|

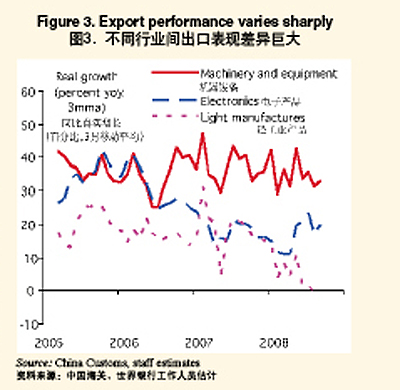

Overall export developments mask significant differences between sectors. While the growth in exports of light manufacturing—including toys and textiles—has declined sharply, exports of (higher value-added) machinery and equipment have continued to grow at a high pace, and exports of electronics have also held up well (Figure 3). Clearly, these sectoral trends have regional implications with, for instance, the Pearl River Delta (Guangdong Province) traditionally concentrating on light manufacturing.

The economic impact in China of the international turmoil is set to intensify. Export growth to the EU started to weaken in August. Exports to emerging markets (including non-Japan Asia)—the destination of over half of China's exports—still grew at 32 percent year on year in U.S. dollar terms in the third quarter but these are set to weaken too. Looking ahead, prospects are for a sharp reduction in export growth as the impact of the international turmoil deepens in the United States and Europe and it starts to hit demand in many emerging markets. Recent indicators on export orders from the purchasing managers' index point in this direction.

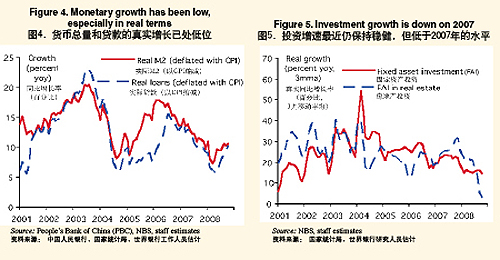

China's overall growth in 2008 has been affected by slower domestic investment growth, partly in response to tighter policies. Monetary and other policies were tightened since the fall of 2007 to contain inflation and "cool off" the economy, notably the real estate sector, with a key role for enforced credit quotas. In real terms (deflated by CPI inflation), M2 and credit lagged economic activity for most of 2008 (Figure 4). Overall real investment growth in 2008 has so far been substantially lower than in 2007 (Figure 5). Surprisingly, investment in manufacturing, which would be expected to be impacted by reduced export prospects, has so far held up well.

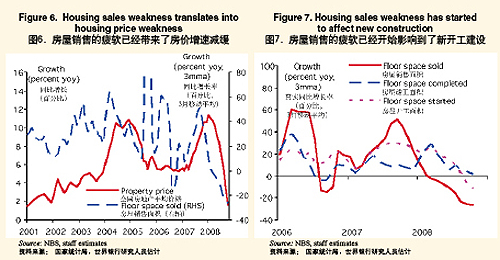

The real estate sector—a key target of the policy tightening—has seen a particularly pronounced slowdown. The initiative to "cool off" the housing market included measures that reduced demand—especially "speculative demand"—such as tighter lending conditions for second houses with others that reduced supply such as stricter land supply and credit policies towards project developers. It appears that the demand side measures had a more rapid impact. Housing sales growth started to decline substantially and housing price increases moderated. The price weakness is affecting most parts of the country, but it seems to be more pronounced in large cities, especially those that saw rapid increases in recent years. Since early 2008 housing sales are falling at an increasing rate, probably fueled further by expectations of housing price declines, concerns about overall economic prospects and China's stock market decline (Figure 6). As a result, new real estate construction has started to weaken, with real estate investment growth now close to zero (Figure 7).

Weakness in real estate construction has contributed to a sharp slowdown in several "upstream" industries. The slowdown in steel and cement gathered pace in October in part in response to large inventory build ups (Figure 8). With these heavy industries decelerating faster than other sectors, "physical indicators" such as of freight volumes and electricity production have slowed significantly more than overall economic activity.

The impact of continued real estate weakness on the financial sector and households' balance sheets is likely to be modest. For the large banks, real estate lending makes up about 20 percent of total lendin—significantly less than in most OECD countries—with about two thirds in the form of mortgages to households and one third as project finance to property developers; minimum down payments of at least 20 percent limit the possibility for widespread negative equity; and household gross and net debt is low. More generally, under reasonable scenarios for the future, banks' balance sheets appear strong enough to reject the possibility of financial sector instability in the near future.

|