|

On the specific expenditure components:

- Strong government influenced investment will support growth in 2009, but market based investment is likely to continue to lag. The prospects for market based investment in several sectors are not very favorable. Economic growth prospects remain uncertain, while large spare capacity in China and globally is putting serious downward pressure on output prices (the PPI) and profits, even as lower commodity prices help. Thus, market based investment may remain subdued for a while, particularly in manufacturing, where foreign sales make up between one-fourth and one-third of the total. In the real estate sector, medium term sales prospects are reasonably good. A large stock of unfinished housing expected to be completed may contain new high end housing projects. However, mass market and low-end construction should expand as a result of government measures.

- Consumption is likely to be resilient but is expected to slow.7 Growth of nominal wages and employment is likely to decline further. Real income should continue to be supported by very low inflation and fiscal support. However, urban consumption has started to lag behind urban incomes, indicating some increase in the household saving rate, consistent with relatively low reported consumer confidence. Improvements in the housing sector would support consumption, because of wealth effects stemming from higher housing prices and the consumption related to home improvement. Assuming some further increase in household saving rates, urban consumption would slow this year (compared to 2008), although it would remain robust. Rural income prospects are more subdued, due to subdued agricultural output prices and migrant wages and employment. Fiscal support will stimulate rural incomes and consumption—including via more government subsidies to medical insurance and spending on household appliances (see our March Quarterly Update, p. 18). However, this is unlikely to be large enough to prevent a slowdown in rural real income and consumption, and keeping up rural income and consumption growth remains a challenge.

- Net trade is likely to subtract from growth this year. The PMIs suggest new export orders are up sharply, signaling that exports should recover from the current trough. However, while China's competitiveness remains good, exports are likely to continue to face headwinds from the weak global economy. Even if part of the relative import strength in March-May may not last, as it was because of restocking of raw materials following earlier destocking, imports should decline less than exports in 2009, given that growth in China is so much higher than that abroad.

In the coming 10 years exports are likely to grow significantly less than in the previous 10 years. This shaves off around 2 percentage points of GDP growth in our illustrative scenario (Box 1). This is significant but not catastrophic.

There are risks to the growth projections. Key short-term growth risks are longer and more severe export weakness; lower market based investment, in light of spare capacity and weak profit prospects in many sectors; and lower consumption. There are also upside risks to the growth forecast, notably higher government influenced spending, perhaps also higher market based investment—if we are too pessimistic on profit prospects—and lower imports (because of more import substitution). Key medium-term risks are that global imbalances are not resolved and, domestically, that potential output growth is lower because of slow progress with rebalancing.

China is unlikely to get into deflation; policy measures can help mitigate the risk. As discussed, globally, the risk of malign deflation seems low. In this context, outright deflation in China is also unlikely, but downward pressure on inflation is likely to continue. The risks of deflation could be mitigated by increasing administrative prices opportunistically and preventing excessive investment in sectors that may have done well traditionally but may do less well in the future (with a different composition of demand and relative prices).

Economic Policies

On current projections it is not necessary, and probably not appropriate, to add more traditional fiscal stimulus in 2009.8 First, while growth may not exactly reach the government's target this year, it will be very respectable, given the global setting, because of the the forceful stimulus. Indeed, China is likely to avoid malign deflation or other major downturn-induced problems. Second, it would be good to retain room for fiscal policy stimulus in 2010, given the uncertainty about the global recovery. China's public finances are quite sound. Nonetheless, the current stimulus is already set to increase China's government deficit substantially, and the higher the fiscal deficit in 2009 is, the less room there is for an additional increase in 2010, given limits on the size of deficits.9 Third, there are limits to how much additional infrastructure-oriented stimulus can be spent effectively and efficiently. If policymakers are concerned about the adverse consequences of the downturn for households, it is less costly to address these by using and beefing up the social safety net. This would also fit well with China's medium- and long-term objectives. Some of the short term measures to boost consumption also seem relatively effective, even if they will have little medium and long term impact.

