|

|

|

(FU YEXING) |

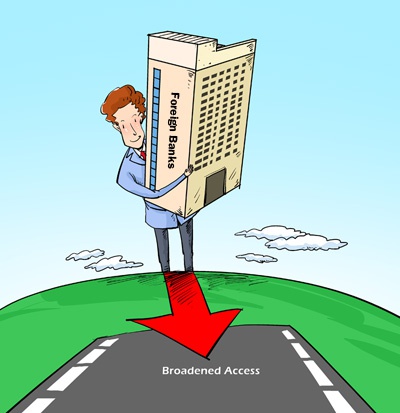

Foreign banks will soon have a much easier time setting up outlets in China. According to regulations recently amended by the State Council, as of January 1, foreign banks will no longer be required to transfer a specific amount of operating funds from the parent banks to their newly established Chinese branches. Moreover, a previous requirement that foreign banks or Sino-foreign joint venture banks must first establish a China representative office before establishing branches in China will be cancelled. The new regulations also relax requirements on foreign banks' bids to carry out yuan business.

According to a press release from the China Banking Regulatory Commission (CBRC) on December 20, 2014, the amendment aims to relax foreign banks' access as well as their requirements for operating yuan business so as to create a more conducive environment for foreign banks.

"The amendment is to implement the country's policy of streamlining administration, reducing administrative examination and further expanding opening up of the financial sector, and to give national treatment to foreign banks," said Guo Tianyong, Director of Center for Chinese Banking Studies of Central University of Finance and Economics, adding that China used to implement excessively strict supervision on foreign banks, restricting their development in China.

Operating funds unnecessary

Under the previous Regulations on the Administration of Foreign-Funded Banks promulgated in 2006, when a wholly foreign-funded bank or a Sino-foreign joint venture bank establishes a branch in China, the parent bank shall unconditionally allocate an operating capital of 100 million yuan ($16.34 million) or an equivalent value in convertible currencies. However, the requirement still maintains that the aggregate amount of the operating capital allocated by a wholly foreign-funded bank or by a Sino-foreign joint venture bank to its branches shall not exceed 60 percent of the total capital of the parent bank.

Zeng Gang, Director of Research Department of Banking Industry of the Institute of Finance and Banking of the Chinese Academy of Social Sciences (CASS), said removal of the requirement on operational capital frees foreign banks from unnecessary restrictions on capital. According to him, foreign bank branches in China used to have narrow channels available to replenish their capitals, mainly relying on retained profits or capital injection by their parent banks. Regarded as foreign direct investment, capital injection has to be subject to approval of the CBRC, the State Administration of Foreign Exchange and the Ministry of Commerce. These complicated procedures have restricted development of foreign banks in China.

A manager of a Shenzhen branch of a foreign bank, who declined to identify himself or his bank, said removal of the requirement on operating capital is conducive for foreign banks to save operating capital.

When asked whether foreign banks will be stimulated to establish more outlets in China, he told Securities Times that the amendment will not have significant influence on foreign banks that already have extensive networks in China, such as HSBC, Bank of East Asia and Standard Chartered. He added, however, that smaller banks with inadequate outlets will find it quite appealing to set up more branches.

|