|

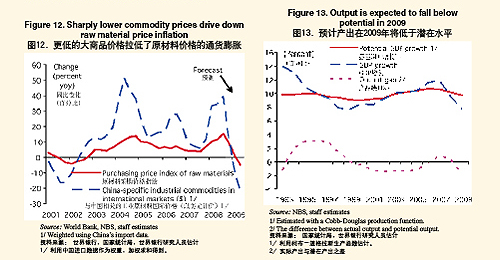

One bright spot for China is the impact of lower raw material prices on inflation and margins. Against a backdrop of significantly weakened global growth prospects, prices of primary commodities including energy and metals have fallen sharply. The World Bank expects China-specific industrial commodity prices to decline substantially year on year on the international markets in 2009. Our empirical estimates suggest that this should result in a further deceleration of year-on-year increases in China's domestic raw material prices into negative territory in the second quarter of 2009, from a peak of over 15 percent in the summer of 2008 (Figure 12). This will help reduce cost pressures in China's industrial sector and support margins in manufacturing industry.

We think consumer price inflation will recede further. Core inflation has remained low throughout the food price pressure episode that has come to an end. With output expected to be below potential output in 2009 (Figure 13) and raw commodity prices expected to fall, inflation is no longer an issue of concern for the immediate future.

Despite export volume weakness, China's current account surplus is likely to increase further in 2009 due to the lower raw commodity prices. Even as import volumes are likely to outpace export volumes significantly, the large improvement in the terms of trade due to lower primary commodity prices is set to boost the current account surplus to almost $430 billion, or 9 percent of GDP, in 2009.4

Macroeconomic Policies—fiscal policy has moved center stage

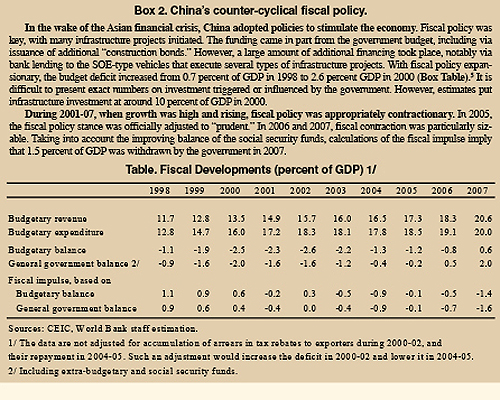

The macro policy stance has shifted rapidly recently, and has rightly become expansionary. Until recently, the stance of overall economic policies had been relatively contractionary, with fiscal policy withdrawing some stimulus (being "prudent") for several years and monetary policy tight since the fall of 2007 (Box 2). Since the summer of 2008, however, as international and domestic growth prospects weakened and inflation came down steadily from its peak in early 2008, the need and room for macroeconomic policy to support domestic demand has increased substantially. As a result, the overall macro stance has shifted, with an acceleration recently. Indeed, in the face of weakening world demand and with competitiveness still overall strong, the case for stimulating domestic demand is stronger than the case for trying to stimulate exports by depreciating the exchange rate or giving tax incentives to exporters.

There are several reasons why economic policy should not try to offset completely the impact of the external shock and housing weakness on growth. Although it is not helpful to have large swings in economic growth, economic cycles are a key part of economic development, fostering discipline, upgrading capital, and advancing technological progress. Moreover, there may be a limit to how much government-influenced investment and consumption can be increased quickly and efficiently. The consequences of temporary economic dislocation and layoffs can also be alleviated by expanding and using the social safety net. The fact that the private sector now plays a larger role than in 1998 (when China used fiscal stimulus to counter the impact of the Asian crisis) may imply a different trade off between boosting growth by overall government spending and by improving and using the social security system.

Flexibility and transparency in the implementation of expansionary policies is very important. At times of major uncertainty such as now, economic projections can change quickly. This means that the desired size of the stimulus may need to be adjusted as developments unfold. Meanwhile, for the benefit of macroeconomic policy making and coordination, it is important that information on all spending and funding is available widely. From the public finance perspective, it is better to channel as much as possible of the stimulus via the normal process of fiscal policy. Transparency is also important in order to assess the effectiveness of policies, something Premier Wen Jiabao saw as an important task.6

The authorities will need to strike a balance between two considerations that will guide economic policy making for 2009.

First, there is the imperative for maximum impact on domestic demand, growth and employment. Direct government spending, in the form of government direct consumption or investment, typically creates more economic activity than an increase in transfers or tax cuts.7 This is because higher transfers or tax cuts that increase income may not necessarily induce spending, especially by higher income people or when times are especially uncertain. Stimulus targeted at increasing demand for products of sectors with excess capacity will have a larger activity and employment effect. In the short term, however, there is no difference in the growth impact between government investment and government consumption.

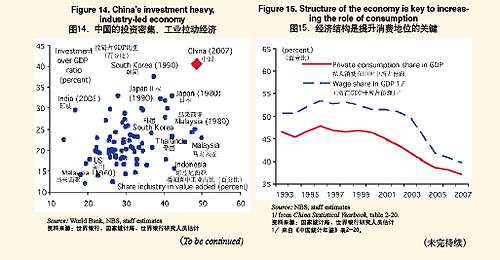

Second, policies need to support the medium-term rebalancing and long-term development and growth agenda. The key medium-term objective of China's 11th Five-Year Plan—the implementation of which has now reached the half way point—is to rebalance the pattern of growth, making growth more domestic-demand led, but also cleaner, less resource intensive, and shared more equally. In terms of the overall economic strategy, rebalancing requires a shift away from a predominance of industry, investment, and exports, towards services and consumption (Figure 14). Such a shift would mean more labor intensive growth, with more urban employment creation. By boosting the share of wages and household income in GDP, this would increase the role of consumption, a key goal of the government, in an economically sustainable way (Figure 15).8 As such, it would also ameliorate the pressures for current account surpluses. Moreover, more labor intensive urban growth would help reducing excess labor in agriculture and the related poverty and urban-rural inequality. In addition, it would make growth less intensive in energy, raw materials, and resources, and less detrimental to the environment. In addition to the rebalancing agenda, there are other important measures and structural reforms that would support China's long-term development agenda, including removing remaining distortions and investing in people-oriented infrastructure.

(To be continued)

|