| Overview

China's economy has continued to feel the brunt of the global crisis. Global economic activity continued to decline in the first part of 2009, even as tentative signs of stabilization have emerged recently in several countries.

However, very expansionary fiscal and monetary policies have kept the economy growing respectably. Fiscal stimulus is centered on the infrastructure-oriented "4-trillion-yuan" stimulus plan and the monetary stimulus has led to a surge in new bank lending. Government-influenced investment has soared. Market-based investment has lagged behind, although positive signs have emerged in the real estate sector. Consumption has held up well. Very weak exports have continued to be the main drag on growth, but import volumes have recovered in the second quarter of 2009 as raw maƒterial imports rebounded.

Global growth prospects remain subdued even as signs of stabilization have emerged. Financial markets have become less strained and there are prospects for stabilization of activity. However, a rapid global recovery seems unlikely and uncertainty remains. The risk of global deflation seems low, although spare capacity will continue to put downward pressure on prices of manufactured goods. Monetary policymakers in major countries should in principle be able to prevent inflation from rising in the medium term, although risks remain, including political ones.

Growth in China should remain respectable this year and next, although it is too early to say there is a sustained recovery. Government-influenced investment will strongly support growth in 2009. Nonetheless, there are limits to how much and how long China's growth can diverge from global growth based on government-influenced spending, given that China's real economy is relatively integrated in the world economy. Meanwhile, market-based investment is likely to continue to lag for a while because of the squeeze on margins amidst spare capacity in many manufacturing sectors. Prospects for real estate activity appear reasonably good, but consumption is unlikely to pick up speed. In all, China's growth is unlikely to rebound to very high single digit rates before the world economy recovers. We project GDP growth of 7.2 percent in 2009 and 7.7 percent in 2010.

China can have the confidence to emphasize forward looking policies and structural reforms. Based on our projections we think it is not necessary or appropriate to add more traditional stimulus in 2009. One reason is that the fiscal deficit is likely to be significantly higher than budgeted and additional stimulus now reduces the room for stimulus in 2010. Nonetheless, with subdued global demand and less export growth, China needs more growth from domestic demand—consumption in particular. Also, relative prices need to change, notably those of natural resources. The transition to more consumption-led, service sector-oriented, and labor-intensive growth requires policy adjustments that: (i) help channel resources to sectors that will grow in the new setting, instead of to sectors that have traditionally done well; and (ii) support thriving domestic markets and successful, permanent urbanization. Such reforms can be pursued more successfully if flanked by a well-functioning public finance system and social safety net.

Recent Economic Developments

Internationally, economic activity continued to decline in the first part of 2009. Tensions on international financial markets have eased, equity markets have rallied, and some tentative signs of stabilization in the economies of key countries including the U.S. have emerged recently. However, in the first 5 months of 2009, the impact of the crisis on the global economy has continued. GDP fell 5.7, 9.7 and 14.2 percent (at a seasonally adjusted annualized rate, or SAAR) in the first quarter in the U.S., the Euro zone, and Japan. In recent months, the decline in output continued, even though the rate of decline appears to have come down. The weak global environment has had a major impact on China's exports and the economy more generally.

In this setting, China's economy continued to slow down, but it received significant support from expansionary policies. Fiscal and monetary policy have been very expansionary since November 2008. Much of the fiscal stimulus is centered around the government's investment and infrastructure oriented "4-trillion-yuan" stimulus plan (see our March Quarterly Update (pp 17-21) for details). With the Central Government committing to 29 percent of the spending under the stimulus plan, its own spending is leveraged by complementary bank lending. This has been a key part of the impressive expansion of bank credit in the first 5 months of 2009.

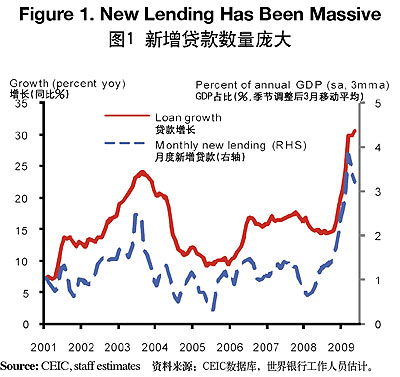

Following a spectacular surge in the first quarter, lending moderated in the second quarter. In the first quarter, monthly new lending averaged a massive 5 percent of annual GDP, leading to some concerns among policymakers about the pace, the high share of bill financing, and credit flowing to financial markets rather than the real economy (Figure 1).

Monthly new lending slowed in April-May, averaging 2 percent of annual GDP. The composition of lending also changed, with the share of bill financing and other short-term lending declining. The share of lending to households also went up, in part due to higher housing sales. In any case, this massive monetary impulse will fuel economic growth in the coming quarters.

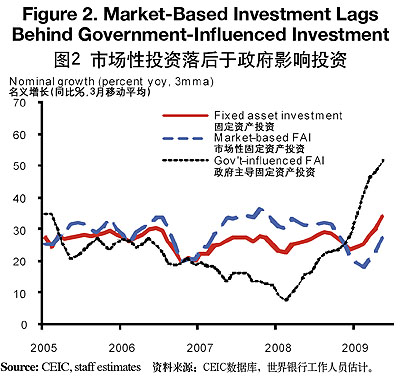

Government-influenced investment (GII) has soared (Figure 2).

