|

|

|

Workers inspect the Khorgos section of Line C of the China-Central Asia gas pipeline network, which supplies 23 percent of China's natural gas demand annually (CNS) | Securing energy imports is particularly important to the economic development and social stability of China, the world's largest industrial nation and exporter, while natural gas is also the key product in the nation's energy imports.

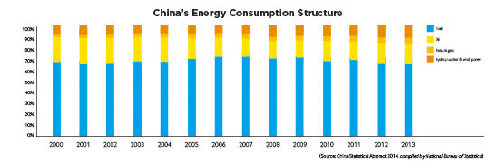

In the global market, natural gas has become the fossil fuel with the fastest-growing demand since the 1980s, possessing twice the annual growth rates for coal and oil demands. It will also be the fastest growing one in China's energy consumption and imports within the foreseeable future. In the 2000-13 period, the proportion of natural gas among China's total energy consumption rose from 2.2 percent to 5.8 percent. China's natural gas consumption is expected to continue growing rapidly for a long time.

China has become the world's third largest natural gas importing nation within a few years, just after Japan and South Korea. In 2013, the country produced 117.8 billion cubic meters of natural gas but imported 52.9 billion cubic meters, accounting for nearly half of its natural gas output. It is estimated that China will become the world's largest natural gas importer in years to come.

Gas prices fluctuate much more than oil prices. Long-term observation shows that natural gas prices fluctuate twice as much as oil prices and four times as much as stock prices, making it more difficult for China to stabilize its natural gas supplies through imports.

Therefore, China must diversify the sources and channels of gas imports, and it is now in the position to achieve this goal as a major gas importer with fast-growing demand.

The international primary commodities market is now in deep depression. U.S.-denominated oil prices dropped by 7.5 percent in 2014, and may continue dropping by another 39.6 percent in 2015 according to predictions by the International Monetary Fund. This offers a good opportunity for China to implement a countercyclical strategy and gain more advantages in negotiations.

When the primary commodities market flourishes, being a top importer means inhabiting an unfavorable position with respect to energy imports, having to suffer high importing prices. But when the market is in depression, top importers will gain more advantages in negotiations. In a market with overcapacity and excessive supplies, almost all the large energy producers are competing for the Chinese market. In fact, major world oil and gas producers are already doing so.

Pipeline gas preferred

Owing to advantages in terms of transportation, pipeline gas is undoubtedly the first choice for gas imports. Central Asian countries are the largest source of pipeline gas imports for China. Turkmenistan alone supplied 46.48 percent of China's gas imports in 2013. With completion of other projects, Central Asian countries will supply even more gas to China.

Line C of the China-Central Asia gas pipeline network only recently started supplying gas to China in June 2014. It is designed to transmit 25 billion cubic meters of natural gas each year from Central Asian countries (Turkmenistan, Uzbekistan and Kazakhstan) and 5 billion cubic meters of synthetic natural gas made in Ili of Xinjiang to China's eastern region. China is also incorporating natural gas from West Siberia of Russia into this line.

Line D of the China-Central Asia gas pipeline network starts from Galkynys Gas Field of Turkmenistan, passes through Uzbekistan, Tajikistan and Kyrgyzstan, and enters China via the Ulugqat County in the south of Xinjiang Uygur Autonomous Region. With a projected annual gas transmission of 30 billion cubic meters, this project is expected to be completed by the end of 2020, which will enable the China-Central Asia natural gas pipeline network to transmit 85 billion cubic meters of gas each year.

In the future, the China-Central Asia natural gas pipeline network could possibly extend westward to Iran.

At present, Russia's share in China's natural gas market is not proportional to its reserves and production capacity. After the east line of the China-Russia natural gas pipeline is completed for operation, Russia will become one of the most important sources of natural gas imports for China.

The China-Myanmar oil and gas pipelines play only a supplementary part in China's total natural gas imports. They mainly serve the regional market in southwest China. Political instability in Myanmar has also seriously restrict ed the value and potential of the pipelines.

