|

Economic Prospects and Policies

Prospects

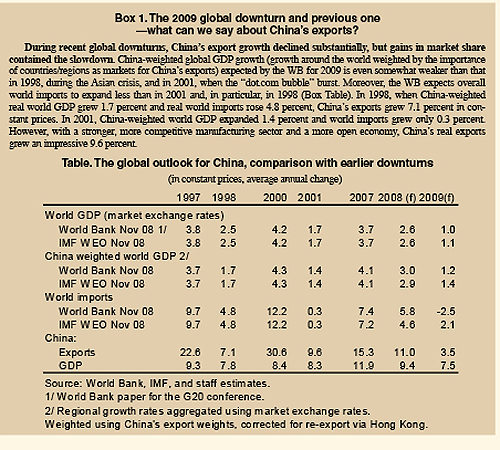

Global growth prospects are distinctly unfavorable. In recent years, even as the United States slowed down, overall world growth held up well, in large part because of strength in emerging markets. World GDP growth, weighted for China (using countries' and regions' weights in China's exports), is expected to ease from 4.1 percent in 2007 to 3.0 percent in 2008 (Table in Box 1). However, with the impact of the financial crisis spreading, a significantly faster deceleration is in sight for 2009. The crisis has already affected European demand. The impact is now also spreading to some emerging markets with risk aversion and deleveraging in financial markets leading to a funding squeeze set to affect domestic demand there. In all, a synchronized global slowdown appears to be in sight, and the World Bank (WB) expects China-weighted global GDP growth to slow much more in 2009 than in 2008, to about 1 percent (in market exchange rates), with a recovery in 2010. Moreover, after an expected moderation in real world import growth from 7.4 percent in 2007 to 5.8 percent in 2008, the WB expects world imports to shrink in 2009, for the first time since 1982.1

The experience in earlier global downturns suggests very weak export growth in 2009, even though China's exports are likely to outgrow world imports significantly. Box 1 describes how continued gains in global market share have allowed China's exports to keep growing during previous global downturns. In line with this experience, we expect that China's exports will continue to gain overall market share in 2009, allowing for positive export growth in a depressed world market. However, the gain is unlikely to be as large as in 2001, because China's existing market share is now much higher and the effective exchange rate has appreciated significantly in the last half year.

China's overall economic growth is sensitive to export developments. Gross exports are almost 40 percent of GDP. About one half of exports is from processing trade, and the share of exports in value-added terms is probably less than 20 percent.2 Nonetheless, exports are more important in China than in other large emerging market economies, even as China is more robust than most to external shocks, because of its strong macroeconomic fundamentals and large balance of payment surpluses.

Private sector investment is likely to be subdued. The weak export outlook for 2009 is set to depress investment in export-oriented industries, which we estimate are responsible for about 15 percent of overall investment.3 A roughly equal share is real estate investment that in the short term is set to grow slowly because of the current housing weakness, even though the medium-term fundamental drivers of demand for urban housing remain good. Another one third of investment is oriented on the domestic market while geared by market considerations. This investment should be less sensitive to the external weakness, although it will also be affected by the overall slowdown in China, if only because of the weak profit growth expected for next year. The VAT reform announced as part of the November package, under which firms can deduct capital spending for the VAT, may provide some support for investment (with both an income effect and a relative price effect), particularly so for capital-intensive parts of the economy. However, the weak short-term growth prospects and overcapacity in several upstream industries are likely to limit the short-term impact.

Government-influenced investment and government consumption will be boosted by the fiscal stimulus announced on November 9 (see below). Financed in part by the government budget, in part by related lending by commercial and policy banks, government-influenced investment makes up almost one third of total investment (including most of transport; some of electricity, water and gas; all of administration; and most of education, healthcare, and social and cultural services). The stimulus package ensures that government-influenced investment, notably in infrastructure, will be very strong in 2009, offsetting some of the weakness in other areas. Government consumption is also set to expand rapidly, supporting overall consumption. In all, government-influenced direct spending would contribute over 4 percentage points to GDP growth, or more than one half of the total and about 1.5 percentage points more than in 2007.

Private consumption growth is likely to soften in 2009, but will receive some support from lower inflation and policy. Slower (nominal) wage and employment growth and weaker confidence will likely depress private consumption growth. However, this will be partly offset by the impact on purchasing power of significantly lower inflation and some fiscal support (mainly higher transfers). Rural consumption is helped by fiscal support to incomes and, in the longer run, other policy support for agriculture, including rural land policy discussed in Box 4.

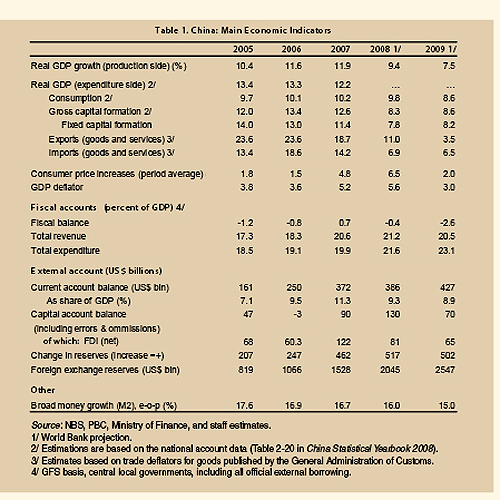

In a scenario based on these considerations, which include significant policy stimulus, GDP growth would be around 7.5 percent in 2009 (Table 1). In this scenario, import growth is significant, even with processing imports assumed to be stagnant, in line with processing exports. With overall imports substantially outpacing exports, net external trade is likely to have a negative contribution to growth of almost 1 percentage point, for the first time in many years.

The risks to this scenario are broadly evenly balanced. There are still downside risks in the international picture. Domestically, downside risks come from further weakening of private sector confidence and a more drawn-out inventory adjustment. On the upside, increasing support from policy may have a larger impact, including on confidence.

|