|

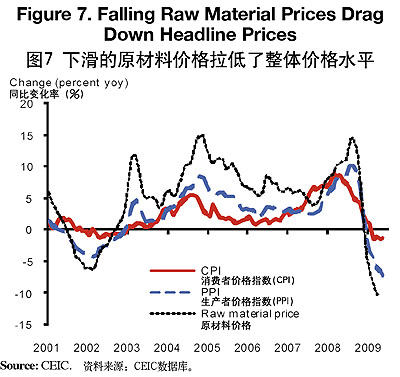

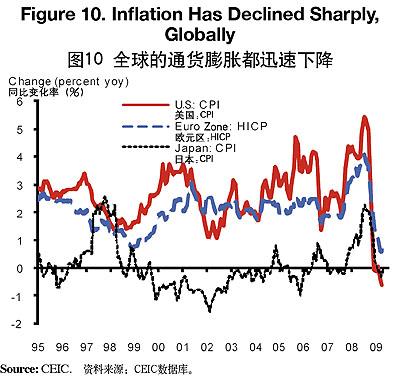

In addition to these benign price pressures, substantial spare capacity in China and abroad is putting downward pressure on prices of manufactured goods.

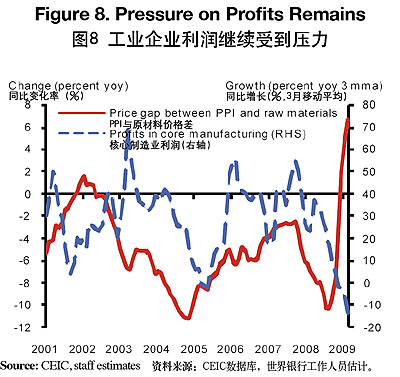

Profitability in industry deteriorated further in early 2009. In 2008, margins in industry were compressed by a surge in raw material prices (Figure 8).

This pressure has reversed as raw material prices have fallen. Moreover, with wage growth coming down, unit labor cost growth is diminishing (Figure 9).

However, margins are squeezed by the impact of spare capacity on PPI (factory gate) prices and the impact of slow or negative sales growth in the face of fixed costs, notably of financing. The impact of lower output prices and extent of the slowdown and its impact in the face of fixed costs are particularly high in heavy industry. Thus, profits in heavy industry fell 43 percent (yoy) in February, while those in light industry dropped only 10 percent (yoy).4

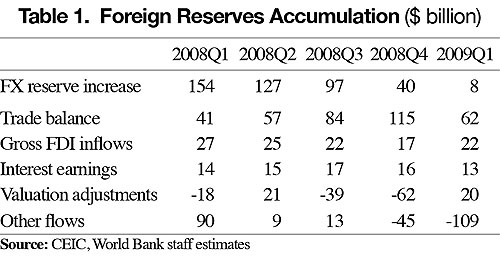

China's foreign exchange reserve accumulation has slowed. In the first part of 2009, the trade surplus and FDI inflows both remained sizable, despite some decline in FDI from early 2009 onward and in the trade balance from April onward (Table 1). The main reasons behind the slower pace of reserve accumulation in the past 9 months (to about $ 2 trillion) are valuation losses due to appreciation of the U.S. dollar against other major currencies, notably the euro, and a sizable apparent net financial outflow.5 Both of these factors are unlikely to be sustained over long periods. Recent indications are that China continues to be a significant net buyer of U.S. bonds, mainly treasuries, despite expressions of concern about the financial security of such investments by senior Chinese leaders (see the Special Focus on global prices).

China's stock market rallied in early 2009. With sentiment on the economy improving since the beginning of 2009 and liquidity in the domestic financial market up substantially due to the easy monetary stance, the Shanghai composite index (of A shares) has risen more than 50 percent since end 2008, led by cyclical sectors such as materials. Rising share prices have re-ignited interests from investors, and turnover has increased in volume terms, even surpassing levels of early 2007.

Economic Prospects

Globally, there are signs of stabilization in financial markets, where the current crisis started. Financial markets in industrialized countries have become less strained since early 2009, with tension in inter-bank markets receding and equity markets having rallied. However, markets have not stabilized fully. Risk aversion is still high, reflected in reluctance among banks to lend. International capital flows in particular are still very subdued, and the corporate sector in many developing countries has difficulties getting access to finance. Moreover, additional shocks originating in the financial system cannot be ruled out.

There are also some tentative signs of stabilization in parts of the global economy. Although global output has continued to decline in the first quarter of 2009, there are signs of sequential (month on month) moderation in the rate of decline and possible prospects of stabilization of activity. Some "green shoots" have been observed in the U.S., including in retail sales, home sales and factory orders. Recently business sentiment in the U.S. and Europe has also improved, although most business surveys are not yet indicating sequential growth. And, globally, orders have rebounded sequentially.6 Several East Asian countries have seen output rising recently, grounded in part in a sharp acceleration in high tech manufacturing.

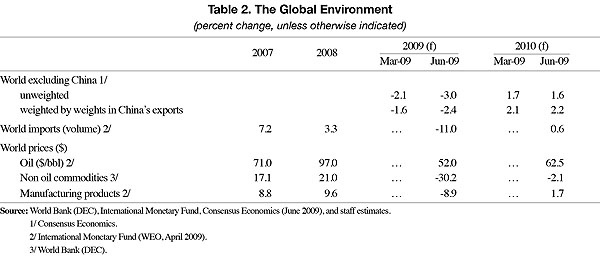

But a rapid global economic recovery seems unlikely and a lot of uncertainty remains. Prospects for 2009 for global growth and trade have again been downscaled, compared to three months ago, in large part because of a sharper than expected decline in the end of 2008 and early 2009 (Table 2). In this light, eventual sequential stabilization of activity does not necessarily presage a rapid, sustained recovery. Morever, in most developing countries and emerging markets outside of East Asia there are no strong signs yet of improvements in the economy. That is because much deteriorated access to external financing and a smaller or less effective policy stimulus than in many industrialized countries are constraining domestic demand. The world excluding China is now expected to shrink by 3 percent in 2009, before posting moderate growth in 2010 (weighted by the geographical composition of China's exports, projected world growth looks slightly better, because of East Asia's relatively good prospects).