In responding to the global crisis, China should have the confidence to emphasize forward looking policies and structural reforms. The economic setting is likely to look different in the coming decade from what it looked in the previous decade. With global demand more subdued, China needs to get more growth from domestic demand—consumption in particular. Also, the government's rebalancing objectives call for changes in relative prices—notably higher prices for resources and environmental impact. The pattern of growth emerging in this setting would be driven more by the service sector (and other relatively clean, energy efficient, and labor-intensive activities), and less by industry (especially environmentally damaging, energy consuming, and capital-intensive heavy industry).

Fiscal and Structural Policies

The transition to such a pattern of growth would be easier and more successful with fiscal and structural policy adjustments that:

- Help channel resources to sectors that should grow in the new setting, instead of to sectors that have traditionally been favored and done well. This calls for reforms to encourage competition and remove barriers to private sector participation in several key services sectors currently reserved for SOEs, as well as in financial sector policy, natural resource pricing and taxation,10 and SOE dividend policy. 11

- Support thriving domestic markets and successful, permanent urbanization. In addition to service sector liberalization, key policies to make this happen include land reform, further liberalization of the Hukou system, and reform of the inter-governmental fiscal system that make it possible for local governments to fund the public services without which migration cannot be successful and permanent. With more successful, permanent migration and thriving service sector-oriented urban activity, wage and household income, and thus consumption, can rise as a share of the economy.

Such reforms could be pursued all the more boldly and successfully if they are flanked by a well-functioning public finance system and social safety net. In addition to the essential reforms of the intergovernmental fiscal system, the following are important:

- A well-functioning social safety net that can deal with the adverse consequences of economic shocks such as the current one and possible temporary or sectoral impact of reforms.

- More equal and less segmented institutions and arrangements for social insurance and social safety nets. This would strengthen them and also increase economic efficiency and mobility. In particular, more pooling and portability and less segmentation of schemes would facilitate domestic market integration and labor mobility.

On current trends, the fiscal deficit is likely to be substantially higher than budgeted. The 2009 budget foresaw revenue rising by 8 percent and expenditure by 22 percent, leading to a budget deficit of 3 percent of GDP (excluding the balances of the social security and extra-budgetary funds). In the first five months of the year, tax revenues fell 9.4 percent on a year ago, and total revenues 6.7 percent, with particularly large declines in corporate tax revenues and large increases in VAT rebates to exporters. A sizeable portion of the decline is because of policy changes and one-off effects, notably the change in VAT treatment of investment, higher VAT rebates to exporters, and fluctuating stamp taxes on stocks. Expenditures rose 27.8 percent (yoy) in the first five months, with particularly large increases in transportation, agriculture, and environmental protection. Revenue forecasts are very difficult to make at the moment. Nonetheless, on the basis of our current economic forecasts and broad estimates of the whole year effect of policy changes, we estimate that revenues may decline somewhat in 2009 as a whole. Our illustrative scenario assumes that expenditure growth in the remainder of the year will come down substantially from the pace of the first 5 months so that expenditures grow 22 percent for the year as a whole, as budgeted (Table 4). This would lead to a budget deficit of almost 5 percent of GDP. Almost one-third of the increase in the deficit in 2009 would be the whole year effect of the discretionary revenue measures, including measures taken only recently such as 2 new rounds of increases in VAT rebate rates. These projections are only tentative, and China's fiscal postion is strong enough to deal with such an increase in the deficit. However, these projections underline the trade off between more general fiscal stimulus in 2009 and having room for stimulus in 2010.

The implementation of the stimulus package and other fiscal initiatives is hampered by longstanding problems with China's intergovernmental fiscal system. Sub-national governments in China are responsible for a much larger share of spending than in most other countries. However, China does not have institutional arrangements that channel substantial amounts of resources from rich to poor areas on the basis of rules guaranteeing minimum levels of public services. As a result, despite transfers from the central government, local governments in poor areas tend to be financially strained. Local governments are legally not allowed to borrow, although for infrastructure spending this constraint has long been by-passed by having SOE type entities that are part of the local governments do the borrowing. Nonetheless, there are large disparities in the provision of public services that amplify regional income inequality.12

In the case of the projects under the stimulus plan, many local governments have difficulty providing the matching funds. For the first 2 phases of the stimulus plan, local governments were supposed to provide 170 billion yuan, matching the central government's commitment of 230 billion yuan.13 The Ministry of Finance found that as of end April local governments had allocated only 88 billion yuan. Partial short-term relief is coming from additional borrowing on behalf of local governments. Since the start of this year the government is operating a pilot whereby the Ministry of Finance issues bonds on behalf of local governments. The scheme is meant to emphasize poorer provinces. To address such problems structurally, China's intergovernmental fiscal system will have to be adjusted.

