| It would be ideal if the policy stimulus in 2009 can be shaped by the rebalancing and long-term development agenda. This is only possible in some policy areas, such as with government spending on health, education, and social security. Many other rebalancing measures are by themselves not expansionary in the short run and would thus not be obvious elements of a stimulus package. However, there is room to supplement stimulus measures with these types of rebalancing measures.

Since the summer of 2008, the authorities have taken several steps to support growth. These include lifting credit quotas, which were the binding constraint on monetary conditions; three (modest) interest rate cuts and one in reserve requirement ratios; several increases in various VAT rebates to exporters; and measures to boost the property market (see above) and the stock market.

On November 9, the government announced the outlines of a large package to stimulate growth and employment. At the same time, the government formally changed the fiscal stance from "prudent" to "active" and the monetary policy stance from "moderately tight" to "moderately easy."

As underscored by the November 9 package, fiscal policy is set to play an important role in supporting growth. And it can, since, unlike in many other countries, with a strong fiscal position and sustainability, there is less need to worry about the negative impact of a fiscal expansion on markets' willingness to hold government debt.9

With the November 9 plan, the government identified measures in 10 areas to boost domestic demand and growth in 2009 and 2010. The emphasis is on infrastructure and other investment, although of a different nature than 10 years ago, with many projects geared to broad long-term development needs and improving living standards instead of mainly to the needs of industry.

- Public housing projects—notably on low-rent residential units, re-development of slumps and renovating deteriorated rural housing.

- Rural infrastructure investment—including water supply and conservation, including expediting the North-South water diversion project; irrigation; rural roads; and the power grid.

- Transport infrastructure—with a focus on railways, both passenger and coal transport lines, but also highways, airports, and the urban power grid.

- Health and education—including improving the local clinic service systems; renovating schools in inland provinces.

- The environment—including enhancing urban water and sewage treatment projects, pollution treatment of key water ways, reforestation, and energy efficiency projects.

- Innovation and restructuring—facilitating structural change and research and development (R&D), and supporting the development of hi-tech and service industries.

- Post-earthquake reconstruction.

l Household income—including increasing grain procurement prices and farm subsidies and increasing payments under the minimum living allowance system.

- Rolling out the VAT reform nationwide in 2009, allowing capital spending to be deducted from the VAT in line with international practice, reducing the corporate tax burden by about 120 billion yuan (0.4 percent of GDP) in the government's estimate.10

- Increasing bank lending to support growth, with priority being given to key projects, rural investment, small and medium-sized enterprises (SMEs), R&D, merger and acquisition (M&A), and consumer loans.

The package has secured and in many cases speeded up the execution of investment projects. Many had been in China's medium and long-term development plans, but without concrete timing and financial envelopes. The significance of the November 9 announcement is that, with the Central Government's approval and financial backing, the projects can now be concreticized and prepared, including arranging supplementary financing. The government estimates that 4 trillion yuan (12 percent of estimated 2009 GDP) is required to carry out the investment projects from the fourth quarter of 2008 until 2010. This spending is planned to be frontloaded, with planned (additional) spending for 2009 higher than for 2010. The Central Government itself has committed a total of 1.18 trillion yuan, of which 120 billion yuan is to be spent in the fourth quarter of 2008.

With reference to the criteria noted above (impact on growth in the short term and support for rebalancing and long-term development), a few observations are:

- Most of the elements imply higher direct government spending, and should thus have significant effect on output in the short term. Indeed, the stimulus from the infrastructure projects would target sectors with probably the largest excess capacity—construction and upstream industries—maximizing its impact.

- The package contains many elements that support China's overall long-term development and improving people's living standards. They include public housing; rural infrastructure; public transport; schools; and waste, water and sewage treatment projects.

- Policy makers will need to deal with several challenges related to the large infrastructure projects. The key challenge is to ensure that the selection, preparation, and execution of the projects is as rules-based and efficient as possible, with an eye to long-term development needs (instead of short-term visibility). This task is made more difficult by the large size of the overall package and the speed with which it is meant to be executed.

- Some of the stimulus measures announced directly support the medium-term effort to rebalance the pattern of growth. In particular, the 10-point plan includes several measures increasing government consumption and transfers, including on health and rural subsidies and transfer payments. These are good examples of measures that can boost disposable incomes, especially of lower income people, and the propensity to consume. Moreover, additional initiatives along these lines are expected. For instance, the government now expects the subsidized voluntary basic pension plan for rural people to cover 60 percent of rural people by 2010 and 80 percent by 2015, an advancement compared to the earlier schedule.11 Also, while not in the package, the large appreciation of the effective exchange rate in the last several months helps rebalancing.

- The package would by itself not lead to decisive rebalancing of the pattern of growth. That is in the nature of the trade off between policies to rebalance and those to stimulate growth.

- Policy making for 2009 is not finished, and further initiatives towards rebalancing are needed and likely. During a press conference discussing the package, Premier Wen Jiabao noted that the policy stimulus provides a good opportunity to implement the reform of energy pricing. Indeed, the recent sharp decline in oil price and subsiding of inflation pressures provides a very good window of opportunity to reform energy pricing, combining a re-link to international prices with a fuel tax for oil products. Additional measures are necessary to make headway with rebalancing the pattern of growth, including on resource and utility pricing; government spending on health, education and social security; and financial reform. Box 3 gives a general overview of possible rebalancing measures.

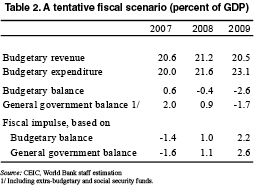

Fiscal policy in 2009 is likely to lead to a sizable but manageable increase in the government deficit. In 2008, revenue growth was strong for much of the year but weakness set in in the fall because of weaker profits and a large swing in tax revenues from the stamp tax on stock market transactions. With the large increase in spending planned for the fourth quarter, the government is likely to run a modest deficit in 2008 (Table 2). As discussed above (prospects), in our scenario for 2009 government-influenced direct expenditure could contribute more than 4 percentage points to GDP growth. Broadly, current indications are that more than one half of this will come from government-influenced investment, and the rest from government consumption and transfers. Only a minority share of government-influenced investment is financed by the central and local governments. Government revenues are likely to lag GDP considerably, largely because of the impact of the two VAT reforms. In all, these rough estimates suggest an increase in the government deficit of 2-2.5 percent of GDP in 2009, most of that because of discretionary policy. The Ministry of Finance has noted that the overall budget deficit in 2009 and 2010 will not be higher than 3 percent of GDP.

Monetary and Exchange Rate Policy

The authorities have started to ease monetary policy. They have already reduced interest rates and reserve requirements. More importantly, in end-October, the People's Bank of China (PBC) announced it would no longer apply the credit quota that had been the binding constraint on credit extension since the more strict enforcement of window guidance beginning in the fall of 2007. The quotas had been partially eased at the beginning of August.

|