|

Overview

Large fiscal and monetary stimulus has supported a recovery in China's economy. Falling exports amidst the global recession have been a major drag on growth. Nonetheless, real gross domestic product (GDP) growth rose to 8.9 percent year-on-year in the third quarter on the back of the stimulus. Although most of the stimulus has shown up in infrastructure-oriented government-led investment, some has been consumption-oriented and domestic demand growth has been broad based. Resurgent housing sales have started to feed through to construction activity. Investment in manufacturing is affected by spare capacity, but consumption has held up well. The strong domestic demand has buoyed import volumes and the current account surplus may fall to 5.5 percent of GDP this year even with import prices down sharply. The downturn has clearly affected the labor market, but the impact has been smaller than expected and the trough may have been past.

Growth is likely to remain robust in 2010, but the composition will change. With a larger-than-expected monetary stimulus, China is on track to meet the target of 8 percent GDP growth this year. We project 8.4 percent growth. Looking ahead, the global recovery is likely to be slow and subject to risk. Nonetheless, China's export growth is likely to resume, helped by strong fundamental competitiveness and the recent depreciation of the nominal effective exchange rate, and net exports are likely to stop being a drag on growth. Real estate investment is also bound to be stronger. However, the growth impact of the government stimulus is set to decline sharply next year and investment in parts of manufacturing is likely to remain under pressure from spare capacity in China and abroad. The global spare capacity is also expected to keep inflation pressures low. With exports and imports projected to grow at broadly the same pace next year and the terms of trade likely to deteriorate, the current account surplus may edge down further.

On policies, the costs and risks of sustaining the current expansionary policy stance will increase over time. In our view, macroeconomic conditions in the real economy do not yet call for a major tightening. However, risks of asset price bubbles and misallocation of resources amidst abundant liquidity need to be mitigated and the overall monetary stance will have to be tightened eventually. Given our economic projections, in 2010 an unchanged or only slightly higher fiscal deficit would fit best but flexibility is important and this includes allowing the automatic stabilizers to work, this year and in 2010.

In the medium term, the recovery can only be sustained by successful rebalancing of the economy. Rebalancing and getting more growth out of the domestic economy call for more emphasis on consumption and services and less on investment and industry. Following on earlier initiatives, some further steps have been taken in recent months to rebalance and boost domestic demand, including increasing the presence of the government in health, education, and social safety; improving access to finance and small and medium enterprise (SME) development; and mitigating resource use and environmental damage. These are useful steps, but more policy measures will be needed to rebalance growth in China, given the strong underlying momentum of the traditional pattern. Structural reforms to unleash more growth and competition in the service sector and stimulate more successful, permanent migration would be particularly welcome.

Recent Economic Developments

In spite of a large drag on growth from exports amidst the global recession, China's economy continues to grow robustly because of expansionary fiscal and monetary policies (Figure 1). Infrastructure investment has been key but consumption has also held up well. More recently, real estate activity has been recovering as well.

In a difficult global climate, exports have been a major drag on growth. After a steep fall, global economic activity has turned the corner as financial conditions have improved. World industrial production grew 6 and 9 percent at a seasonally adjusted annualized rate (SAAR) in the second and third quarters of 2009, with especially rapid expansion in emerging markets. Nonetheless, this was from a low base in early 2009 and imports have remained weak in many parts of the world (Figure 2).1 With processing exports particularly hard hit by the outbreak of the crisis, China's overall goods exports initially fell even faster than the imports of its trading partners. Processing trade subsequently recovered rapidly (Box 1). Nonetheless, total volumes of goods exports have remained weak and were still down 6.7 percent on a year ago in September. Net external trade withdrew 3.6 percentage points from GDP growth in the first three quarters.

Nevertheless, overall growth held up very well through the third quarter, driven by domestic demand. After almost coming to a halt in late 2008, GDP rose 17 percent in the second quarter and 10 percent in the third (SAAR), to a level 8.9 percent up on a year ago.2 Domestic demand grew 12 percent year on year (yoy) in the first three quarters, led by government-influenced investment (Figure 3). The acceleration in GDP growth during 2009 was reflected in stronger industrial and electricity production.