Monetary Policy

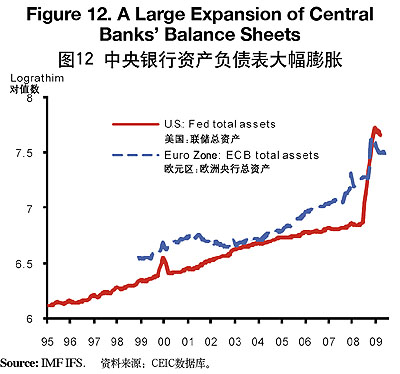

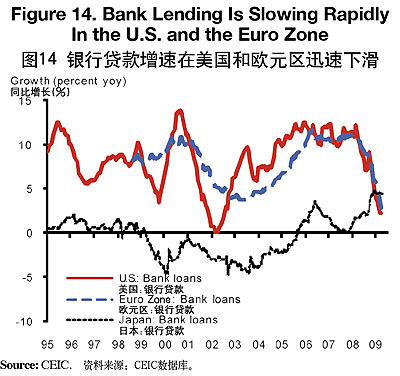

Large liquidity injections are supporting the surge in bank lending. In the last months of 2008, the PBC injected large amounts of liquidity into the banking system, in addition to lifting the credit quotas that had constrained bank lending. In large part the injection came about because of lower required reserve ratios (from 17.5 percent to 14-15 percent). Base money has stabilized in March, but the liquidity injection is still working its way through the financial system. With lending growth continuing at a rapid pace, banks' excess reserve ratio has declined.

A sharp increase in the share of bill financing caused concerns, but may be less worrisome than it appears. The concerns include that bill financing does not lead to economic activity but to arbitrage and asset transactions. However, there are reasons not to be too worried about the increased share of bill financing. Bill financing largely crowded out other short term credit. The total share of short term lending inched up only moderately, to 52.2 percent at end March, and is still lower than in early 2007. Moreover, from the perspective of the banks, replacing other open credit with bill financing was a rational response to a combination of sharply increased liquidity, and thus lower cost of funds, and increased risk aversion because of the downturn (unlike other forms of short term credit, bill financing is backed by receivables as collateral).

The high pace of lending is not sustainable. As the backlog of projects gets cleared, banks' excess reserves come down because of all the lending, and government-related projects receive their financing, new bank lending is expected to come down later in 2009. Even so, credit is likely to outpace nominal activity by a very large margin this year, and this implies risks.

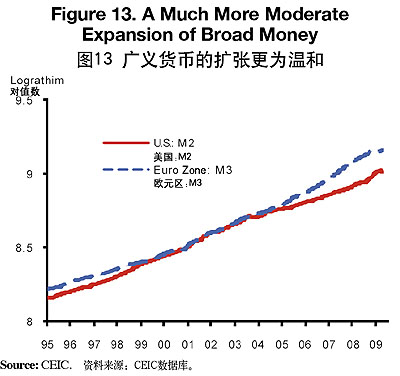

- The risk of inflation seems low. Some worry that the rapid growth of money and credit will lead to inflation. However, with a lot of space capacity in China and worldwide putting downward pressure on prices and raw material prices unlikely to soar soon, substantial generalized price pressures seem unlikely any time soon.14 The Special Focus looks into risks of global deflation and policy-induced inflation.

- However, the rapid credit expansion can have consequences other than inflation and the authorities are right in being cautious and vigilant.

Abundant liquidity in an environment of subdued demand could lead to unwarranted asset market inflation. In principle, asset transactions are a function of portfolio decisions, and these will eventually be consistent with economic outcomes and expectations. However, given the large liquidity shock, the still immature financial system, and with capital controls making capital outflows difficult, unwarranted flows and processes could happen along the way.

It also increases the risk of misallocation of credit, and thus of resources, as well as NPLs. Amidst concerns about the impact of the credit surge on the quality of banks' loan portfolios, the CBRC raised its loan-loss coverage ratio to 150 percent.

|