million migrants had lost their job (15 percent of the total). The Ministry of Human Resources and Social Security (MHRSS) estimates that, of the 70 million rural migrant workers who returned home for the Spring Festival, about 80 percent, or roughly 56 million, came back to urban areas after the Festival. Of this group, about 11 million had not yet found a job in early March.5

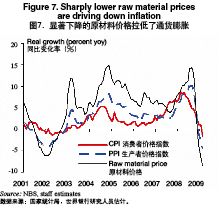

The slowdown is adding further downward pressure on inflation. As the previous large price increases for food, oil, and raw materials are fading out, inflation is receding to low levels. Prices of raw materials are now much lower than a year ago and this is the main driver of downward pressure on PPI (factory gate) and CPI inflation, causing consumer prices to be 1.6 down on a year ago in February (Figure 7). In addition, attempts to redirect sales from foreign markets to domestic markets and to substitute for imports are reported to have started to add to downward pressure on prices.

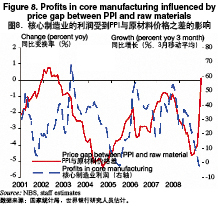

Profitability in the corporate sector deteriorated in the second half of 2008. After over five years of very rapid growth, profit growth in industry decelerated rapidly, notably in heavy industry, but also in the machinery and light industrial sectors. Margins in core manufacturing were hit as raw material prices increased much faster than PPI (factory gate) prices (Figure 8).6 In addition, the slowdown in demand has started to affect profitability. Looking ahead, the sharp fall in raw material prices more recently should help mitigate the impact of the downturn on profitability.

Economic Prospects and Risks

Continued global turmoil and economic weakness is likely to contain growth in China in 2009 and 2010, notably via weaker exports and market-based investment. However, China is likely to continue to outgrow most other countries, because it does not rely on external financing for growth; its domestic banks are largely unscathed by the international financial turmoil and have deleveraged in recent years, enabling them to help finance growth; and there is space and willingness to use fiscal and monetary policy stimulus. Indeed, the policy stimulus has started to provide support to activity and sentiment.

Even so, China's economy cannot escape the impact of the global weakness. Government influenced activity makes up a modest share of the total; it cannot and probably should not offset fully the downward pressures on market based activity. With growth in 2009 falling short of potential growth, increasing spare capacity is set to lead to weaker market-based investment, less job growth and migration, downward pressure on prices and profit margins, redirection of exports to the domestic market, and import substitution.

Global financial markets are likely to remain strained during 2009. Market conditions in the industrialized countries are likely to continue to be difficult pending the implementation of forceful policy action to restructure the financial sector, resolve the uncertainty about losses, and break the adverse feedback loop with the slowing real economy.7 In many emerging economies, financial conditions will likely remain tense for some time-especially for those that have relied on external financing for their growth.

Global growth prospects are very unfavorable and uncertain. Since end-November 2008, when we released our previous quarterly update, the global outlook has worsened strongly. The economic downturn is particularly severe because it is synchronized, affecting all major economies. Assuming that forceful, coordinated policy actions can normalize financial market conditions while fiscal and monetary stimulus can support activity, output in industrialized countries may start recovering in late 2009 or 2010. Emerging markets and developing countries are more robust now than during previous crises, because of better fundamentals. Nonetheless, their growth will decline substantially in 2009 because of the slowdown in export markets, lower commodity prices, and much tighter external financing conditions, especially for economies that depend on external capital to finance growth. With world GDP down by 5 percent (saar) in the fourth quarter of 2008, and probably as well in the first quarter, world GDP would fall significantly in 2009 as a whole even with a modest rebound in late 2009. The World Bank now projects a decline of 1.5 percent (in market exchange rates), a full 2.5 percentage point markdown compared to November 2008 (Table 2). Moreover, the Bank now projects world imports to shrink 6 percent in 2009. In this context, we have further downgraded our projection for China's exports. The one positive feature about this setting is that international prices of primary commodities including energy and metals have fallen sharply. The World Bank forecasts declines of over 50 and 30 percent for oil and non-oil commodities in 2009. This will help reduce cost pressures and support margins in manufacturing.

Risks and uncertainty about the international outlook are unusually large. The scale and scope of the current financial crisis have taken the global economy in unfamiliar territory. The pernicious feedback loop between real activity and financial markets may intensify, leading to a deepened impact on global growth. Emerging market corporate sectors could be badly damaged by continued limited access to external finance. Markets may respond adversely to the sharp increases in public debt in many countries, with implications for currencies and interest rates. There are also risks of rising protectionism in trade and finance. An upside risk is that financial conditions improve faster than expected.

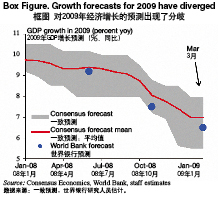

Domestically, on balance the outlook suggests support for activity. China's growth can only rebound significantly and sustainably if the world economy recovers, and this does not seem likely to happen soon. Nonetheless, the policy stimulus provides support to activity and sentiment. There have at least been early signs of stabilization, although, given the international weakness, it is too early to expect a sustained rebound. In these circumstances, growth forecasts for China for 2009 have diverged (Box 1).

Box 1. Growth forecasts for 2009 have diverged

It is more difficult than usual to project China's growth for 2009, and projections have diverged. The negative impact of the international financial turmoil and economic crisis is very large. This affects China's real economy by means of lower exports, but also lower investment and even consumption. While there is broad agreement that the external situation will imply very subdued exports,  opinions differ about the sensitivity of overall growth to export developments. At the same time, many believe China has some strengths in addressing this shock, including a substantial fiscal and monetary policy stimulus and a banking system with a relatively healthy balance sheet that is able to lend. The divergence of forecasts of GDP growth for 2009 for China is due to large differences in perception on how large and effective the offsetting impact from the policy stimulus is going to be, relative to the impact of the shock from the external weakness. How these two forces play out will also determine the "shape of the recovery" in 2009-10, another actively debated issue. opinions differ about the sensitivity of overall growth to export developments. At the same time, many believe China has some strengths in addressing this shock, including a substantial fiscal and monetary policy stimulus and a banking system with a relatively healthy balance sheet that is able to lend. The divergence of forecasts of GDP growth for 2009 for China is due to large differences in perception on how large and effective the offsetting impact from the policy stimulus is going to be, relative to the impact of the shock from the external weakness. How these two forces play out will also determine the "shape of the recovery" in 2009-10, another actively debated issue.

Notes:

1. After the initial disbursement of 100 billion yuan in November 2008, the Central Government disbursed 130 billion yuan for projects under the 4-trillion-yuan stimulus package in early 2009. The overall general government budget probably remained in surplus, because of surpluses in the social security funds.

2. Key measures included more government spending on public housing, lower minimum down payments for mortgages and lower interest rates for several types of buyers, and lower own-capital requirements for bank lending to developers building cheap rentals.

3. Our government-influenced investment covers utilities, transport, scientific research, water and environment conservancy, education, health care, social security, culture, sport, and public administration.

4. This data suggests real retail sales growth rose to 17 percent in the fourth quarter of 2008 and was still 15.8 percent on average in January-February 2009.

5. China's labor market data is very weak, so it is difficult to have a good picture of overall trends. This led the government to initiate more additional, comprehensive labor market surveys this year.

6. Core manufacturing excludes petroleum and metal processing, chemicals, utilities, and food processing.

7. IMF World Economic Outlook Update, January 2009.

(To be continued)

|