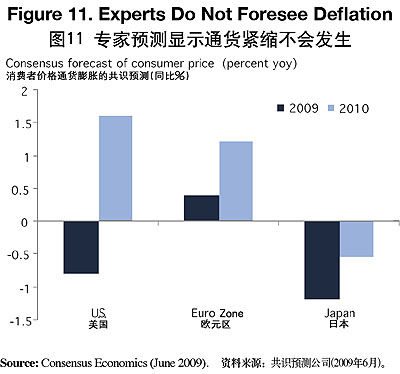

Global price prospects are receiving a lot of attention. Prices of most raw commodities have come off earlier lows in international markets, with some, including the oil price, having risen significantly recently. However, they are still much lower than their peaks of mid-2008. Forecasters do not expect commodity prices to rise significantly from current levels in the coming one and a half year (Table 2). As to global headline prices, the combination of large global downturn and very aggressive policy responses in many countries, notably the U.S., has incited concerns of both global deflation and inflation, also among China's policy makers. The Special Focus discusses the issues and concludes that the risk of deflation is considered low. Monetary policy makers should in principle also be able to manage the challenges associated with preventing inflation from rising too much. This is also what financial markets think. But risks remain, including political risks.

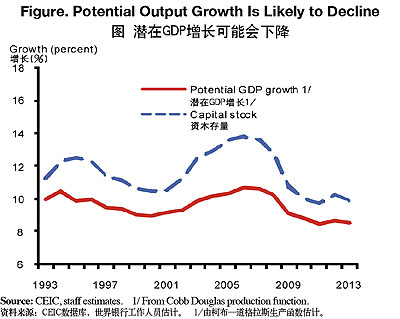

It is too early to say that there is a sustained recovery in China. The policy stimulus allows China to continue to grow in this weak global setting. Nonetheless, there is a limit to how much and how long China's growth can diverge from global growth, given that China's real economy is relatively integrated in the world economy. Government-influenced spending only makes up one-third of domestic demand. The current surge in government influenced investment is welcome, and more domestic demand in China is helpful for the world economy. However, it is unlikely to lead to a rapid, broad based recovery in China, given the current global environment and the subdued short term prospects for market based investment. China's economic growth is unlikely to rebound to a high single digit pace before the world economy recovers to solid growth.

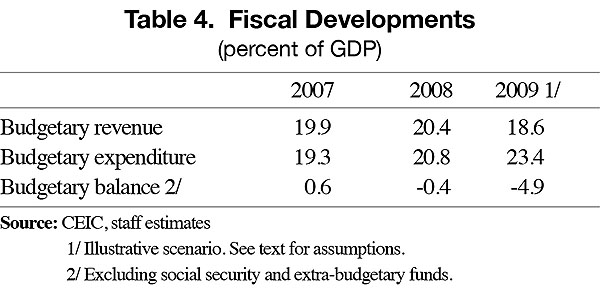

In our view, overall growth prospects for 2009 have improved somewhat, compared to 3 months ago, but with little carry-over into 2010. The downward revision of export prospects is offset by a more favorable domestic growth outlook. Developments in the real economy have been somewhat better than expected three months ago. More importantly, bank lending in the first part of 2009 has been much larger than expected. After such an expansion, it is likely and appropriate that new lending will moderate during the rest of the year. Nevertheless, the massive monetary impulse of the first five months will support economic growth in the coming quarters. Government expenditure has also substantially outpaced expectations in the first five months.

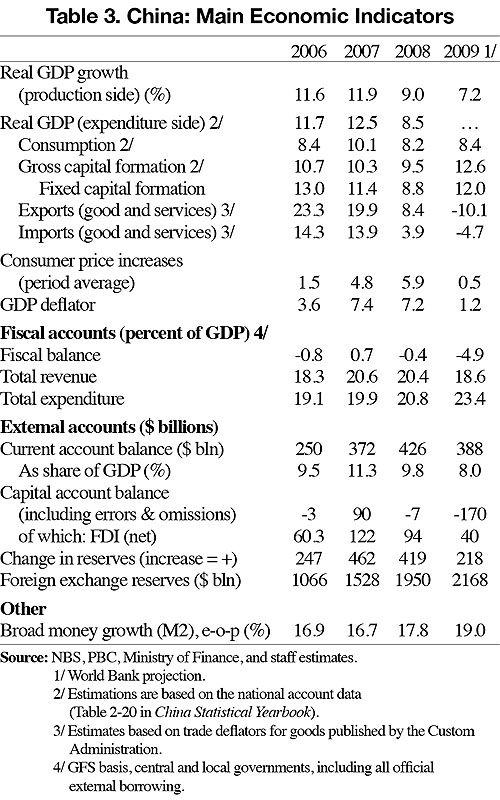

In this light, we forecast GDP growth of 7.2 percent in 2009 (Table 3). A full 6 percentage point of growth is estimated to be contributed by government-influenced expenditure, with additional stimulus from lower tax revenues. We expect growth to pickup somewhat in 2010, but not as much as in many other countries, largely because China already saw a large fiscal policy stimulus in 2009, whereas many other countries will see much of it at the end of 2009 and 2010. Moreover, it appears that many companies still have to fully adjust investment plans to the subdued prospects in several manufacturing sectors.

|