Boosted by the stimulus package, infrastructure and other government-influenced investment rose rapidly in the first five months (an estimated 39 percent (yoy) in the first four months in national accounts terms, up from an estimated 13 percent in 2008).1

The stimulus has also supported some market-based sectors, but overall, market based investment (MBI) lags behind significantly. The monthly urban fixed asset investment (FAI) data suggest real MBI also rebounded, driven by commodity and specialized machinery industries that benefit from the stimulus spending. However, the FAI data over-estimate growth of fixed capital formation.2 Moreover, in several key manufacturing sectors—notably those oriented on exports (textiles, clothes, furniture, computers, and IT)—FAI has continued to decelerate, reflecting subdued and uncertain prospects for exports and profits and substantial spare capacity. Nominal MBI rose by an estimated 12.6 percent (yoy) in the first four months in national account terms, compared to 20 percent in 2008.

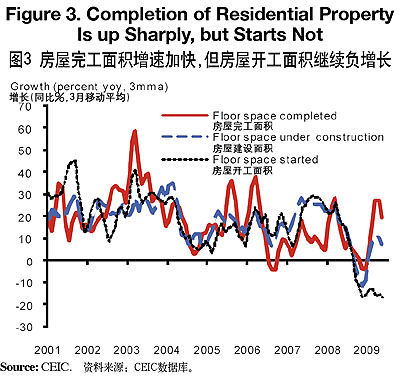

Housing sales have recovered in early 2009, but new real estate activity remained subdued so far. Sales had been falling throughout 2008. Amidst a more positive sentiment stemming in part from the stimulus package, sales have benefited from lower interest rates and taxes, as well as from an earlier easing of prices. Higher sales nudged up prices in April and May, but they are still down on a year ago. The completion of residential property projects has also risen sharply since early 2009 (Figure 3).

To date this appears to be driven less by the recovery in sales than by a boom in property construction in 2007 and early 2008, when the amount of floor space under construction was growing much faster than that completed. Indeed, floor space started is still falling strongly (yoy). This may change if the positive recent developments gain momentum.

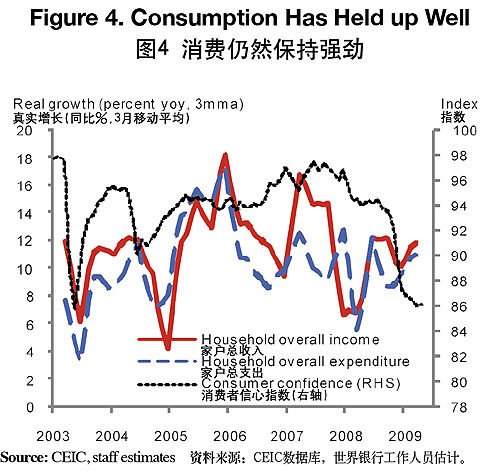

Consumption has held up well. It grew at an estimated 11 percent in real terms in the first quarter (yoy) (based on household survey data), even though reported consumer confidence has fallen to the low level registered at the time of SARS (Figure 4).

Retail sales data for April and May indicate that consumption growth remained robust. Consumption has been supported as lower inflation buoyed real incomes even though nominal income growth came down in the first part of 2009. Rural income growth decelerated in the first quarter, due to subdued farm output prices and significantly less buoyant earnings of migrants.3 Seemingly at odds with reported low consumer confidence, and following a pronounced deceleration in 2008, car sales rose 14 percent on a year ago in January-May. This is in part due to lower consumption taxes for small cars, but apparently also because expectations of lower car prices have diminished as concerns and uncertainty over China's prospects have subsided somewhat.

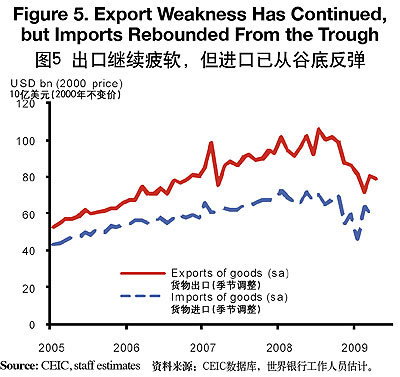

Exports have remained very weak while imports recovered (Figure 5).

The export weakness since the end of 2008 has been across the board, in terms of type and destination, and export volumes were still down an estimated 20 percent on a year ago in April-May. Meanwhile, China's import volumes have picked up swiftly since March because of stimulus package-induced demand for raw materials. In April-May, total import volumes were down an estimated 6.8 percent on a year ago, with raw materials import volumes up strongly even as those of manufactured goods were still down sharply. Part of the strength of raw materials imports since March follows particular weakness earlier—China's manufacturing firms sharply curtailed inventories of raw materials in response to the crisis—and it may thus not fully reflect underlying patterns. Nonetheless, the impact of the import rebound dominated that of improved terms of trade due to lower raw material prices, and China's trade surplus was down on a year ago in April-May.

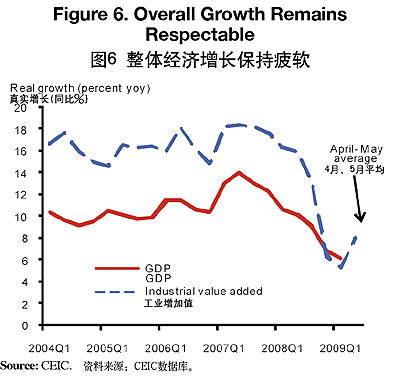

Overall, economic growth remained respectable in a very difficult global environment. GDP rose 6 percent (SAAR) in the first quarter, to a level 6.1 percent up on a year ago. Industrial production seems to have picked up pace somewhat recently, with (yoy) growth up from 5.3 percent in the first quarter to an average 8.1 percent in April-May (Figure 6), while fiscal revenues posted positive (yoy) growth in May for the first time this year.

Downward pressure on inflation has continued. Prices of raw materials are now much lower than a year ago and this has driven PPI (factory gate) and CPI prices down from a year ago (Figure 7).

|