|

Even so, because weakness in the real estate sector affects local government revenues and economic growth, the government has taken some supportive measures. As sizable local government revenues are generated from the property market, a long housing slump can affect local government revenues and thus their ability to sustain or increase spending. In addition to lowering interest rates, the central authorities have reduced the deed tax for small houses and the minimum down payment for mortgages, suspended the stamp duty and value-added tax (VAT) on land for individual home sales, and lowered the floor on mortgage rates for first homes. Many city governments have taken additional measures including a (modest) tax refund to house buyers, price subsidies, and issuing hukou (resident certificate) to house buyers from other areas. These measures have rightly focused on the demand side instead of directly supporting property developers. However, the overall size of the financial incentives is modest. More support for the real estate market will come from the housing element of the November 9 stimulus package (see below).

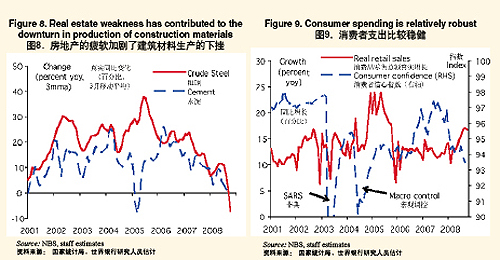

Most other segments of the domestic economy, notably consumption, seem to have held up reasonably well so far. The extraordinarily strong retail sales data in 2008 may not be completely representative of overall consumption trends, but other indicators support the conclusion that consumer spending and confidence have held up reasonably well. Nominal retail sales growth was 22 percent year on year in October, suggesting real growth of around 17 percent (Figure 9). Household survey indicators suggest per-capita household incomes have continued to grow at around 10 percent year on year in urban areas and 12-13 percent in rural areas through the third quarter (in nominal terms). Urban consumption spending growth in the surveys seems to have been affected by the Olympics in the third quarter, even as rural spending growth held up at around 10 percent in real terms through the third quarter. Consumer confidence came down at the end of 2007, but has not budged much yet since. Although overall consumption spending has so far held up well, car sales growth has weakened significantly, possibly in part reflecting similar factors as those affecting housing sales.

With the trade surplus soaring again, foreign exchange accumulation continues. While overall export growth has held up quite well, import volume growth declined in the third quarter due to weak processing trade and the impact of inventory build up in upstream industries. As a result, exports have again outpaced imports in U.S. dollar terms, even though the terms of trade declined substantially from a year ago because of high raw material prices. The trade surplus has started to grow again, breaking new records since mid-2008 to hit $35 billion in October. In all, domestic demand has slowed down more than the contribution of net external trade to GDP growth so far in 2008. Even as net non-FDI capital inflows appear to have slowed somewhat in the third quarter, foreign exchange accumulation continues uninterrupted, adding $97 billion to reach $1.9 trillion by end-September.

Inflationary pressure has receded. As the large food price increases are fading out and core inflation remains very modest, headline CPI inflation fell to 4.0 percent year on year in October (Figure 10). In the meantime, the pressure from higher raw material prices is easing as prices of oil and other raw commodities continued to decline in international and domestic markets. The outlook for raw commodity prices means that, looking ahead, inflation is no longer a concern in the near future. During the recent episode of food and raw commodity price related inflation, China's flexible economy and labor market have allowed the economy to absorb the exogenous price shocks well without leading to a wage price spiral. This is encouraging, given the outstanding need to reform several administered prices.

The effective exchange rate has strengthened considerably. In recent months, the authorities' policy has kept the renminbi stable against the U.S. dollar when the U.S. dollar gained strength as demand for dollar liquidity swept world markets (Figure 11). China's exchange rate policy has thus been a source of stability in regional and global financial markets.

Despite capital controls, China's equity markets have been affected substantially by the global slowdown. China's stock market has fallen by almost two thirds since October 2007, from levels considered inflated—one of the sharpest decreases in stock prices in the world. In addition to general contagion and confidence effects, this is because the global slowdown has weakened the outlook for corporate earnings and domestic factors including the circulation of non-tradable shares have also been at play. The ups and downs of China's stock market do not seem to have had significant impact on the real economy.

|