LNG still important

In general, liquefied natural gas (LNG) costs more than pipeline gas. However, the construction of gas pipelines requires huge amounts of investment and involves massive cross-border infrastructure construction. Since gas pipelines can only be used for special purposes, they are apt to be obstructed by unforeseeable events in the countries that hold them.

In comparison, LNG doesn't involve cross-border infrastructure construction and operations. The facilities can be used for other purposes, and the operations are more flexible. Therefore, China must further expand LNG imports to improve its position in the natural gas trade.

According to estimations by Gas Logistics of Monaco, in 2012, LNG only accounted for 13 percent of the global natural gas trade, while at the same time, tanker-transported oil accounted for 45 percent of the global crude oil trade. In 2013, of all the natural gas China imported, LNG accounted for 47 percent. After all the large-scale development projects are completed, the share of LNG in the world natural gas market will rise from the present 15-20 percent to at least 30 percent. In the future, LNG's proportion in China's gas imports will the very least not significantly decline.

Chinese companies have taken actions to diversify their sources of LNG imports.

In 2013, China National Petroleum Corp. (PetroChina) spent $4.2 billion buying a 20-percent stake in Mozambique's Area 4 from Italian oil and gas major Eni. The project is expected to be put into production in 2018, and PetroChina also plans to invest $10 billion in natural gas exploitation and LNG production in Mozambique.

Australia is expected to become the world's largest LNG producer after the completion of the LNG projects in Western Australia and Queensland, while China has become the biggest buyer of Australian LNG. North West Shelf Australia LNG Pty. Ltd. from Western Australia won the bid for a LNG project in south China's Guangdong Province, which was opened for tender in August 2002, marking the largest single export order for Australia with a contract value of AU$25 billion ($20 billion) for a 25-year supply of 3.3 million tons per annum of LNG. In May 2003, China National Offshore Oil Corp. (CNOOC) acquired a 5.3-percent share in the North West Shelf Venture for $348 million for an LNG processing project in Guangdong Province. The world's first projects to turn coalbed gas into LNG are based on Curtis Island of Queensland, and CNOOC is the first buyer of LNG from Queensland. It was also the first company in the world to sign an LNG purchasing contract turned with coalbed gas.

Russia is now the world's 10th largest LNG producer, but its resources are also more than sufficiently qualified to become the world's largest LNG producer. Before Chinese and Russian companies signed the agreement for the east-route gas pipeline in 2014, Russian natural gas producer Novatek had signed a 20-year contract with PetroChina for supplying 3 million tons of LNG per annum.

With the recent Shale Gas Revolution, the United States has become an important potential gas supplier to China. Indeed, with huge oil and gas production capacity and potential, the United States is close to becoming the world's largest oil and gas producer. During the 10-year flourishing of the international energy market, as well as the Shale Gas Revolution and the ban on oil and gas exports, energy prices in the United States were much lower than in the international market, which had helped push forward U.S. reindustrialization.

Now, however, the global energy market is in depression, so the price gap between the international and U.S. energy markets has significantly narrowed. The ban on oil and gas exports has hindered the fast-growing U.S. oil and gas industry in the competition for the world market. The U.S. Government has relaxed its ban on oil and gas exports, and, in my opinion, it is only a matter of time before they completely lift the ban.

In the U.S.-China Strategic and Economic Dialogues of recent years, China has reiterated the request that the United States should lift the ban on oil and gas exports, and the U.S. side has responded actively. Both China and the United States will benefit from the ban been lifted. Even if the United States does not directly export oil and LNG to China and only exports to Japan and South Korea, China's position in the natural gas trade will still improve, because gas prices are the highest in East Asia, and U.S. exports will help lower energy prices in this region.

The author is an op-ed contributor to Beijing Review and a researcher with the Chinese Academy of International Trade and Economic Cooperation

Copyedited by Kylee McIntyre

Comments to yushujun@bjreview.com |