Box 1. Import Developments in More Detail

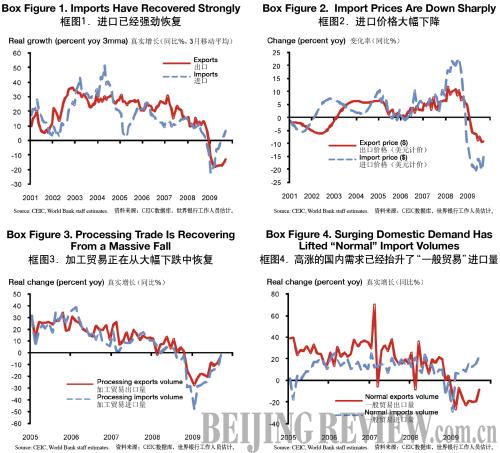

After collapsing together with exports, China's imports recovered briskly (Box Figure 1). However, this recovery did not show up in the value of imports because of large falls in import prices, especially those of raw materials (Box Figure 2). After collapsing together with exports, China's imports recovered briskly (Box Figure 1). However, this recovery did not show up in the value of imports because of large falls in import prices, especially those of raw materials (Box Figure 2).

Imports promoted by domestic demand rose particularly strongly. Volumes of processing imports remained very weak during the first half of 2009, after collapsing together with processing export volumes (Box Figure 3). Processing trade recovered briskly in June to September, partly in line with more favorable developments in global electronics trade. Meanwhile, "normal" (non-processing) import volumes (for the domestic market) had already rebounded strongly early in the year on the back of the surge in domestic demand and grew 17 percent (yoy) in the third quarter (Box Figure 4). Restocking of raw materials—which made up almost one-half of normal imports in 2008—has been key in the import surge so far this year. Given the scale of the restocking surge, raw material imports are unlikely to continue to expand at the pace registered so far this year. However, underlying demand for raw materials is likely to hold up and imports of machinery and equipment have also been strong.

The domestic demand expansion has been fueled by very large fiscal and monetary stimulus. The government's own budget shows some of the surge in government-influenced spending. Fiscal expenditure rose 24 percent in the first nine months of 2009 (in nominal terms). But, with the government contribution to the stimulus package investment being only around one-third, government-influenced investment is much larger than the budget suggests. Bank lending toward the stimulus projects leveraged by the government's contribution is a key part of the massive expansion of bank credit since November 2008. In the first half of 2009, new medium- and long-term lending to infrastructure rose 42 percent (yoy), contributing more than one-half of the total increase in credit. Headline new lending declined in the third quarter. However, this was because some of the bill financing that had taken place earlier expired. Excluding bill financing, underlying new lending actually rose to 6.5 percent of annual GDP in the third quarter, with mortgage lending growing particularly rapidly (Figure 4).

While much of the stimulus showed up in infrastructure-oriented government-influenced investment, the domestic demand surge has been more broad based.3 Government-influenced investment contributed almost half of total investment growth of 16.4 percent in the first three quarters (on national accounts definition) (Figure 5). But the domestic demand growth came from other sources as well.

Resurgent housing sales have started to feed through to construction activity. Following a recovery of property sales and completions earlier this year, growth of floor space became positive in June and it reached 27 percent (yoy) in the third quarter, after languishing for a year (Figure 6). The rebound in construction activity is driven by (i) strong low-end and mass market housing construction, as part of the stimulus package; and (ii) a rebound in construction of higher-end and commercial properties, driven in part by stronger-than-expected sales and the liquidity boom (bank lending to developers has rebounded, and mortgage lending has been increasing rapidly).

Other market based investment in several sectors, notably manufacturing, has lagged, as excess capacity is limiting the incentive to invest (Figure 5). This is so even as profitability in industry is recovering, up 6.5 percent (yoy) in the third quarter. Concerns about excess capacity led the government to reinforce measures to prevent "overcapacity" in sectors including steel, cement, and aluminum and "redundant" investment in sectors including the manufacturing of wind power equipment (see below, footnote 6).

Consumption has held up, but lagged investment (Figure 3). Sales of discretionary items such as cars and electronic appliances have been particularly strong. Consumption has benefited from falling prices, which have boosted purchasing power, and government measures such as lower consumption taxes for small cars and subsidies for rural consumption of electronic appliances. Incomes and consumption have further been supported by strong increases in government transfers. However, weaker labor market conditions (see below) have dampened income growth. Nominal growth of "per-capita wage income" in rural areas fell from 16 percent in 2008 to 10 percent in the first three quarters of 2009, with growth particularly low early in the year.4 In urban areas total per-capita disposable income growth declined from 14.4 percent in 2008 to 9.3 percent in the first three quarters of 2009, with growth weakening through the third quarter.

The surge in domestic demand fuelled imports. After falling sharply in the first quarter, imports recovered and import volumes (in constant prices) rose by 6.2 percent in the third quarter, even though large price declines have kept the value of imports in U.S. dollar ($) down substantially on a year ago (Box 1). In particular, "normal" import volumes (for the domestic market) have been fueled by the domestic demand surge (Figure 7).

|